22 AUG 2024 Market Close & Major Financial Headlines: The Dow And The S&P 500 Recorded New Historic Highs Minutes After The Opening Bell Only To Slide Precipitously Into The Red Shortly After, Finally Closing Sharply Down In The Red

Summary Of the Markets Today:

- The Dow closed down 178 points or 0.43%, (Closed at 40,713, New Historic high 41.027)

- Nasdaq closed down 1.67%,

- S&P 500 closed down 0.89%, (Closed at 5,571, New Historic high 5,643)

- Gold $2,518 down $29.40,

- WTI crude oil settled at $73 up $0.95,

- 10-year U.S. Treasury 3.862 up 0.086 points,

- USD index $101.53 up $0.49,

- Bitcoin $60,314 down $657 or 1.07%,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Highlights:

U.S. stocks declined on Thursday, with technology stocks leading the losses as investors turned their attention to Federal Reserve Chair Jerome Powell’s upcoming speech at the Jackson Hole symposium on Friday. Market Dynamics: The market’s focus has shifted to the Fed’s Jackson Hole symposium, which began on Thursday. Investors are particularly interested in any potential changes in tone from policymakers during Powell’s speech on Friday. This comes after minutes from the Fed’s last meeting revealed that several officials were open to a July rate cut, suggesting a possible pivot in next month’s policy decision. Economic Data: New data from the Department of Labor showed 232,000 initial jobless claims for the week ending August 17, slightly up from the previous week and in line with economists’ expectations. This data has gained increased attention following an official revision to payrolls that indicated the labor market may have been cooling earlier than initially thought. Rate Cut Expectations: Market expectations for interest rate cuts have been fluctuating. While there were earlier hopes for a 0.5% reduction, recent developments have tempered these expectations. Currently, markets are pricing in just a 25% chance of a 50 basis point cut at the Fed’s September meeting, down from 38% the previous day.The upcoming speech by Powell at Jackson Hole is highly anticipated, as investors look for any signals that might contradict or confirm the market’s current optimistic outlook on rate cuts.

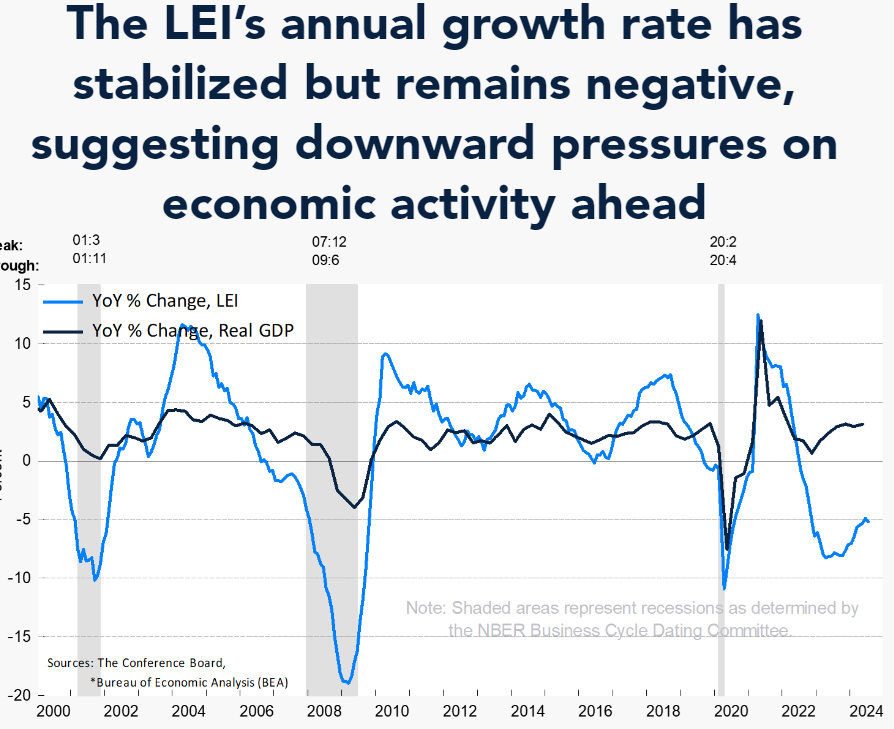

Click here to read our current Economic Forecast – August 2024 Economic Forecast: New Recession Flag

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The Chicago Fed National Activity Index (CFNAI) three-month moving average, CFNAI-MA3, was unchanged at –0.06 in July 2024 which implies the economy is not recessionary but is in the neighborhood of weak expansion. Twenty-eight of the 85 individual indicators made positive contributions to the CFNAI in July, while 57 made negative contributions. Thirty-one indicators improved from June to July, while 53 indicators deteriorated and one was unchanged. Of the indicators that improved, 12 made negative contributions.

Existing-home sales improved in July 2024 but year-over-year sales fell 2.5%. Total housing inventory was up 19.8% from one year ago with unsold inventory sits at a 4.0-month supply at the current sales pace, down from 4.1 months in June but up from 3.3 months in July 2023. The median existing-home price for all housing types in July was $422,600, up 4.2% from one year ago ($405,600). Note that existing home sales are not a component of GDP. NAR Chief Economist Lawrence Yun added:

Despite the modest gain, home sales are still sluggish. But consumers are definitely seeing more choices, and affordability is improving due to lower interest rates.

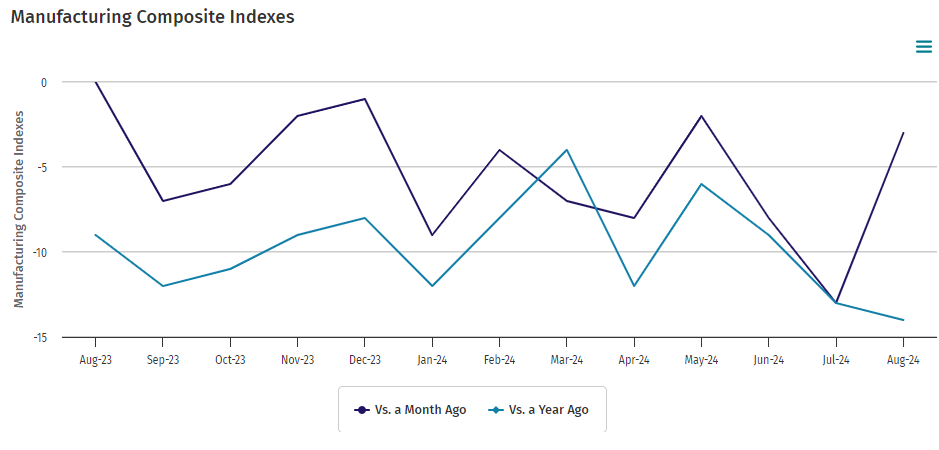

The Kansas City Fed’s manufacturing activity declined less in August 2024 than in July. The month-over-month composite index was -3 in August, up from -13 in July and -8 in June . Manufacturing remains the soft spot in the current economy.

In the week ending August 17, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 236,000, a decrease of 750 from the previous week’s revised average. The previous week’s average was revised up by 250 from 236,500 to 236,750. There is no indication in unemployment numbers that a recession is in view.

Here is a summary of headlines we are reading today:

- Oil Buying Opportunity May Have Arrived: Citi

- Is China’s Steel Industry on the Brink of a Major Crisis?

- Experts Skeptical of Lasting Cease-Fire Between Israel and Hamas

- Global Offshore Wind Installations to Surpass 520 GW by 2040

- Ford’s $5 Billion EV Loss Sparks Strategic Shift Towards Hybrids

- Fed Minutes Signal September Rate Cut

- Stocks close lower, Nasdaq slides 1% as Treasury yields rise and Powell speech looms: Live updates

- Peloton shares soar 35% as turnaround plan takes hold, losses shrink

- FDA approves updated Pfizer, Moderna Covid vaccines as virus surges; shots to be available within days

- Philadelphia Fed President Harker advocates for interest rate cut in September

- Stocks making the biggest moves midday: Urban Outfitters, Peloton, Advance Auto Parts and more

- ‘No Israeli Withdrawal, No Ceasefire Deal’: Hamas

- Treasury yields jump by most in at least a week after fresh data ease near-term recession concerns

- Is the August stock-market volatility behind us? This key indicator says not yet.

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.