27 AUG 2024 Market Close & Major Financial Headlines: Markets Opened Lower, Immediately Trended Higher, Traded Across The Unchanged Line For A While Before The Dow Closed At A New Closing High

Summary Of the Markets Today:

- The Dow closed up 10 points or 0.02%,

- Nasdaq closed up 0.16%,

- S&P 500 closed up 0.16%,

- Gold $2,551 up $5.20,

- WTI crude oil settled at $76 down $1.73,

- 10-year U.S. Treasury 3.833 up 0.015 points,

- USD index $100.55 down $0.03,

- Bitcoin $61,990 down $809 or 1.29%,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Highlights:

The US stock market experienced mixed trading on Tuesday, with the Dow Jones Industrial Average managing to secure another record close while the S&P 500 and Nasdaq Composite saw modest gains. Investors remained cautious ahead of Nvidia’s highly anticipated earnings report scheduled for Wednesday.

Key Factors Influencing the Market:

Nvidia Earnings Anticipation

Investors are eagerly awaiting Nvidia’s (NVDA) second-quarter earnings report, which is expected to be a significant market-moving event. The chipmaker’s results could have broader implications for the tech sector and the AI-driven rally that has propelled markets this year.Inflation UpdateMarket participants are also focused on the upcoming release of the PCE price index, the Federal Reserve’s preferred inflation gauge. This report could impact expectations for potential interest rate cuts in the near future.

Corporate News

Apple (AAPL) announced a change in its CFO position, with Kevan Parekh set to replace the long-standing executive whilst the Paramount (PARA) takeover saga appears to be nearing conclusion, with Skydance Media likely to secure a deal.

Analyst Insights

Kevin Mahn, chief investment officer at Hennion & Walsh, expressed optimism about Nvidia’s upcoming earnings report, stating, “I think they will once again exceed earnings expectations. They’ll exceed revenue expectations, and they’re going to announce substantial growth in their data center business”.As the market awaits Nvidia’s results, the company’s performance could have significant implications for the broader AI ecosystem and investor sentiment in the tech sector

Click here to read our current Economic Forecast – August 2024 Economic Forecast: New Recession Flag

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

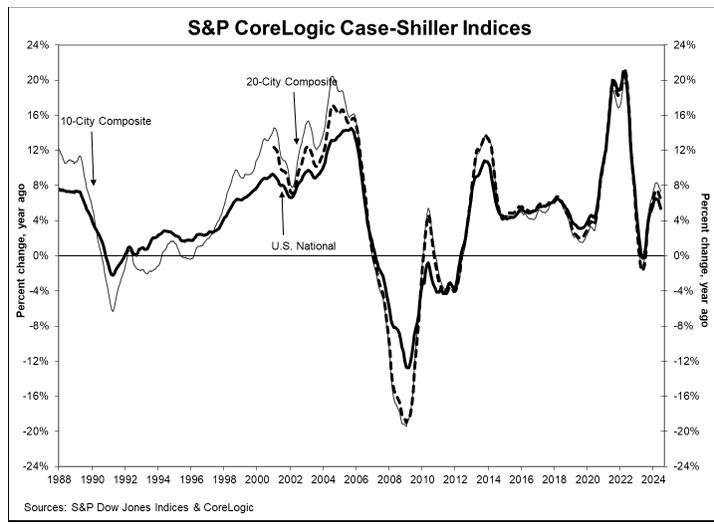

The S&P CoreLogic Case-Shiller 20-City Composite posted a year-over-year increase of 6.5% in June 2024, dropping from a 6.9% increase in the previous month. I do not hold out much hope there is a good solution to moderate home price inflation as overall it is not good for anyone except for flippers.

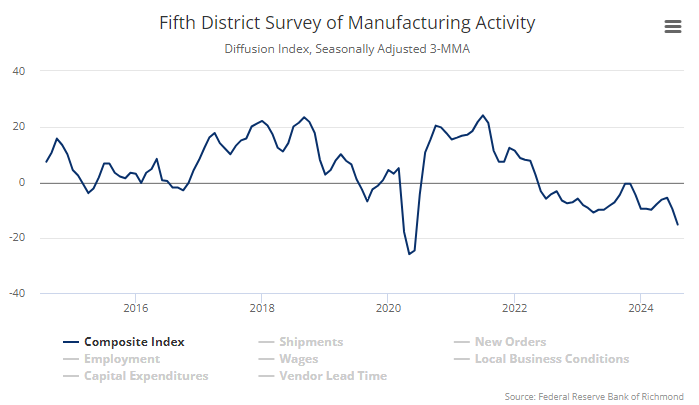

Richmond Fed Manufacturing Survey slowed in August 2024, according to the most recent survey from the Federal Reserve Bank of Richmond. The composite manufacturing index edged down from −17 in July to −19 in August. Of its three component indexes, shipments rose from −21 to −15, new orders decreased from −23 to −26, and employment fell from −5 to −15. Manufacturing is not doing well in the U.S.

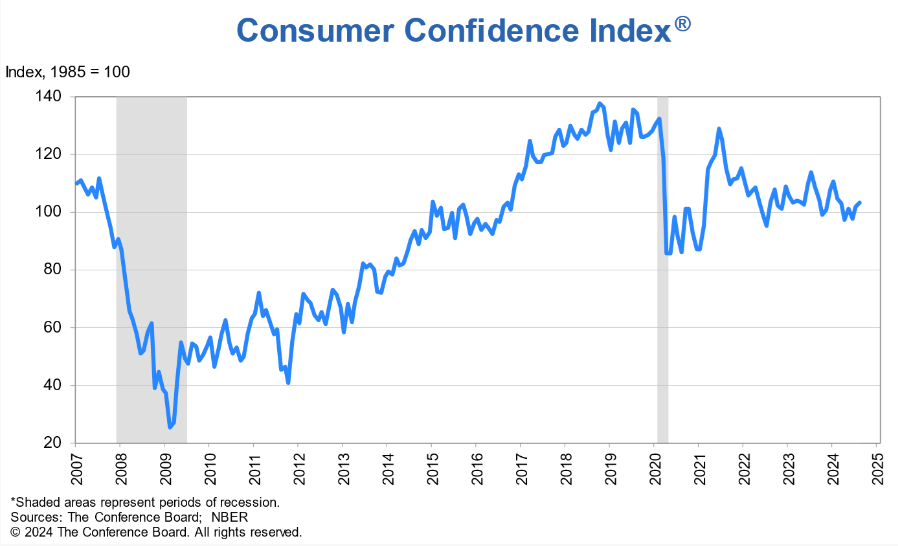

The Conference Board Consumer Confidence Index® rose in August 2024 to 103.3 (1985=100), from an upwardly revised 101.9 in July. The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—improved to 134.4 from 133.1 in July. Dana M. Peterson, Chief Economist at The Conference Board added:

Overall consumer confidence rose in August but remained within the narrow range that has prevailed over the past two years. Consumers continued to express mixed feelings in August. Compared to July, they were more positive about business conditions, both current and future, but also more concerned about the labor market. Consumers’ assessments of the current labor situation, while still positive, continued to weaken, and assessments of the labor market going forward were more pessimistic. This likely reflects the recent increase in unemployment. Consumers were also a bit less positive about future income. In August, confidence declined among consumers under 35 while it increased for those 35 and older. On a six-month moving average basis, confidence remained the highest among young consumers. Despite the overall improvement in the headline Index, confidence declined for consumers earning less than $25K. On a six-month moving average basis, consumers earning over $100K remained the most confident. Confidence among consumers earning $15K to $24.9K continued to trend down and was almost as low as for those earning less than $15K.

Here is a summary of headlines we are reading today:

- Iran Nuclear Deal ‘Off the Table,’ U.S. Affirms

- Norway’s Natural Gas Exports Surge in 2024

- Largest U.S Grid Faces Tough Test as Heat Wave Hits Midwest

- Goldman Sachs Cuts Its Expected Oil Price Range by $5

- Low Hydro Storage Forces New Zealand to Boost Fossil Fuel Power Generation

- Home prices hit record high in June on S&P Case-Shiller Index

- Nvidia has become world’s ‘most important stock,’ adding pressure to upcoming earnings report

- S&P 500, Nasdaq close slightly higher Tuesday, lifted by Nvidia shares: Live updates

- 2 people killed, 1 injured in reported tire explosion at Delta facility in Atlanta’s Hartsfield-Jackson airport

- Freezing your credit is the first step to avoid identity theft, expert says. Here’s what to know

- Solid 2Y Treasury Auction Prices At Lowest Yield In Two Years

- Lowe’s becomes latest company to back away from diversity plans

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.