10 SEPT 2024 Market Close & Major Financial Headlines: Small Caps Lead The Markets Higher While The Dow Closes Moderately Lower

Summary Of the Markets Today:

- The Dow closed down 93 points or 0.23%,

- Nasdaq closed up 0.84%,

- S&P 500 closed up 0.45%,

- Gold $2,545 up $12.60,

- WTI crude oil settled at $66 down $2.52,

- 10-year U.S. Treasury 3.646 down 0.053 points,

- USD index $101.62 up $0.07,

- Bitcoin $57,839 up $834 or 0.46%,

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

U.S. stock markets experienced a mixed performance in a volatile trading session on Tuesday as investors anticipated a crucial consumer inflation report on Wednesday. This report is seen as key to determining the timing and size of potential interest rate cuts by the Federal Reserve.

JPMorgan Chase shares dropped about 5% after warning that forecasts for net interest income were too high, weighing on the Dow. Brent crude dropped below $70 per barrel, reaching its lowest level since December 2021. The decline followed OPEC’s lowered demand growth forecast for 2024 and 2025. Apple shares edged lower after losing an EU court battle over a $14 billion tax bill. Oracle stock jumped more than 10% following strong earnings, driven by cloud services demand.

Markets are also anticipating the first presidential debate between Donald Trump and Kamala Harris on tonight. The market’s volatility reflects investors’ uncertainty, balancing hopes for significant rate cuts against concerns about potential recession risks.

Click here to read our current Economic Forecast – September 2024 Economic Forecast: One Recession Flag Removed With Three Remaining

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

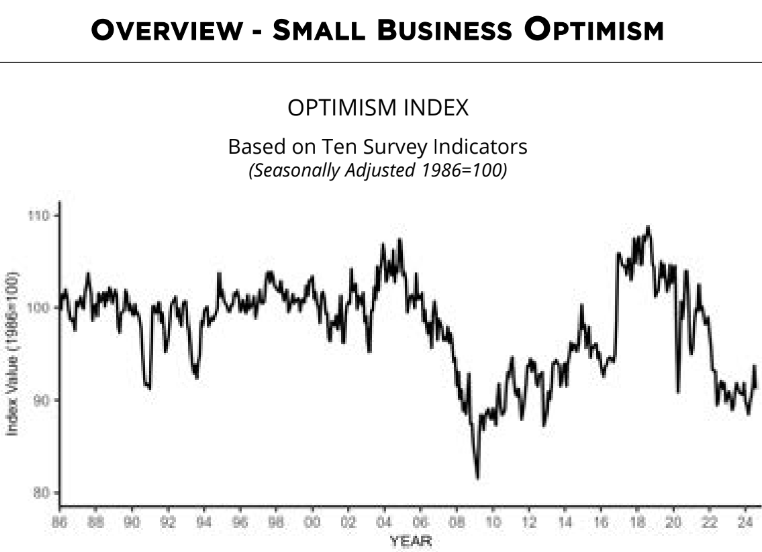

The NFIB Small Business Optimism Index fell by 2.5 points in August 2025 to 91.2, erasing all of July’s gain. This is the 32nd consecutive month below the 50-year average of 98. The Uncertainty Index rose to 92, its highest level since October 2020. Inflation remains the top issue among small business owners, with 24% of owners reporting it as their top small business operating issue, down one point from July. NFIB Chief Economist Bill Dunkelberg added:

The mood on Main Street worsened in August, despite last month’s gains. Historically high inflation remains the top issue for owners as sales expectations plummet and cost pressures increase. Uncertainty among small business owners continues to rise as expectations for future business conditions worsen.

Here is a summary of headlines we are reading today:

- WTI Oil Price Hits 3-Year Low Ahead of Trump-Harris Showdown

- Falling Chinese Steel Prices Send Ripples Through Global Markets

- Oil Prices Drop 4.5% On Record-Bearish Sentiment from Money Managers

- European Natural Gas Prices Drop as Wind Power Soars

- Futures Prices Point to Spike in U.S. Natural Gas Prices in 2025

- Two key inflation reports this week will help decide the size of the Fed’s interest rate cut

- JPMorgan Chase shares drop 5% after bank tempers guidance on interest income and expenses

- Crypto will be ‘big boon’ for financial services over time, Robinhood CEO says: CNBC Crypto World

- Jamie Dimon says ‘the worst outcome is stagflation,’ a scenario he’s not taking off the table

- Volkswagen Declares War On Unions, Scraps Three-Decade-Old Job Protections

- Americans Lost $5.6 Billion In Cryptocurrency Scams Last Year, FBI Says

- Biden’s FAA Punishes SpaceX, Delays Starship Rocket Launch By Months

- Falling oil prices and China concerns add fuel to market fears of a U.S. recession

- Treasury yields establish fresh 2024 lows amid persistent recession worries

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.