Summary Of the Markets Today:

- The Dow closed up 235 points or 0.58%,

- Nasdaq closed up 1.00%,

- S&P 500 closed up 0.75%,

- Gold $2,586 up $43.80,

- WTI crude oil settled at $69 up $1.92,

- 10-year U.S. Treasury 3.687 up 0.034 points,

- USD index $101.28 down $0.40,

- Bitcoin $57,730 up $126 or 0.22%,

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

[Publisher note: This section highlights what the markets’ believe – and much of it is opinion and may be contradicted by our review of market releases.] U.S. stocks rose on Thursday as investors processed new inflation and labor data ahead of the Federal Reserve’s upcoming interest rate decision. The August Producer Price Index (PPI) data released on Thursday indicated easing inflationary pressures. Additionally, initial jobless claims climbed more than anticipated, reaching 230,000 last week, an increase of 2,000 from the previous week. These reports led traders to increase their odds of a 25 basis point rate cut to 87%, up from 50% just days earlier. The market’s reaction suggests that investors are now leaning towards expectations of a smaller, quarter-point interest rate cut from the Federal Reserve next week, rather than a larger half-point reduction. This shift in sentiment follows the release of consumer price data on Wednesday, which showed gradual cooling of inflation. In the corporate sector, Moderna’s shares fell by 12% after the company lowered its annual revenue outlook for 2025 and announced plans to reduce its research and development budget. Meanwhile, tech stocks led the market gains, with companies like Nvidia and Meta each rising by approximately 2%.

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

In the week ending September 7, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 230,750, an increase of 500 from the previous week’s revised average. The previous week’s average was revised up by 250 from 230,000 to 230,250.

According to CoreLogic, home prices nationwide, including distressed sales, increased year over year by 4.3% in July 2024. The CoreLogic HPI Forecast indicates that home prices will rise by 2.2% on a year-over-year basis from July 2024 to July 2025.

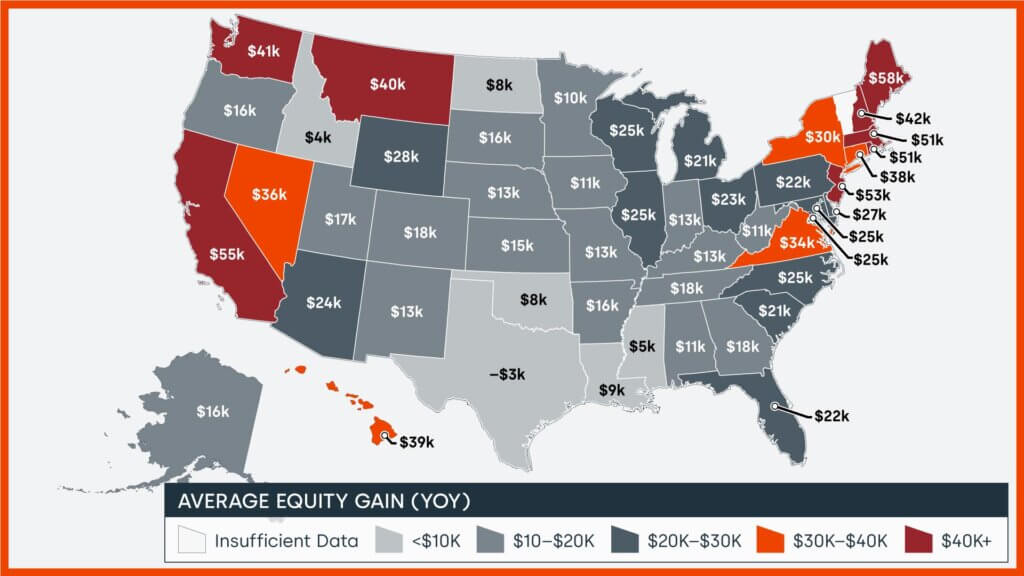

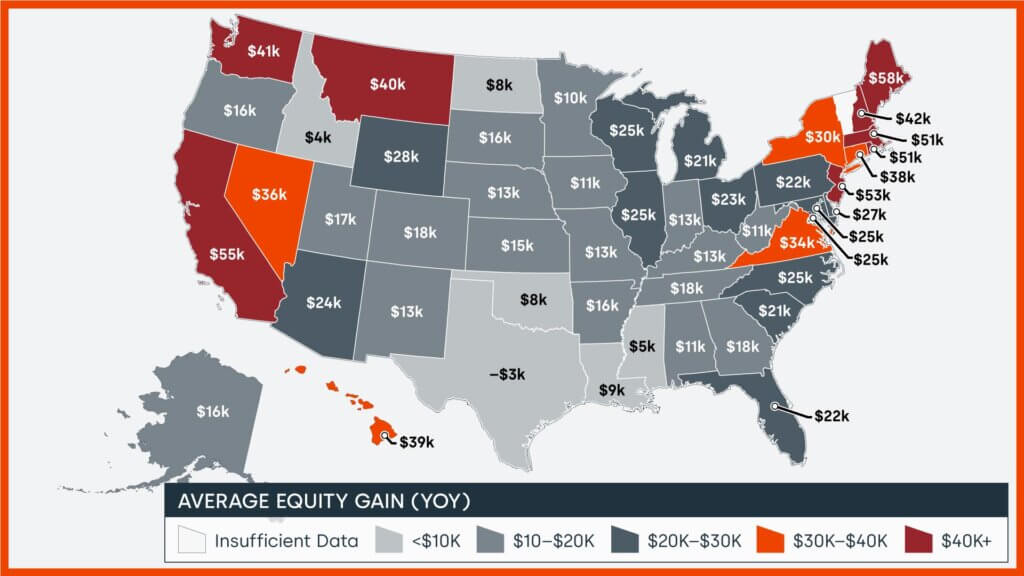

CoreLogic’s Homeowner Equity Report (HER) for the second quarter of 2024 shows that U.S. homeowners with mortgages (which account for roughly 62% of all properties) saw home equity increase by 8.0% year over year.

The Producer Price Index for final demand increased 1.7% for the 12 months ended in August 2024 (down from 2.1% for the previous month). What is going on is that the prices for oil have decreased significantly year-over-year which is evident when one removes food, energy, and trade – which shows the year-over-year inflation rate has remained steady around 3.3% year-over-year. The Federal Reserve generally removes food and energy when they look at inflation pressures – and the current situation shows inflation pressures are not subsiding but remaining steady.

Here is a summary of headlines we are reading today:

- How Falling Oil Prices Could Save The Economy

- Nippon Steel’s Investment Could Revitalize U.S. Steel Industry

- Why Goldman Sachs is Still Bearish on Lithium

- Florida LNG Export Project Delayed Five Years Due to Supply Chain Issues

- Europe’s LNG Ambitions Face Reality Check

- U.S. Gasoline Prices Set to Drop Below $3 Before Election Day

- Here’s the deflation breakdown for August 2024 — in one chart

- Dow closes 200 points higher, S&P 500 posts four-day win streak as tech giants rally: Live updates

- Interest payments on the national debt top $1 trillion as deficit swells

- New high yield funds are hitting the market as Fed prepares to cut interest rates

- Trump rejects second Harris debate

- “We’re Just Giving Them Away”: EV Leases Have Plunged To As Low As $20 Per Month

- National debt forecast to treble over next 50 years

- Sell signs are all over the stock market now — but the bulls are holding out

- 30-year Treasury yield finishes just below 4% after soft bond auction

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Federal Reserve data release (Z.1 Flow of Funds) – which provides insight into the finances of the average household – shows most Americans are worse off in the second quarter of 2024 than they were in the first quarter – and also are worse off than they were one year ago. This is notwithstanding that their average net worth increased from $152,985 one year ago to $163,797 in 2Q 2024.

The Federal Reserve data release (Z.1 Flow of Funds) – which provides insight into the finances of the average household – shows most Americans are worse off in the second quarter of 2024 than they were in the first quarter – and also are worse off than they were one year ago. This is notwithstanding that their average net worth increased from $152,985 one year ago to $163,797 in 2Q 2024.