24 SEPT 2024 Market Close & Major Financial Headlines: Markets Opened Higher, Took A dip Into The Red Before Trading Higher Where The Dow And The S&P 500 Set New Record Highs

Summary Of the Markets Today:

- The Dow closed up 84 points or 0.20%, (Closed at 42,208, New Historic high 42,281)

- Nasdaq closed up 0.56%,

- S&P 500 closed up 0.25%, (Closed at 5,733, New Historic high 5,734)

- Gold $2,687 up $34.80,

- WTI crude oil settled at $72 up $1.17,

- 10-year U.S. Treasury 3.732 down 0.006 points,

- USD index $100.37 down $0.48,

- Bitcoin $64,378 up $991 or 1.56%,

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

US stocks experienced modest gains on Tuesday, with both the S&P 500 and Dow Jones Industrial Average achieving record closes. Investor sentiment was bolstered by China’s announcement of significant stimulus measures aimed at revitalizing its economy, which had a positive ripple effect on global markets. Notably, US-listed Chinese e-commerce stocks surged, with JD.com seeing a nearly 14% jump following the news. However, this optimism was tempered by a decline in US consumer confidence; the Conference Board’s index fell to 98.7 in September from 105.6 in August, missing economists’ expectations. The Federal Reserve’s recent interest rate cuts also contributed to market positivity, despite some dissent among policymakers regarding inflation risks. Fed Governor Michelle Bowman expressed concerns about potential inflationary pressures following last week’s half-point rate cut.

Click here to read our current Economic Forecast – September 2024 Economic Forecast: One Recession Flag Removed With Three Remaining

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

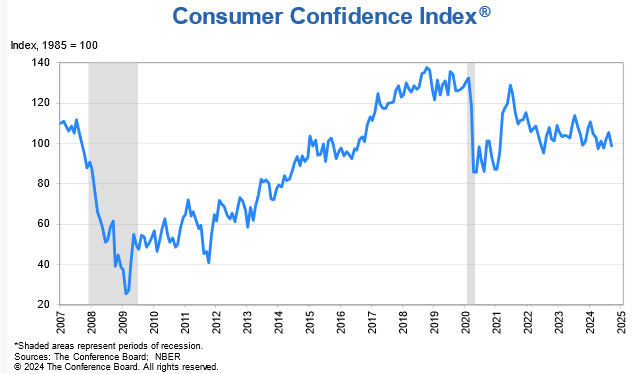

The Conference Board Consumer Confidence Index® fell in September 2024 to 98.7 (1985=100), from an upwardly revised 105.6 in August. Consumer Confidence has been little changed in the the last 2 years. Dana M. Peterson, Chief Economist at The Conference Board added:

Consumer confidence dropped in September to near the bottom of the narrow range that has prevailed over the past two years. September’s decline was the largest since August 2021 and all five components of the Index deteriorated. Consumers’ assessments of current business conditions turned negative while views of the current labor market situation softened further. Consumers were also more pessimistic about future labor market conditions and less positive about future business conditions and future income. The drop in confidence was steepest for consumers aged 35 to 54. As a result, on a six-month moving average basis, the 35–54 age group has become the least confident while consumers under 35 remain the most confident. Confidence declined in September across most income groups, with consumers earning less than $50K experiencing the largest decrease. On a six-month moving average basis, consumers earning over $100K remained the most confident.

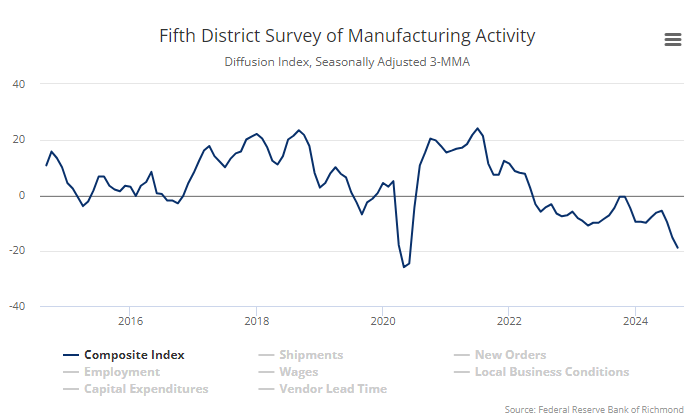

Richmond Fed manufacturing activity remained sluggish in September 2024. The composite manufacturing index edged down from −19 in August to −21 in September. Of its three component indexes, shipments decreased from −15 to −18, new orders increased from −26 to −23, and employment fell from −15 to −22. Manufacturing remains in a recession in the USA.

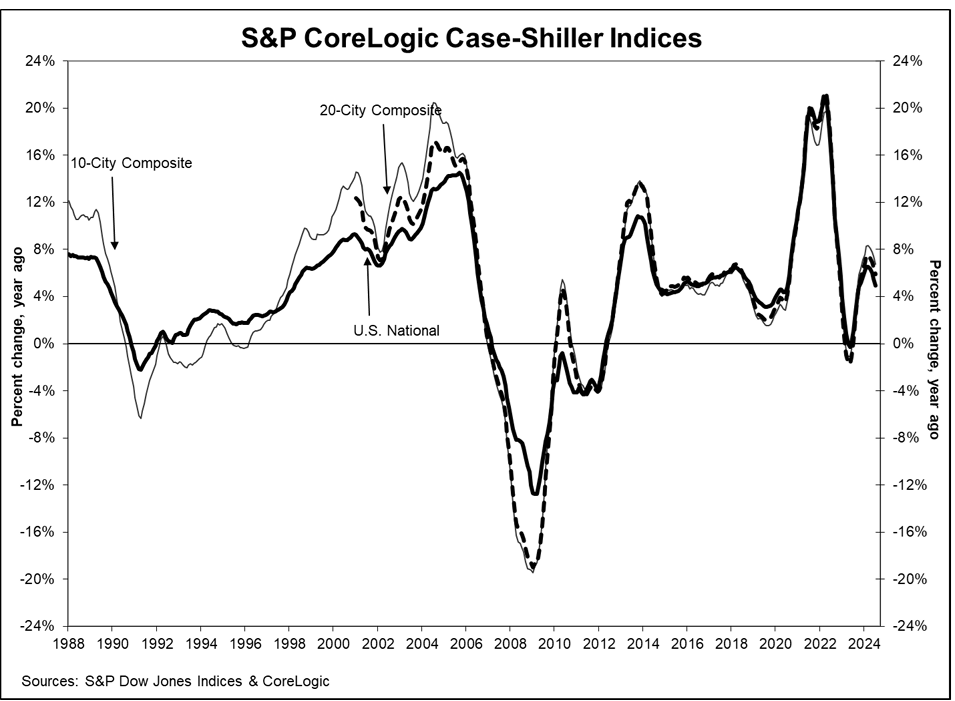

The S&P CoreLogic Case-Shiller 20-City Composite posted a year-over-year increase of 5.9% in July 2024, dropping from a 6.5% increase in the previous month. CoreLogic Chief Economist Dr. Selma Hepp explains:

With the summer characterized by broader cooling of housing demand amid high mortgage rates, home prices continued to weaken, and July monthly gains appear to be falling below the historical trend. Nevertheless, with a speedy decline in mortgage rates since August, housing market demand tracked by pending sales activity in CoreLogic data is finally showing signs of a rebound, which is expected to boost monthly price gains and return them to historical trends. Interestingly, the weakness in home prices remains in markets that have struggled with demand this year, including markets in Texas and Florida, while more expensive Western markets started to feel the pressure from rising rates in late spring. Going forward, home prices are likely to see a boost from a drop in mortgage rates and improved affordability.

Here is a summary of headlines we are reading today:

- Rising EV Charging Costs Threaten UK’s Electric Vehicle Adoption

- Saudi Aramco Looks To Raise $3 Billion from New Bond Issue

- Goldman Sees Upside for Oil Prices Amid Supply Concerns

- Coal’s Resurgence Challenges Global Energy Transition

- The U.S. Is the World’s Top Gasoline Exporter

- 81% of New Renewable Energy Capacity Added in 2023 Was Cheaper Than Fossil Fuels

- ‘Stop ripping us off’: Senate grills Novo Nordisk CEO on weight loss drug pricing

- September consumer confidence falls the most in three years

- S&P 500 rises to new record high Tuesday, posts back-to-back gains: Live updates

- ‘Childless cat lady’ is a more common lifestyle choice. Here’s what being child-free means for your money

- US accuses Visa of debit card monopoly

- Oil ends higher after back-to-back losses as China announces stimulus measures

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.