- The Dow closed down 185 points or 0.44%,

- Nasdaq closed down 7 points or 0.04%,

- S&P 500 closed down 10 points or 0.17%,

- Gold $2,678 up $8.50 or 0.28%,

- WTI crude oil settled at $74 up $3.83 or 5.31%,

- 10-year U.S. Treasury 3.850 up 0.067 points or 0.54%,

- USD index $101.97 up $0.30 or 0.3%,

- Bitcoin $60,987 up $314 or 0.52%,

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

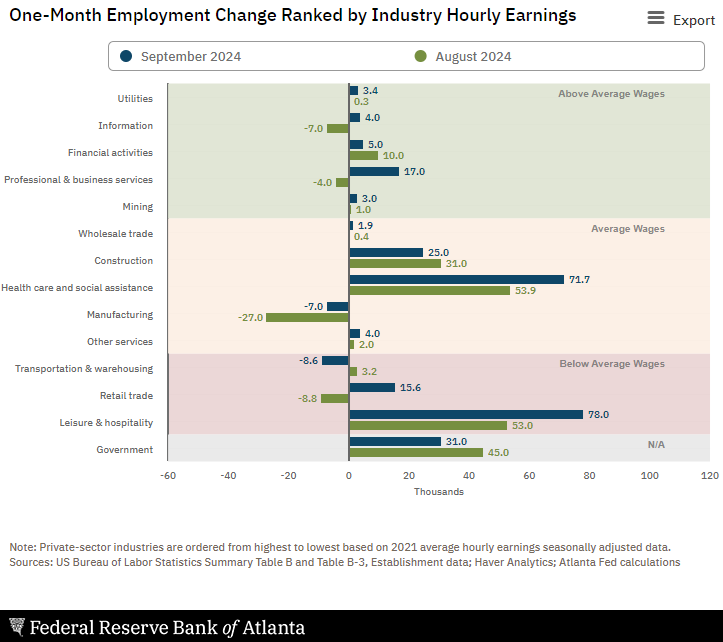

U.S. stocks slipped on Thursday as investors turned their focus back to the economy and the upcoming monthly jobs report, while concerns over the Middle East conflict pushed oil prices higher. Here are the key points: Investors are bracing for the September jobs report to be released on Friday. This comes after a surprise uptick in private payrolls and signs of loosening in the labor market. Weekly jobless claims increased slightly from the previous week, indicating a general cooling trend in the labor market. A report from Challenger, Gray and Christmas showed planned layoffs in the U.S. decreased from a five-month high. The ongoing Israel-Iran crisis has contributed to rising oil prices for the third consecutive day. Brent crude and West Texas Intermediate futures both gained over 5% following comments from President Biden about a potential Israeli retaliatory attack on Iran’s oil facilities. Signs of labor market deterioration could prompt the Federal Reserve to consider another significant interest rate cut, following last month’s 0.5% reduction. Tesla stock continued to decline, falling more than 3% on Thursday, following disappointing delivery figures and reports of halting U.S. online orders for its cheapest Model 35.

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

New orders for manufactured goods in August 2024 were down 0.6% year-over-year – down from +3.8% the previous month. I believe that manufacturing remains in a recession and no action to re-shore manufacturing is evident.

U.S.-based employers announced 72,821 job cuts in September 2024, a 4% decrease from the 75,891 cuts announced one month prior. It is up 53% from the 47,457 cuts announced in the same month in 2023. The current layoffs are a sign of a mature market where employers are trying to optimize profits. Andrew Challenger, Senior Vice President of Challenger, Gray & Christmas, Inc. added:

We’re at an inflection point now, where the labor market could stall or tighten. It will take a few months for the drop in interest rates to impact employer costs, as well as consumer savings accounts. Consumer spending is projected to increase, which may lead to more demand for workers in consumer-facing sectors. Layoff announcements have risen over last year, and job openings are flat. Seasonal employers seem optimistic about the holiday shopping season. That said, many of those who found themselves laid off this year from high-wage, high-skill roles, will not likely fill seasonal positions.

In the week ending September 28, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 224,250, a decrease of 750 from the previous week’s revised average. The previous week’s average was revised up by 250 from 224,750 to 225,000. There is no sign of a recession in this data.

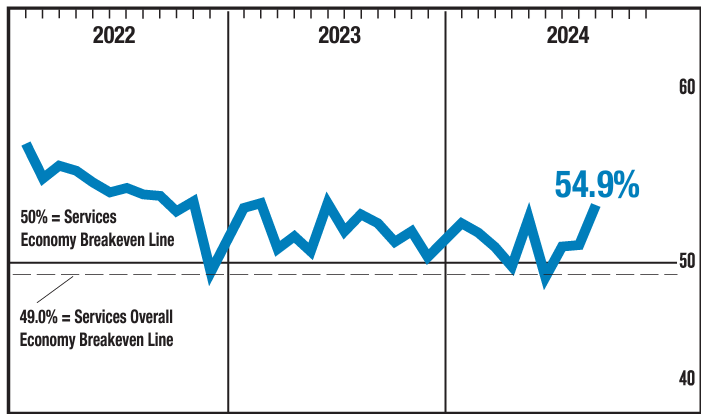

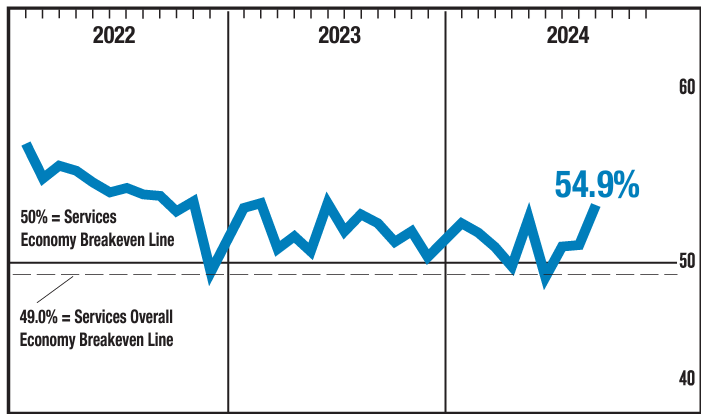

In September 2024 , the ISM Services PMI® registered 54.9%, 3.4 percentage points higher than August’s figure of 51.5 percent. The Business Activity Index registered 59.9 percent in September, 6.6 percentage points higher than the 53.3 percent recorded in August, indicating a third month of expansion after a contraction in June. The New Orders Index expanded to 59.4 percent in September, 6.4 percentage points higher than August’s figure of 53 percent. The Employment Index contracted for the first time in three months; the reading of 48.1 percent is a 2.1-percentage point decrease compared to the 50.2 percent recorded in August. These are not great numbers as the US is a services driven economy – but at least they are moving in the right direction.

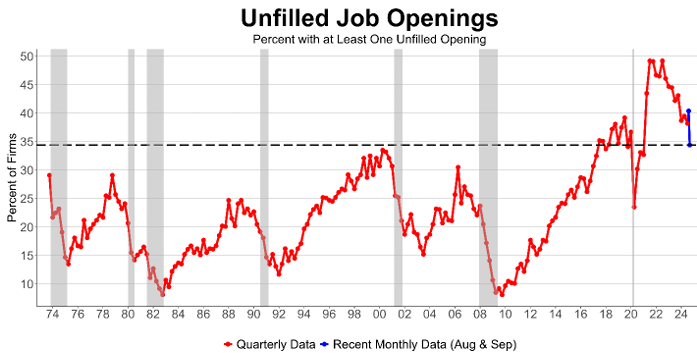

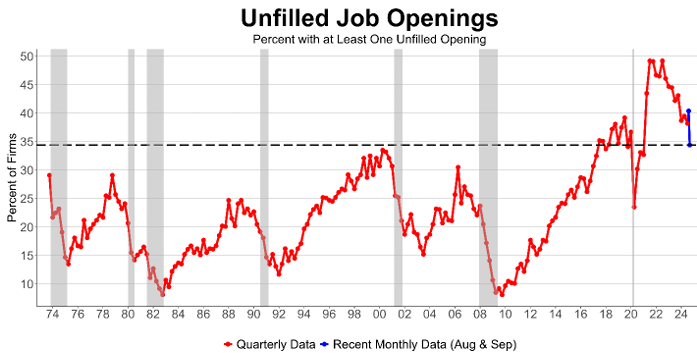

NFIB’s September jobs report found that 34% (seasonally adjusted) of small business owners reported job openings they could not fill in September, down 6 points from August and the lowest reading since January 2021. It appears that the abnormally high unfilled positions in small business is moderating. NFIB Chief Economist Bill Dunkelberg added:

Overall, the job market appears to be softening. Fewer small firms have openings they can’t fill as we head into fall. But many still report trouble finding qualified applicants and plans to increase compensation is once again on the rise.

Here is a summary of headlines we are reading today:

- AI-Powered Disinformation Campaigns Target U.S. Voters

- Nuclear Power Gains Momentum as Multiple Plants Seek Revival

- Reuters Poll Shows OPEC September Output At Yearly Low

- Oil Explodes 4% Amid Talk of Israel Attacking Iranian Oil & Gas

- Bank of England Warns Middle East Conflict Could Lead to a Major Oil Price Shock

- Here’s everything to expect when the September jobs report is released Friday

- Panic buying amid U.S. ports strike is creating supermarket supply concerns

- U.S. crude oil jumps as Biden comments on possible Israel retaliation against Iran

- OpenAI gets $4 billion revolving credit line, giving it more than $10 billion in liquidity

- States affected by Hurricane Helene warn of price gouging and other scams. Here’s how to avoid being a victim of post-storm schemes

- Why Open AI’s $100 billion 2029 revenue target seems like a tech-fever dream

- 10-year Treasury yield ends at highest level since August after better-than-expected ISM data

Click on the “Read More”