NOAA Updates its ENSO Alert on October 10, 2024 – We Remain in ENSO Neutral – Published October 11, 2024

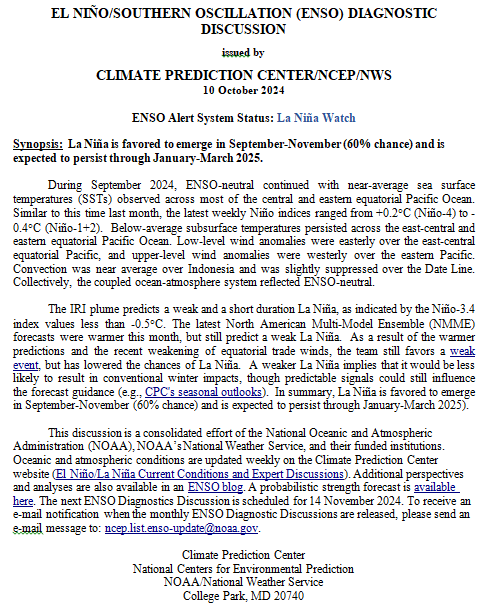

“Synopsis: La Niña is favored to emerge in September-November (60% chance) and is expected to persist through January-March 2025. ”

So we are really in ENSO Neutral but NOAA may not want to admit their forecast was wrong so they present it as waiting for La Nina. It is correct that we are in La Nina Watch but it is also correct that we currently remain in ENSO Neutral.

On the second Thursday of every month, NOAA (really their Climate Prediction Center CPC) issues its analysis of the status of ENSO. This includes determining the Alert System Status. NOAA now describes their conclusion as “ENSO Alert System Status: La Nino Watch”

The exact timing of the transition is now perhaps more clear which should increase the reliability of the Seasonal Outlook to be issued next Thursday.

We have included an ENSO Blog article by Emily Becker.

CLIMATE PREDICTION CENTER ENSO DISCUSSION (LINK)

| The second paragraph is what is important:

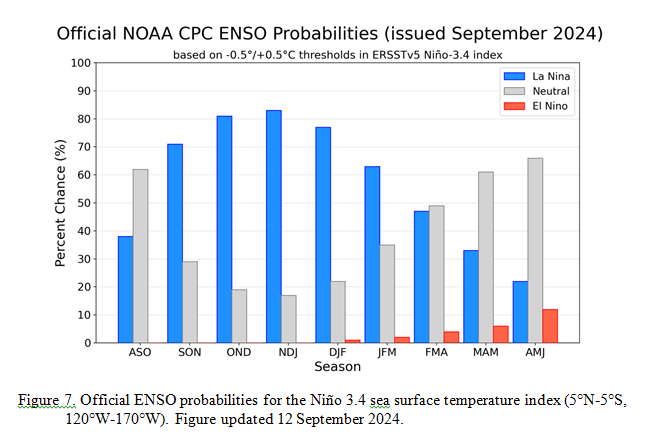

“The IRI plume predicts a weak and a short duration La Niña, as indicated by the Niño-3.4 index values less than -0.5°C. The latest North American Multi-Model Ensemble (NMME) forecasts were warmer this month, but still predict a weak La Niña. As a result of the warmer predictions and the recent weakening of equatorial trade winds, the team still favors a weak event, but has lowered the chances of La Niña. A weaker La Niña implies that it would be less likely to result in conventional winter impacts, though predictable signals could still influence the forecast guidance (e.g., CPC’s seasonal outlooks). In summary, La Niña is favored to emerge in September-November (60% chance) and is expected to persist through January-March 2025).” Below is the middle paragraph from the discussion last month. “The IRI plume predicts a weak and a short duration La Niña, as indicated by the Niño-3.4 index values less than -0.5°C (Fig. 6). This month, the team relies more on the latest North American Multi-Model Ensemble (NMME) guidance, which predicts La Niña to emerge in the next couple of months and continue through the Northern Hemisphere winter. The continuation of negative subsurface temperatures and enhanced low-level easterly wind anomalies supports the formation of a weak La Niña. A weaker La Niña implies that it would be less likely to result in conventional winter impacts, though predictable signals could still influence the forecast guidance (e.g., CPC’s seasonal outlooks). In summary, La Niña is favored to emerge in September-November (71% chance) and is expected to persist through January-March 2025 (Fig. 7).” |

We now provide additional details.

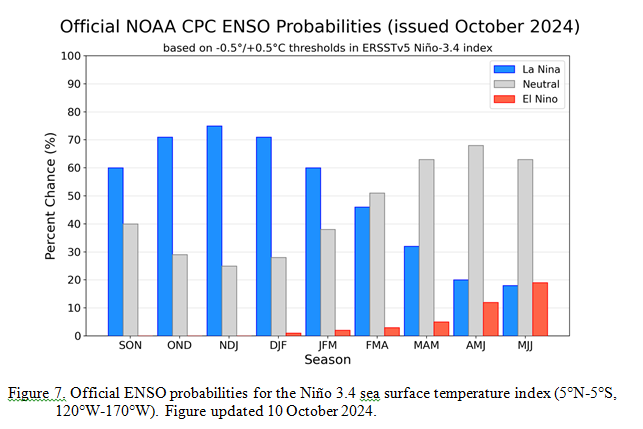

CPC Probability Distribution

Here are the new forecast probabilities. The probabilities are for three-month periods e.g. ASO stands for August/September/October.

![]() Here is the forecast from last month.

Here is the forecast from last month.

| The analysis this month and last month are a bit different with again the transition to La Nina being slightly slower than thought last month. Also the probabilities of a La Nina are lower than estimated last month. This seems to be a trend. The chart is clearer than the discussion in the summary report above. The La Nina is a bit slower to arrive. I am not sure that we will actually have a La Nina. |

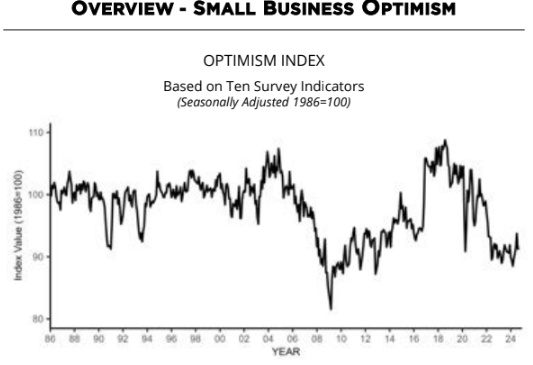

This graphic from Emily Becker’s ENSO Blog Post says it all.

| We have been waiting for this La Nina a long time. |

![[Image of WPC Flash Flooding/Excessive Rainfall Outlook]](https://www.nhc.noaa.gov/storm_graphics/AT14/refresh/AL1424WPCERO+gif/032332WPCERO_sm.gif)