Headlines:

Stocks end lower ahead of a 3-day holiday weekend amid continued Ukraine jitters.

The Oil And Gas Rig Count Continues To Soar.

Walt Disney World Increases Prices For Multiday And Park Hopper Tickets.

Gold Soars, Credit Cracks, Stocks Sink As Putin, Powell, & The President Pontificate.

Draftkings CEO California Sports Betting Revenue Could Help Address ‘Homelessness And Mental Health.’

Wall Street equities sea-sawed downward until 1320 EST, when markets reversed their downward spiral with help from the BTFD crowd. The DOW and oil prices mark the second losing week over the Russia-Ukraine tensions. The Russian invasion of Ukraine is becoming larger than life to some wary investors, even though quarterly financial reporting isn’t all that bad.

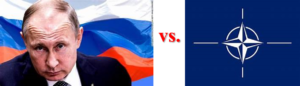

The primary force moving markets has been the distinct possibility of Russia invading Ukraine and creating a global problem not easily solved. The White House says Russia has deployed 190,000 troops, doubling its presents at the Ukrain border, while Russian sources claim a pullback.

WTI crude is trending downward, but support at the 90 mark is getting closer. Falling through the 89/90 support will certainly signal further depreciation to at least the 84 level. Gold started the session falling steeply from yesterday’s high of 1905 to eventually rebounding at noon from 1885 to settle at 1896. On the other hand, Silver rose from 23.66 at noon to 24.08 before sliding to 23.94 at 4 o’clock.

Bitcoin is drifting lower, falling through its SMA only to rise above the session low of 39500 to 40100. Dogecoin has been trading at the $0.1392 level and trending down over the last week.

Some analysts are betting choppy markets are here to stay. However, the red volume has been fractionally lower, suggesting that market swings are not conclusive of total investor sentiments. It also presents a ‘hold-and-see’ approach to the Fed’s approach to controlling inflation through interest rate manipulation.

A Fed Policy Mistake Would Be To Stay Loose Relative To Markets. Since April last year, the Fed has watched inflation rise higher. Front-end yields were patient, too, then, given the monetary authority’s inflation-targeting framework. But, as the price footprints began getting stronger and stronger, the Fed kept dismissing it as transitory. The reasoning was inflation failed to uncork above 2% in the longest post-war expansion before the pandemic struck, with the implicit suggestion being there is no reason to suspect this time would be different.

As usual, we have included below the headlines and news summaries moving the markets today.