03May2022 Market Close & Major Financial Headlines: Market’s Up Slightly And Awaiting Federal Reserve’s Rate Announcement Tommorrow

Summary Of the Markets Today

- The Dow up 0.2%,

- Nasdaq up 10.2%,

- S&P 500 up 0.5%,

- WTI crude oil down $22.24 to $102.91,

- gold up $3 to $1,866,

- Bitcoin down 2.1% to $37,659,

- 10-year U.S. Treasury down 2 basis points to 2.98%

Today’s Economic Releases

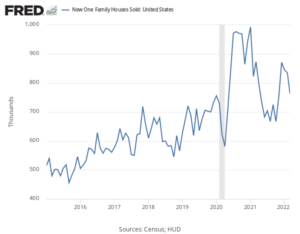

According to Corelogic, home price growth jumped to over 20% in March, marking the 14th straight month of double-digit price gains. However, annual gains are projected to slow to around 6% by next March, as rising mortgage rates and higher home prices hamper affordability for some home shoppers.

The BLS March 2022 Job Openings and Labor Turnover (JOLTS) shows job openings and hires were little changed at 11.5 million and 6.7 million respectively.

Other Economic News

As usual, we have included below the headlines and news summaries moving the markets today including:

- Shale Producers Face $42 Billion In Hedging Losses

- New Lockdowns In China Are Hindering Global Steel Supply

- Putin Publishes New Sanctions Against The West

- NASA chief says competition is making space exploration cheaper, in dramatic shift on contracts

- Russia beats final deadline to avoid debt default

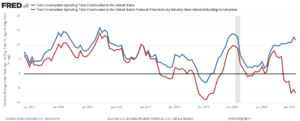

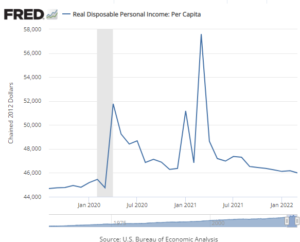

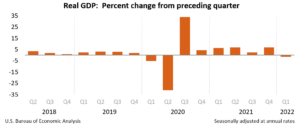

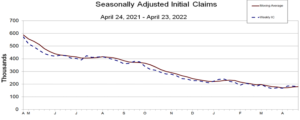

- How high can the Fed hike interest rates before a recession hits? This chart suggests a low threshold.