07June2022 Market Close & Major Financial Headlines: Wall Street Major Indexes Gap Down On The Opening Bell To See-Saw Higher Closing Near The Last Session Highs, Investors Shake Off Target Profit Warning Followed By Choppy Trading

Summary Of the Markets Today:

- The Dow closed up 264 points or 0.80%,

- Nasdaq closed up 0.89%,

- S&P 500 closed up 0.95%,

- WTI crude oil settled at 120, up 0.602%,

- USD $102.53 up 0.12%,

- Gold 1854 up 0.18%,

- Bitcoin $30950 up 4.77%,

- 10-year U.S. Treasury down 0.52% / 2.988%

Today’s Economic Releases:

According to an analysis by Calculated Risk, May 2022 rail carloads are down year-over-year. In normal economic times, contraction in the transport sector is a recession flag. But this contraction may be a sign of the supply chain catching up with demand combined with a modest economic slowing.

Consumer Credit expanded in April 2022 according to Federal Reserve headlines for G.19 data. However, consumer debt payments are about mid-range for the period since 1980 – this will worsen as interest rates rise.

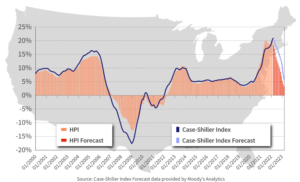

CoreLogic says home price growth continues its record-breaking streak growing by 20.9% year-over-year in April 2022. However, this growth is forecast to slow to 5.6% in the period April 2022 to April 2023.

The BEA reports that the trade deficit was $87.1 billion in April 2022 – down $20.6 billion from $107.7 billion in March. Interestingly, imports declined which is a usual recession flag.

A summary of headlines we are reading today:

- Upward Pressure On Oil Prices Is Only Going To Increase

- Target expects squeezed profits from an aggressive plan to get rid of unwanted inventory

- Stocks making the biggest moves midday: Target, Kohl’s, Peloton, and more

- Stocks & Bonds Spike As Growth/Stagflation Scares Soar

- Bond Report: 10- and 30-year Treasury yields drop by most in 2 weeks as investors await Friday’s U.S. inflation data

These and other headlines and news summaries moving the markets today are included below.