22July2022 Market Close & Major Financial Headlines: Wall Street Closed Lower. Weak Business Surveys Darken Outlook.

Summary Of the Markets Today:

- The Dow closed down 137 points or -0.43%,

- Nasdaq closed down 1.87%,

- S&P 500 down 0.93%,

- WTI crude oil settled at $95 down 1.6%,

- USD $106.57 down 0.32%,

- Gold $1723 up 0.6%,

- Bitcoin $22,725 down 1.8%,

- 10-year U.S. Treasury 2.5% unchanged,

- Baker Hughes Rig Count: U.S. +2 to 758 Canada +4 to 195

Today’s Economic Releases:

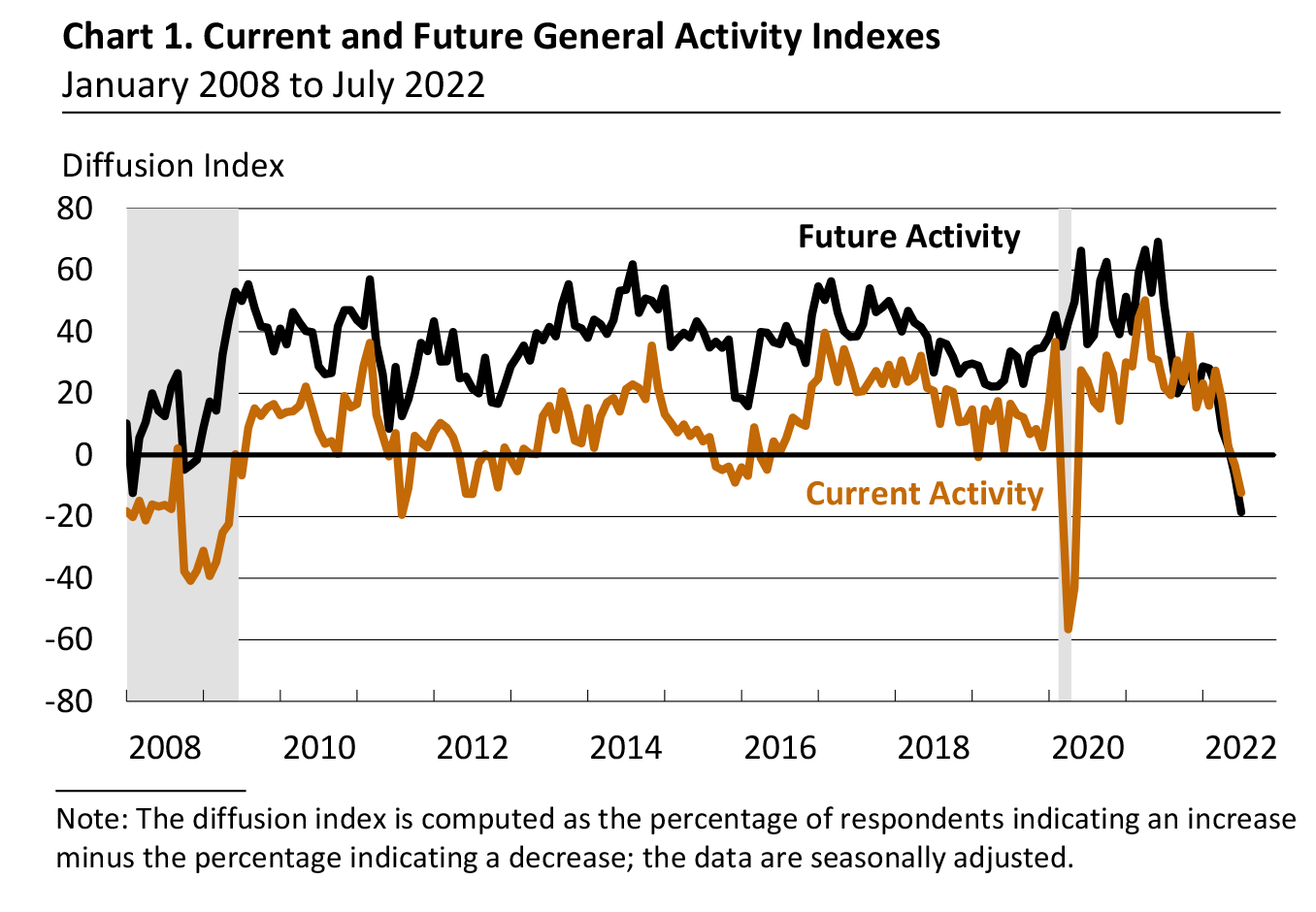

This morning’s reported financials were anything but reassuring. S&P Global Manufacturing PMI Flash JUL Fell To 52.3 From 52.7 – this was the weakest level in two years. S&P Global Composite PMI Flash JUL Fell To 47.5 From 52.3 – the rate of decline was the sharpest since the initial stages of the pandemic in May 2020. S&P Global Services PMI Flash JUL Fell To 47 From 52.7 – this was the weakest level in two years.

A summary of headlines we are reading today:

- U.S. Oil Rig Count Unchanged As WTI Slumps Below $100

- Verizon shares fall after company cuts full-year forecast

- Airlines were too ambitious chasing the travel rebound. Now they’re scaling back

- Convenience store chain 7-Eleven cuts 880 corporate jobs as part of restructuring

- Volkswagen CEO Forced Out After Clashes With Union Bosses

- “It All Adds Up To One Word: Pain”: Traders Forced To Chase Gamma Higher As Stocks Refuse To Drop Despite Dire News And Data

- Powell seen slowing Fed hikes after 75 basis points next week

- Top Ten: Weekend reads: Prepare for a big week — a crucial Federal Reserve decision, tech-company earnings and a GDP report

These and other headlines and news summaries moving the markets today are included below.