Summary Of the Markets Today:

- The Dow closed down 229 points or 0.71%,

- Nasdaq closed down 1.87%,

- S&P 500 down 1.15%,

- WTI crude oil settled at $95 down 1.51%,

- USD $107.18 up 0.65%,

- Gold $1716 down 0.186%,

- Bitcoin $20,828 down 5.52% – Session Low 20,760,

- 10-year U.S. Treasury 2.8% down 0.02%

Today’s Economic Releases:

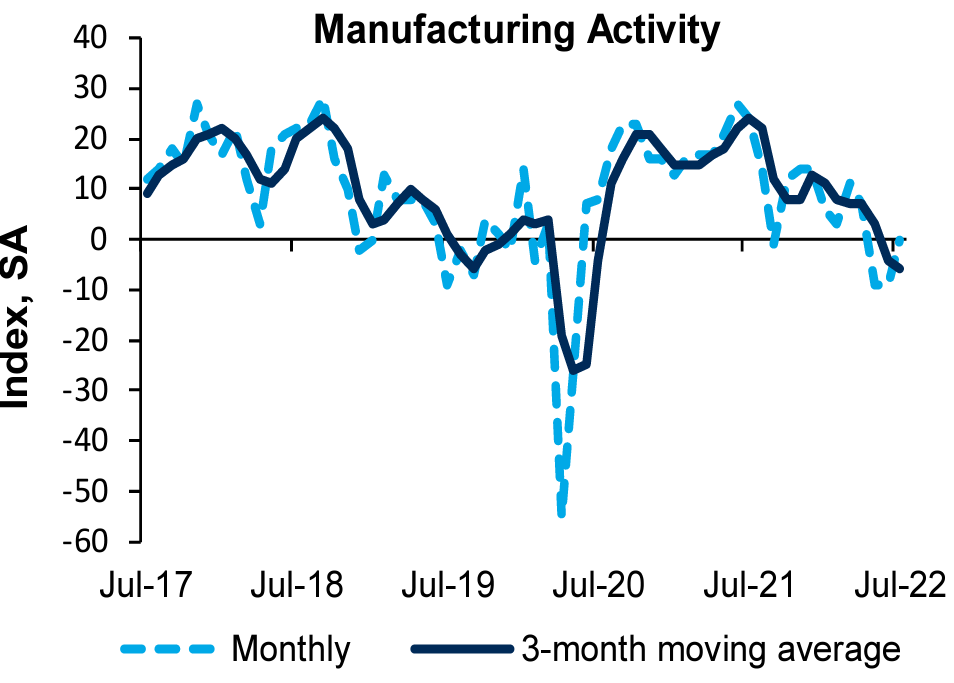

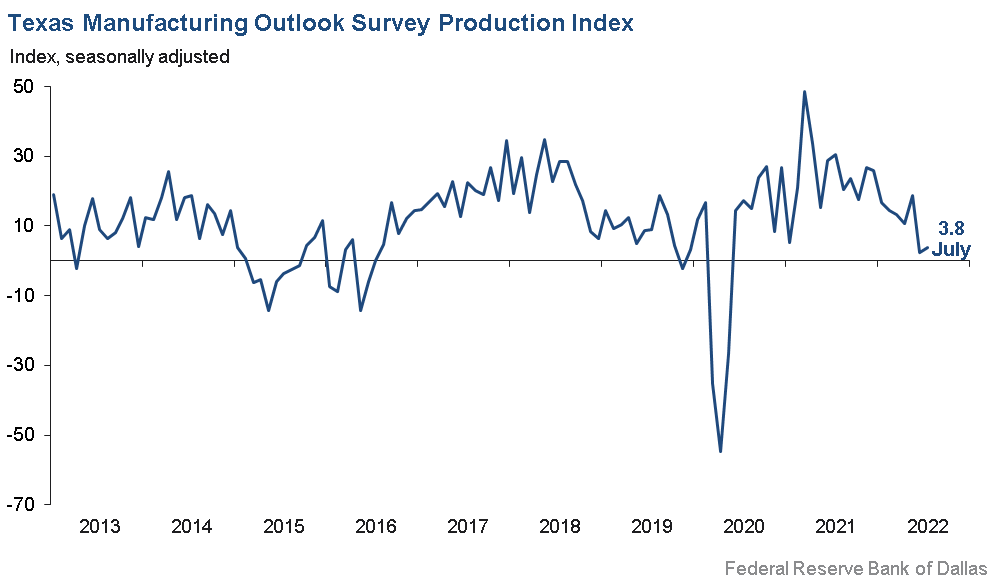

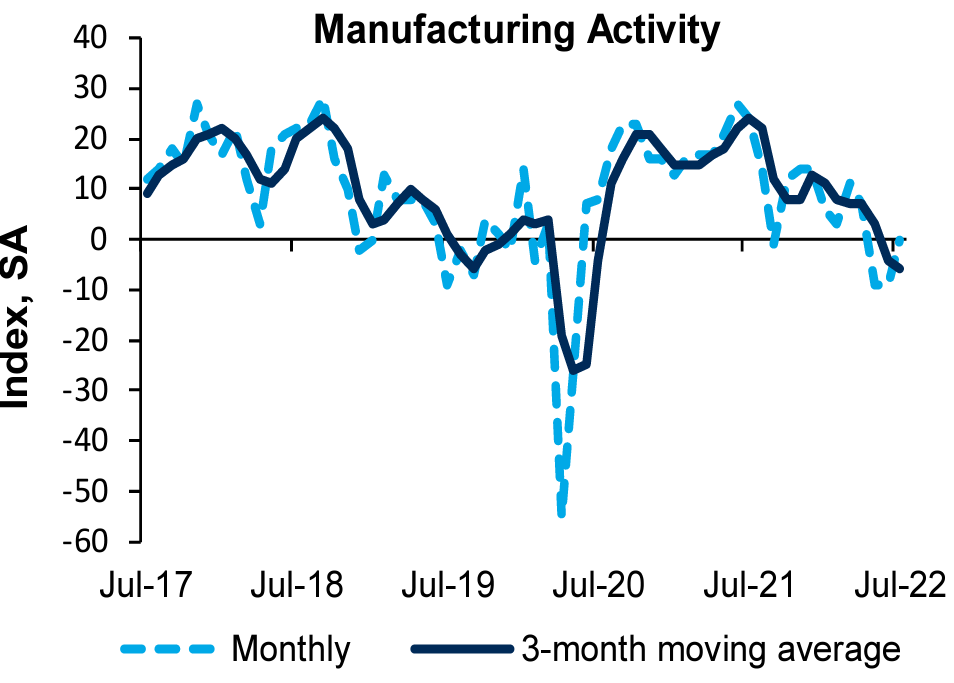

The Richmond Fed’s manufacturing index rose from −9 in June to 0 in July 2022.

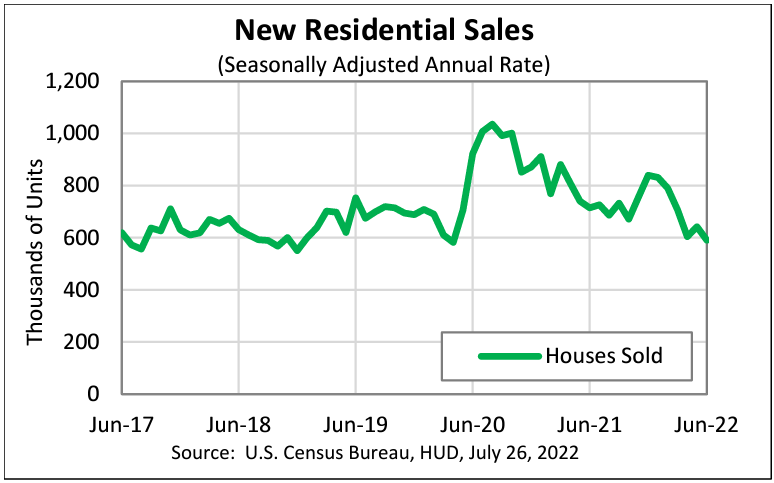

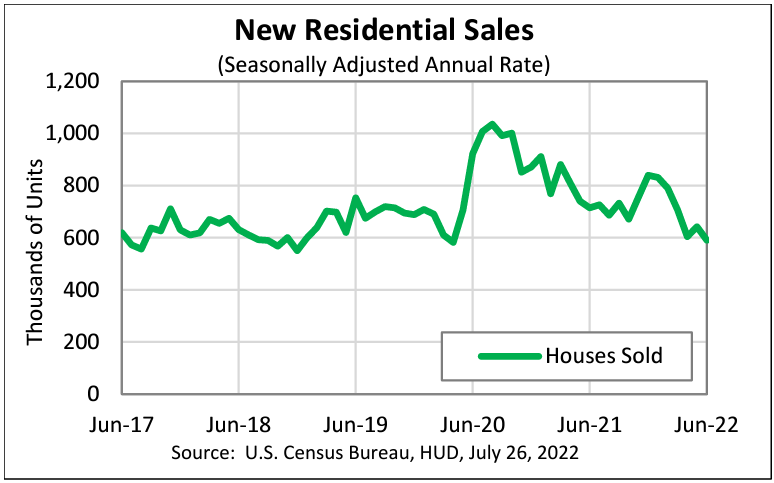

New residential sales for June 2022 was down 8.1% month-over-month and 17.4% year-over-year. The median and average sales prices continue to increase.

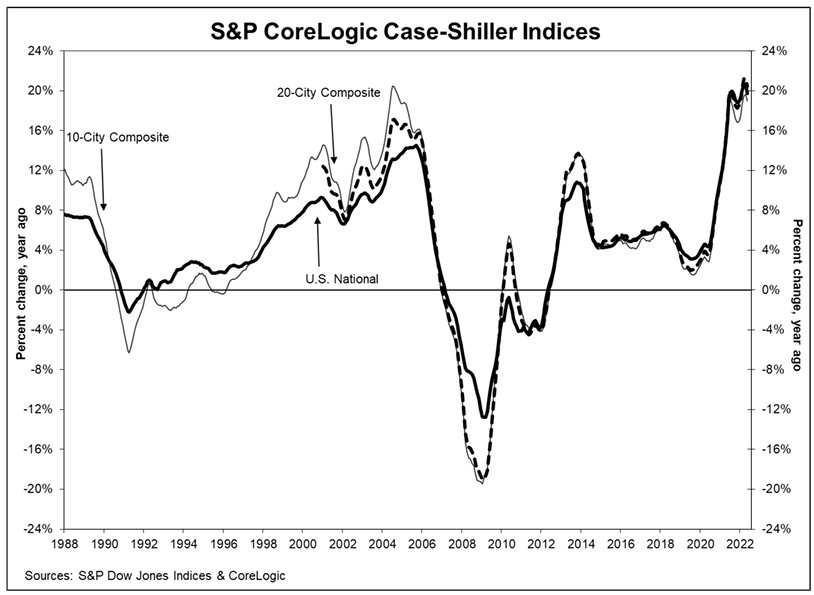

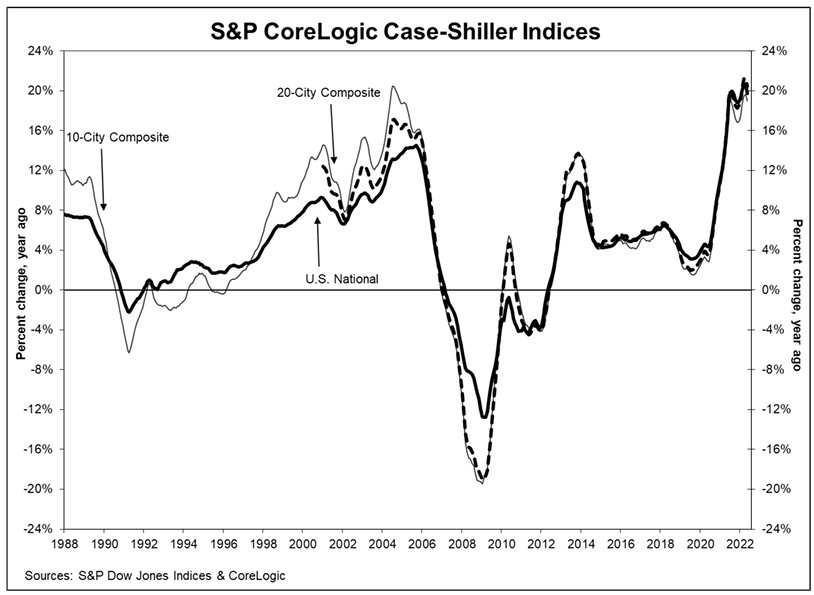

S&P Corelogic Case-Shiller Index Reports Annual Home Price Gain Of 19.7% year-over-year In May 2022. – marginally down from the 20.6% reported for April. CoreLogic Deputy Chief Economist Selma Hepp states:

Signs of slowing home buyer demand are spreading wider across markets. In May, the CoreLogic S&P Case-Shiller Index posted a second month of slowing growth, up 19.7%, but down from 20.6% peak in March and April. Nevertheless, some markets continue to heat up, particularly in Florida, but also Chicago, Boston and New York – marking search for deals in regions that suffered outmigration during the pandemic. Bifurcation in housing markets is also reflected in the ongoing competition for attractive properties that continue to have multiple offers and sell over the asking price, compared to those that are now seeing price reductions and remain unsold. But, given the continued pressure on properties that sell, home price growth is forecasted to remain elevated and in the mid-teens through the end of the year.

The Conference Board’s Consumer Confidence declined again in July 2022. Lynn Franco, Senior Director of Economic Indicators at The Conference Board stated:

Consumer confidence fell for a third consecutive month in July. The decrease was driven primarily by a decline in the Present Situation Index—a sign growth has slowed at the start of Q3. The Expectations Index held relatively steady, but remained well below a reading of 80, suggesting recession risks persist. Concerns about inflation—rising gas and food prices, in particular—continued to weigh on consumers. As the Fed raises interest rates to rein in inflation, purchasing intentions for cars, homes, and major appliances all pulled back further in July. Looking ahead, inflation and additional rate hikes are likely to continue posing strong headwinds for consumer spending and economic growth over the next six months.

A summary of headlines we are reading today:

- Oil Prices Slide As IMF Sees Global Economy Teetering On The Brink

- Russia To Leave ISS As Space Shakeup Continues

- Walmart’s slashed profit outlook sends a warning about the state of the American consumer

- General Motors falls short of Wall Street expectations as supply chain challenges dent profit

- Home price growth slowed for the second straight month in May, S&P Case-Shiller says

- Stocks, Crypto, & Yield Curve Tumble As ‘Strong Consumer’ Narrative Crushed

- Market Snapshot: Dow drops nearly 250 points as worries about big tech earnings weigh on stocks

These and other headlines and news summaries moving the markets today are included below.