Summary Of the Markets Today:

- The Dow closed down 86 points or 0.26%,

- Nasdaq closed up 0.41%,

- S&P 500 down 0.08%,

- WTI crude oil settled at $88 down 2.90%,

- USD $105.93 down 0.42%,

- Gold $1793 down 0.54%,

- Bitcoin $22,525 down 3.84% – Session Low 22,469,

- 10-year U.S. Treasury 2.663% down 0.085%

Today’s Economic Releases:

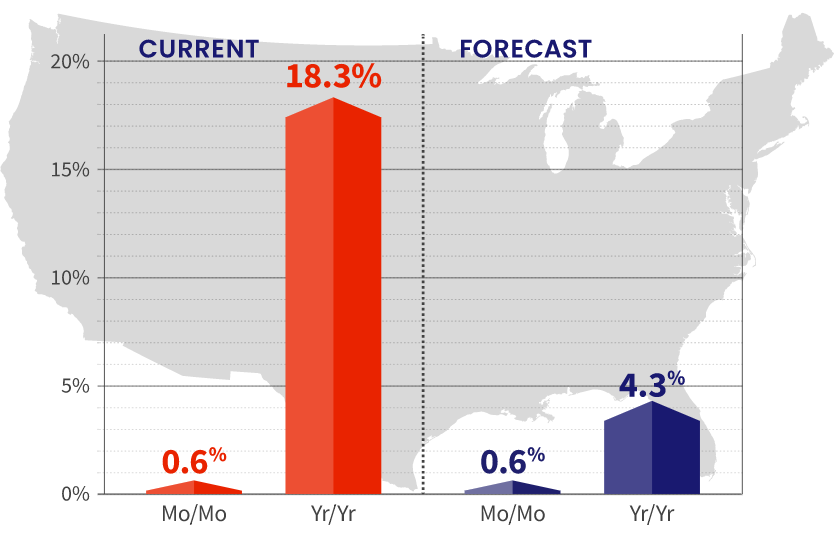

Tomorrow the BLS will issue the employment report for July 2022. Small businesses across the country continue to raise wages to keep employees and fill a historically high level of open positions, according to NFIB’s monthly jobs report. Seasonally adjusted, 49% of all owners reported job openings they could not fill in the current period, down one point from June and down two points from May’s 48-year record high. NFIB Chief Economist Bill Dunkelberg says:

Hiring has never been harder for small business owners. The labor shortage remains frustrating for many small business owners as they continue to manage inflation and other economic headwinds. Owners are adjusting business operations where they can to help mitigate lost sales opportunities due to staffing shortages.

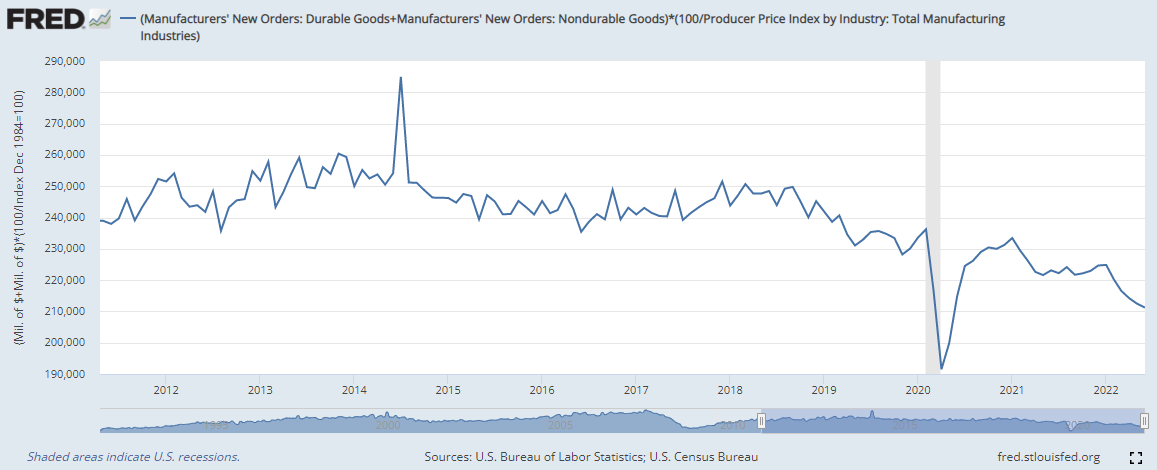

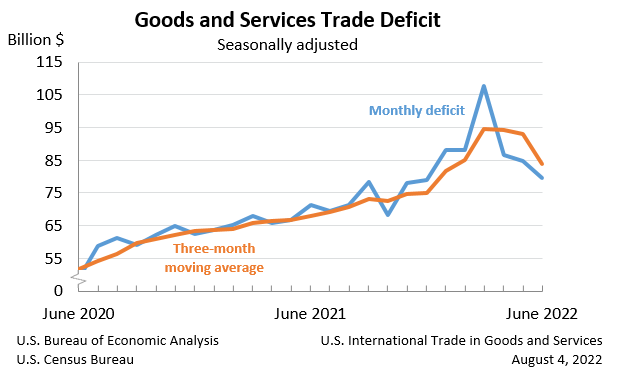

The U.S. monthly international trade deficit decreased in June 2022. Exports increased whilst imports decreased. In normal times, slowing imports suggests a slowing economy.

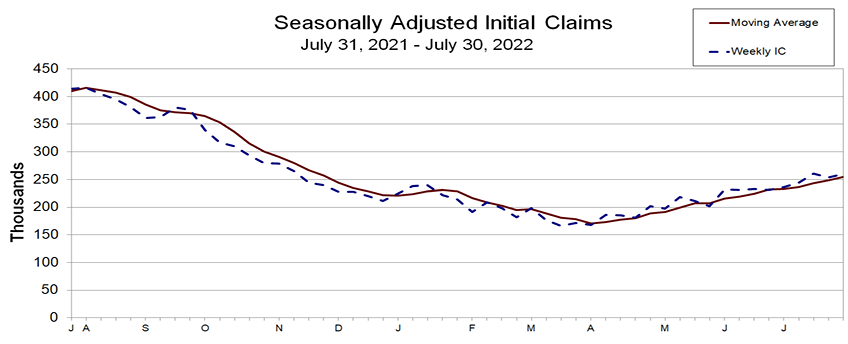

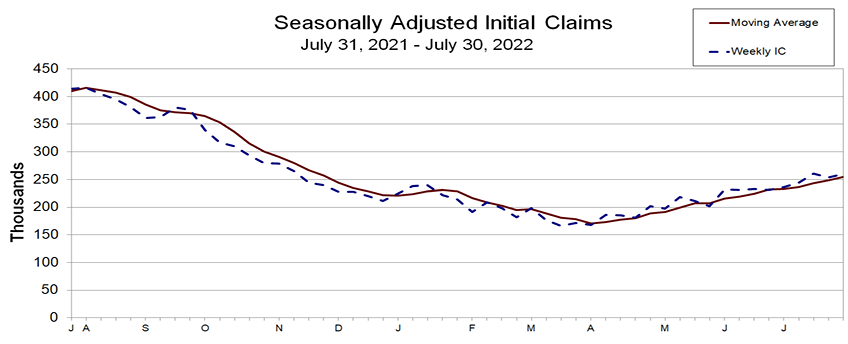

The 4-week moving average of initial unemployment insurance weekly claims increased from the previous week’s revised average – and continues to moderately increase.

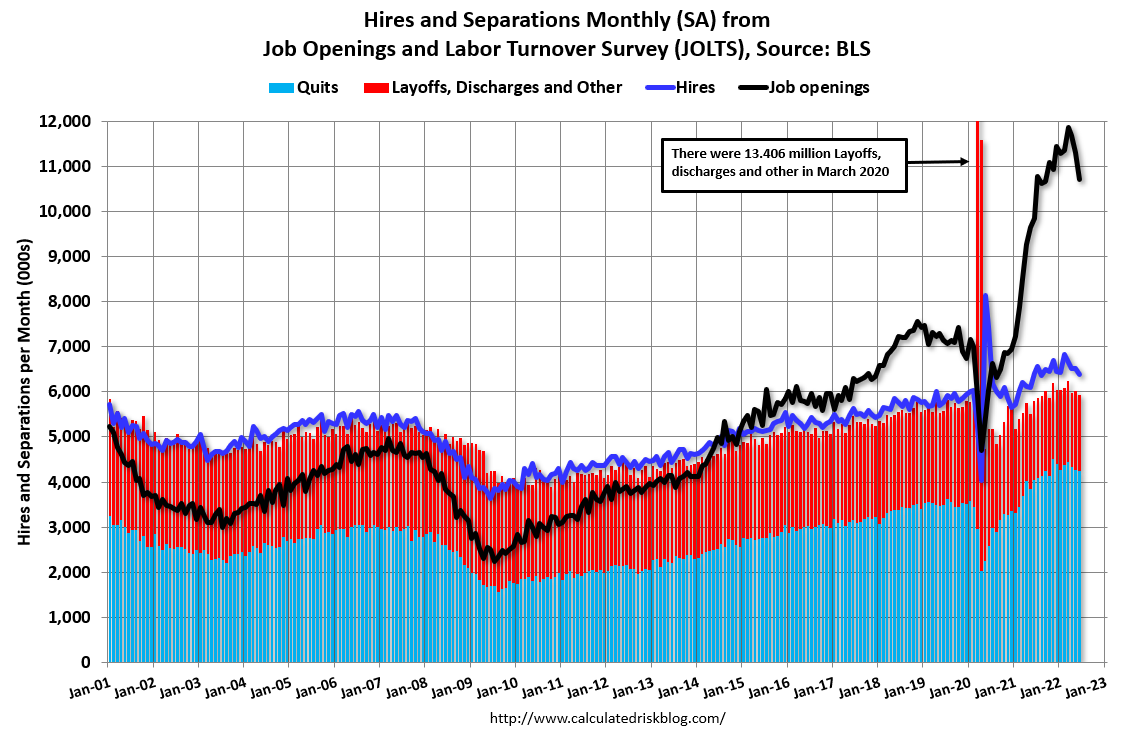

U.S.-based employers announced 25,810 cuts in July, a 20.6% decrease from the 32,517 cuts announced in June. It is 36.3% higher than the 18,942 cuts announced in the same month last year, according to a report released Thursday from global outplacement and business and executive coaching firm Challenger, Gray & Christmas, Inc.

A summary of headlines we are reading today:

- Prices At The Pump Continue To Plunge, But Stronger Demand Could Halt The Trend

- Burger King parent says more customers are redeeming coupons and loyalty rewards

- Nikola’s revenue tops expectations on the delivery of 48 electric trucks

- Restaurant Brands International earnings top estimates, fueled by stronger Tim Hortons, Burger King sales

- Walmart lays off corporate employees after slashing forecast

- Indian investors hunt for value in US stocks amid rate hikes

- From food to fuel: What sparked the transformation in the sugar industry?

These and other headlines and news summaries moving the markets today are included below.