Summary Of the Markets Today:

- The Dow closed up 239 points or 0.71%,

- Nasdaq closed down 0.19%,

- S&P 500 up 0.19%,

- WTI crude oil settled at $86 down 3.29%,

- USD $106.47 down 0.07%,

- Gold $1790 down 0.42%,

- Bitcoin $23,930 down 0.70%,

- 10-year U.S. Treasury 2.815% unchanged

Today’s Economic Releases:

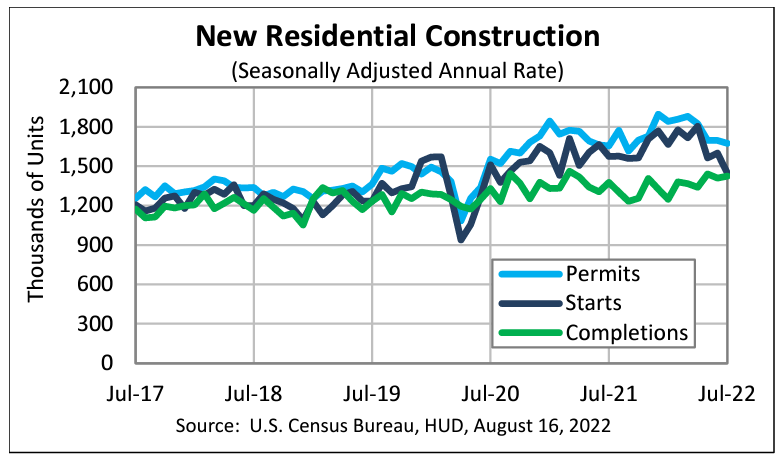

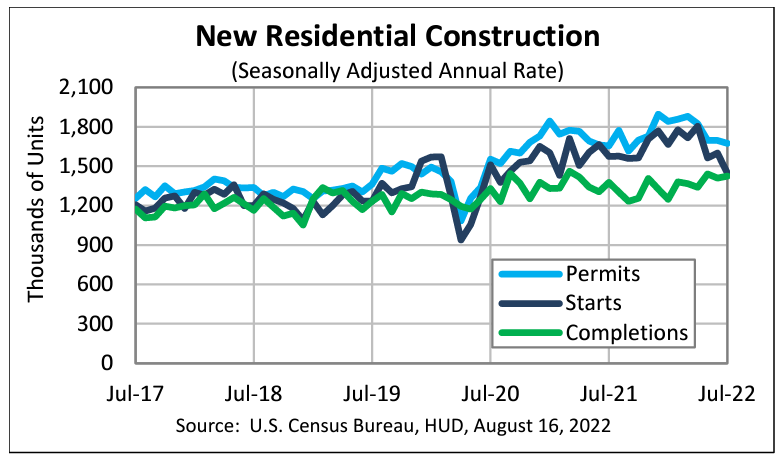

Privately‐owned housing units authorized by building permits in July 2022 were down 1.3% month over-month and 1.1% year-over-year. Housing starts were down 9.6% month-over-month and is 8.1year-over-year. Housing completions were up 1.1% year-over-year and up 3.5% year-over-year. Although the numbers are slowing, they are still above pre-pandemic levels.

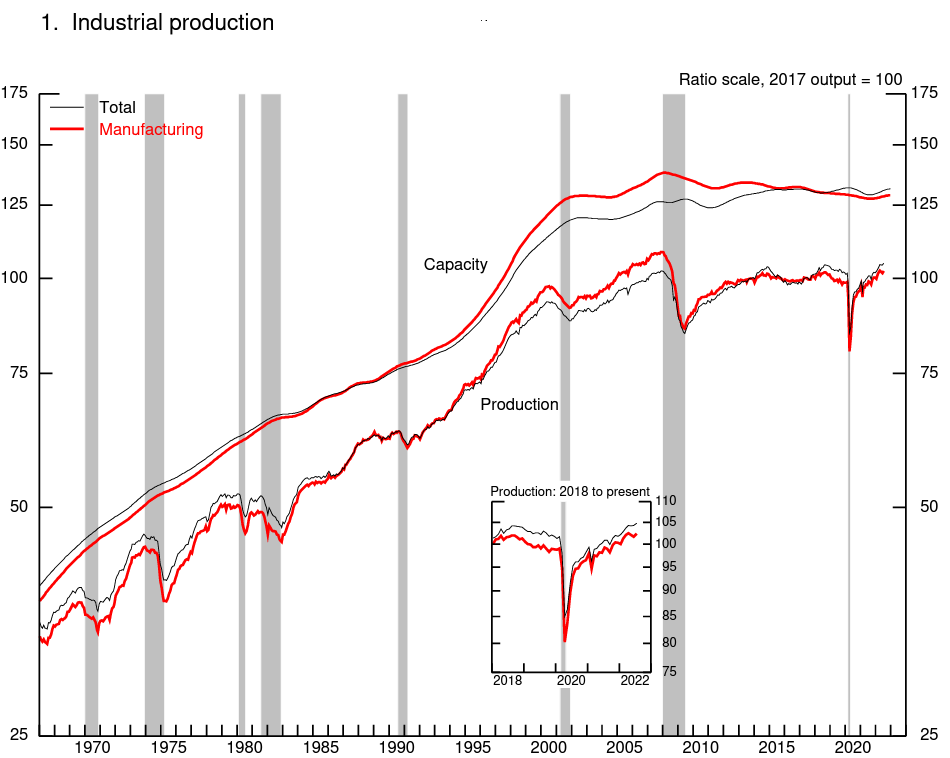

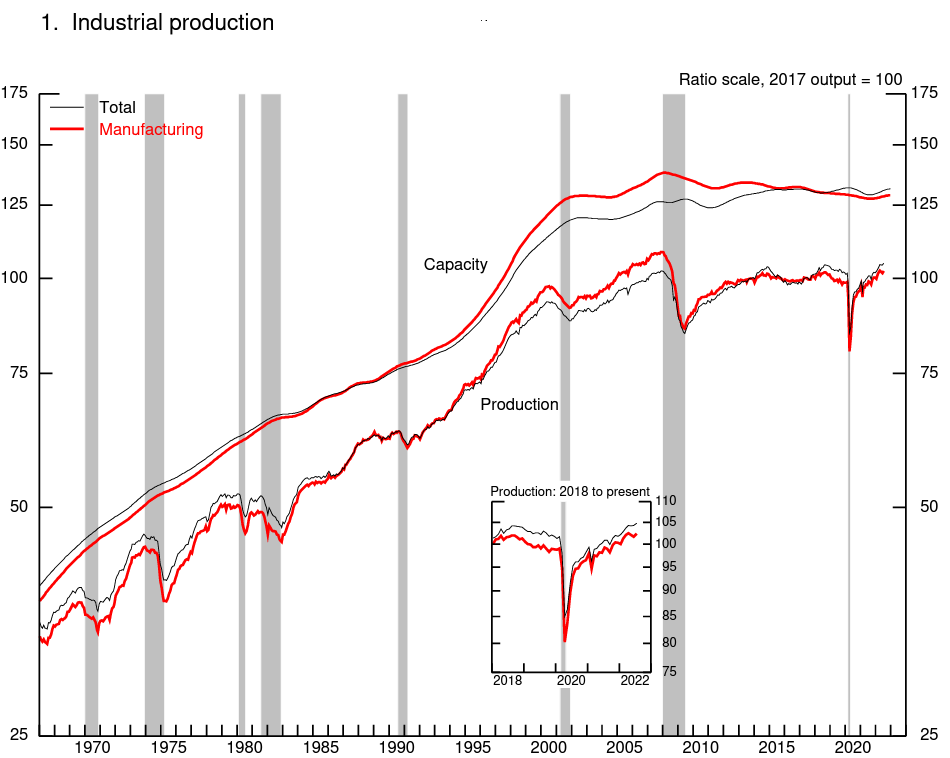

In July 2022 industrial production increased 0.6% month-over-month with manufacturing up 0.7%; mining increased 0.7%; and utilities decreased 0.8%. On a year-over-year basis industrial production was up 3.9% wth manufacturing up 3.2%, mining up 7.9%, and utilities up 2.2%. Capacity utilization is up 1.3% year-over-year.

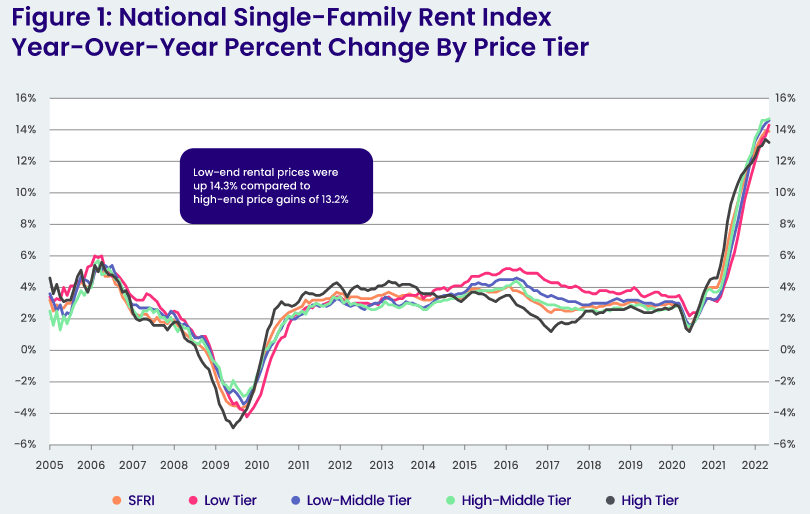

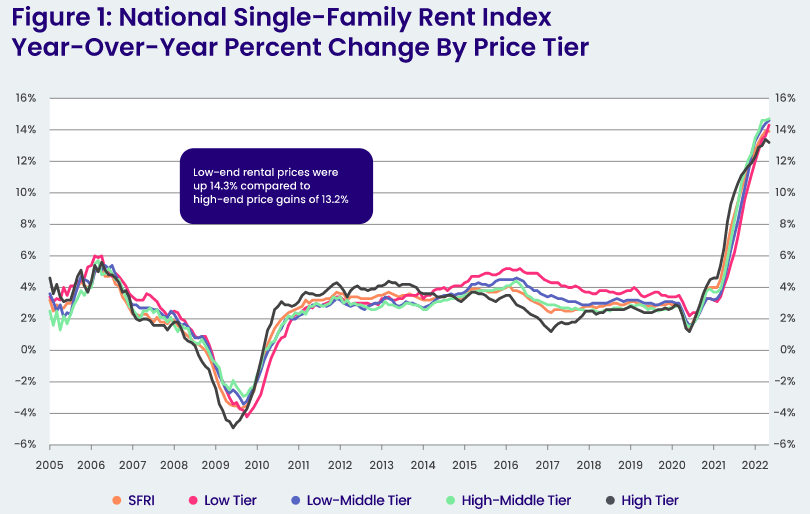

CoreLogic shows that in June 2022, single-family rent prices remained elevated, up 13.4% from one year earlier, but have continued to relax compared to growth seen earlier this year. This deceleration could be partially due to worries over an impending economic slowdown. June also saw trends shift away from pandemic-era preferences as attached rentals growth (13.2%) slightly outpaced detached rentals price growth (12.8%). Molly Boesel, principal economist at CoreLogic stated:

While the annual growth in single-family rents is nearly double that of a year ago and is still near a record level, price growth began decelerating in June. Nationwide, both year-over-year and month-over-month growth were slower in June than they were earlies year, and roughly half of the largest U.S. metro areas experienced a slowdown in annual growth in June.

A summary of headlines we are reading today:

- Nuclear And Hydropower Falter As Droughts Grip Europe

- Hydropower In China Struggles Amid Worst Heatwave In Decades

- WTI Crude Falls To Lowest Level Since January

- Homebuyers are backing out of more deals as high mortgage rates persist and recession fears linger

- Walmart CEO Doug McMillon says even wealthier families are penny-pinching

- Inflation drives fastest fall in real pay on record

These and other headlines and news summaries moving the markets today are included below.