Summary Of the Markets Today:

- The Dow closed down 641 points or 1.90%,

- Nasdaq closed down 2.55%,

- S&P 500 down 2.13%,

- WTI crude oil settled at 91 down 0.11%,

- USD $108.94 up 0.77%,

- Gold $1748 down 0.82%,

- Bitcoin $21,032 down 2.17% – Session Low 20,938,

- 10-year U.S. Treasury 3.029 up 0.73

Today’s Economic Releases:

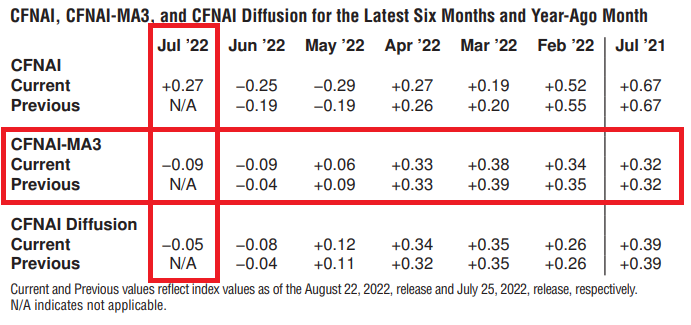

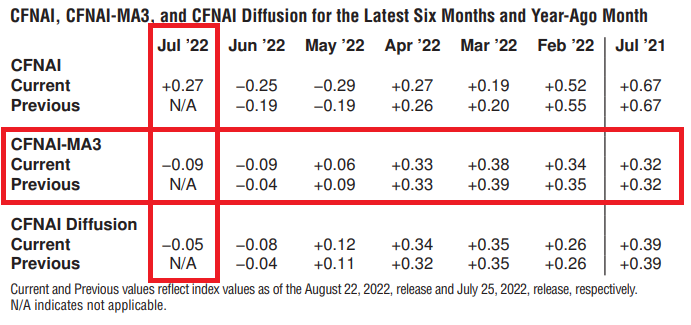

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) rose to +0.27 in July 2022 from –0.25 in June. All four broad categories of indicators used to construct the index made positive contributions in July, and all four categories improved from June. The index’s three-month moving average, CFNAI-MA3, was unchanged at –0.09 in July. Economic forecasting uses the three month average – and this would mean that the economy is expanding slightly below its historical trend (average) rate of growth. The CFNAI is the best coincident indicator of the economy – and it makes sense that this indicator views the economy as slightly soft.

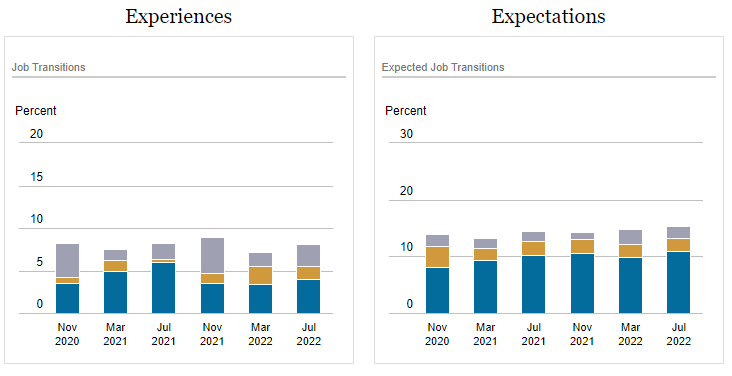

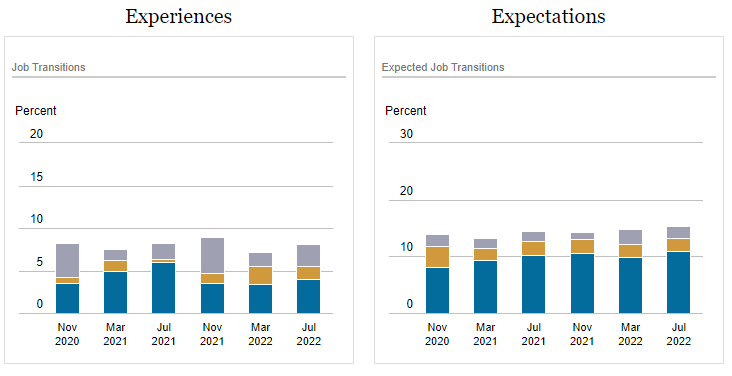

The Federal Reserve Bank of New York’s Center for Microeconomic Data today released the July 2022 SCE Labor Market Survey, which shows a decline in transitions to a different employer, compared to a year ago. Satisfaction with wage compensation at respondents’ current jobs deteriorated, while satisfaction with nonwage benefits and promotion opportunities improved. Regarding expectations, the average expected likelihood of receiving an offer in the next four months declined. The average expected wage offer (conditional on receiving one), as well as the average reservation wage — the lowest wage at which respondents would be willing to accept a new job — increased year-over-year. Expectations regarding job transitions improved.

August 22-29 Elliott Wave International invites you to join their Trader Education Week — a free chance to learn a ton, and very quickly — from just 5 video lessons. They do not want your credit card info. The Week is brought to you by their Trader’s Classroom, a video mentoring service for traders seeking to improve. Your 5 lessons come straight from the editor Jeffrey Kennedy, one of the world’s top technical analysts.

A summary of headlines we are reading today:

- Europe Splurges on Russian Oil As EU Ban Nears

- Chinese Banks Slash Key Interest Rate In Bid To Bolster Stalling Economy

- Ford to eliminate 3,000 jobs in an effort to cut costs

- Single-stock ETFs are ‘way too risky for 99% of investors,’ an advisor says. What to know before adding one to your portfolio

- Nomura Warns “Fed’s Hands Are Tied” For Now As USDollar “Wrecking Ball” Tightens Global Financial Conditions

- Futures Movers: Natural-gas prices surge to their highest level since 2008; oil slips

These and other headlines and news summaries moving the markets today are included below.