Summary Of the Markets Today:

- The Dow closed down 308 points or 0.96%,

- Nasdaq closed down 1.12%,

- S&P 500 down 1.10%,

- WTI crude oil settled at $92 down 4.98%,

- USD $108.78 down 0.05%,

- Gold $1735 down 0.82%,

- Bitcoin $19,995 down 1.64% – Session Low 19,591,

- 10-year U.S. Treasury 3.112 unchanged

Today’s Economic Releases:

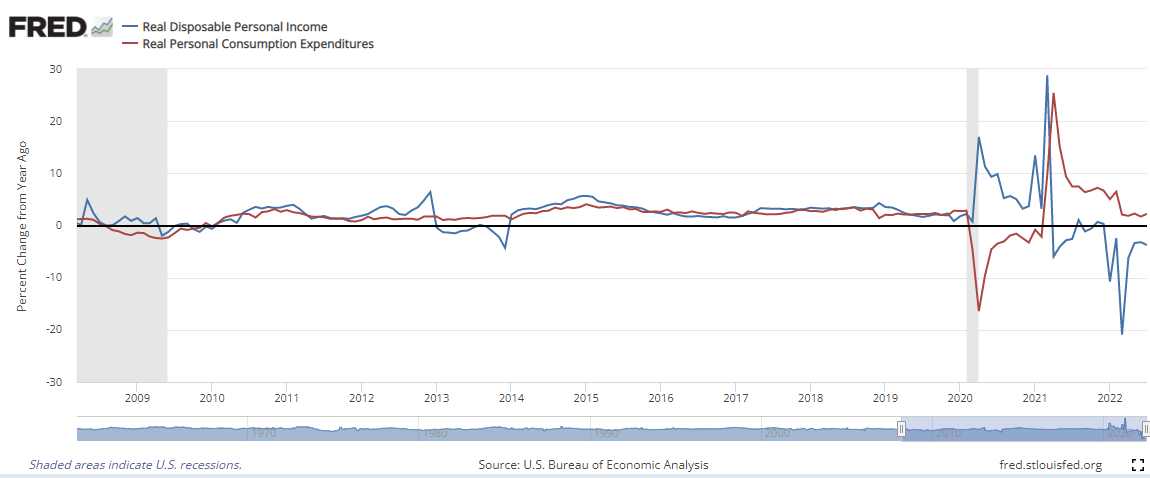

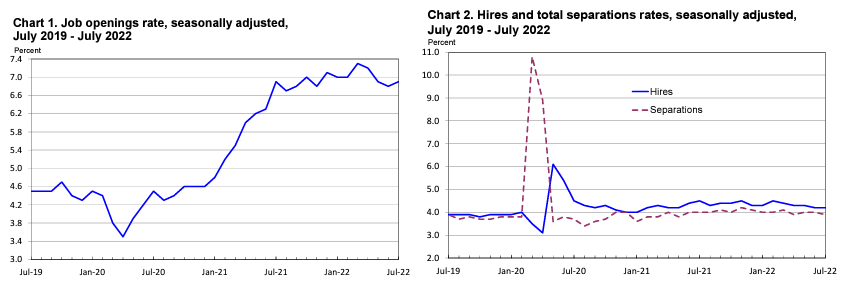

On the last business day of July,

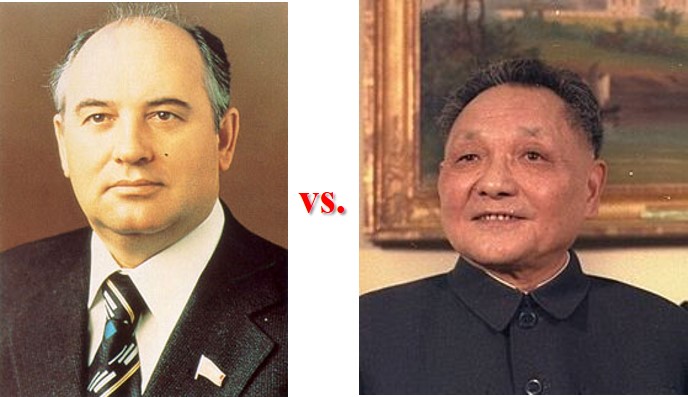

the number and rate of job openings were little changed at 11.2 million and 6.9 percent, respectively. Job openings increased in transportation, warehousing, and utilities (+81,000); arts, entertainment, and recreation (+53,000); federal government (+47,000); and state and local government education (+42,000). Job openings decreased in durable goods manufacturing (-47,000). The weird situation continues where the economy is running cool whilst demand for workers exceeds supply. Note that hires and separations historically have little impact on the economy.

The

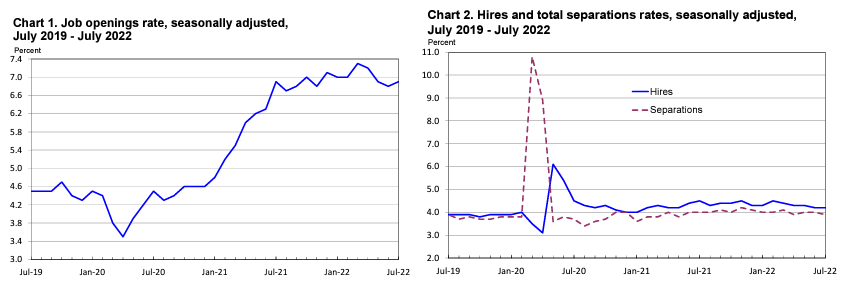

S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported an 18.0% annual gain in June, down from 19.9% in the previous month. The 10-City Composite annual increase came in at 17.4%, down from 19.1% in the previous month. The 20-City Composite posted an 18.6% year-over-year gain, down from 20.5% in the previous month. The moderation of home prices is expected for a variety of reasons – the main reasons are 1) that home price increases are now being compared to the higher home prices of one year ago and 2) the demand for houses are these elevated prices have cooled. A perspective from CoreLogic Deputy Chief Economist Selma Hepp:

In June, the CoreLogic S&P Case-Shiller Index posted an 18% increase, down from a 19.9% gain in May, marking the third month of slower home price growth and decided reversal toward long-run rate of about 5%. Housing market activity cooled markedly since the June’s surge in mortgage rates leading to widespread slowing of home price growth and rising concerns over potential home price declines in the future.

Elliott Wave International has been around for 43 years. From those four decades, they also learned a thing or two. And today, they’ve prepared something special. They’re giving you 4 short excerpts from their August Global Market Perspective. FREE. (Easily a $30 value). We think you will appreciate the insights. It’s EWI’s quick take on markets in the U.S., Europe, and Asia, plus a look at the U.S. dollar. FREE: Get “4 Market Charts You Won’t See Anywhere Else” now.

A summary of headlines we are reading today:

- Oil Falls 5% On Growing Inflation Fears

- Royal Caribbean partners with SpaceX’s Starlink for onboard internet

- Home prices weakened in June, but were still much higher than a year ago, says S&P Case-Shiller

- China Is Aggressively Reselling Russian Gas To Europe

- Investing legend Warren Buffett turns 92 today. Here are his top 5 investing mantras

- The Wall Street Journal: Secret Service official who figures in Jan. 6 investigation of Trump retires

These and other headlines and news summaries moving the markets today are included below.