Summary Of the Markets Today:

- The Dow closed up 146 points or 0.46%,

- Nasdaq closed down 0.26%,

- S&P 500 up 0.30%,

- WTI crude oil settled at $86 down 9.44% for the week,

- USD $109.62 up 0.86%,

- Gold $1707 down 1.14%,

- Bitcoin $19,857 up 1.01% – Session Low 19,614,

- 10-year U.S. Treasury 3.257 up 0.127%

Today’s Economic Releases:

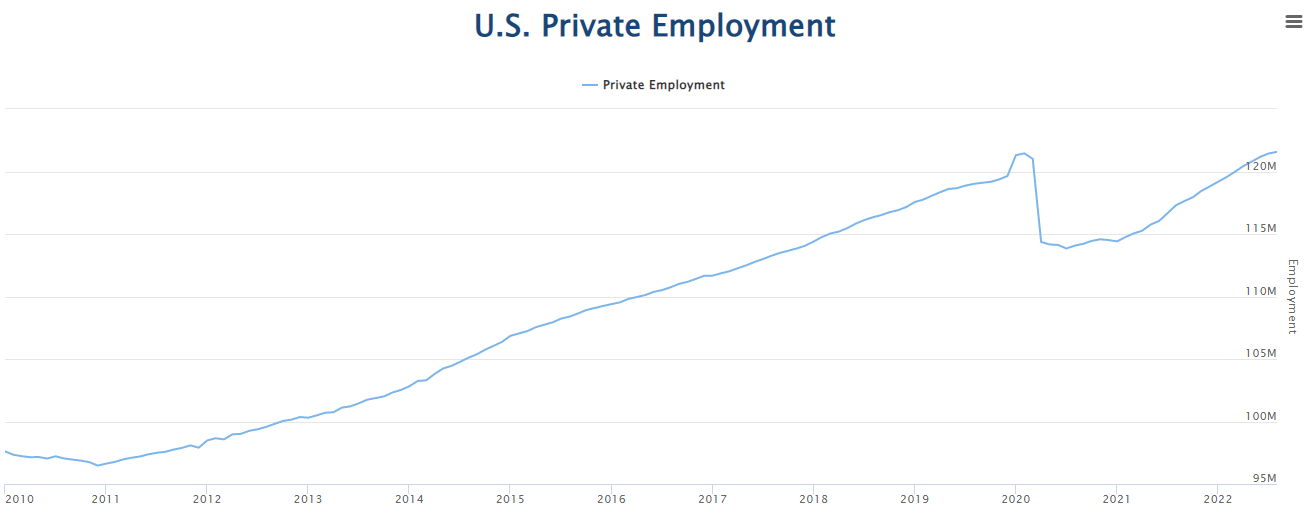

Small business owners continue to hire, but 49% (seasonally adjusted) of owners reported job openings they could not fill in the current period. According to NFIB Chief Economist Bill Dunkelberg:

The labor market continues to be a significant challenge for small business owners. Owners are managing several economic headwinds and continue to make business adjustments to mitigate lost sales opportunities due to staffing shortages. Almost half of owners are raising compensation to attract workers for their open positions.

U.S.-based employers announced 20,485 cuts in August, a 21% decrease from the 25,810 cuts announced one month prior. It is 30% higher than the 15,723 cuts announced in the same month last year. August marks the fourth time this year that cuts were higher in 2022 than in the corresponding month a year earlier. Andrew Challenger, Senior Vice President of Challenger, Gray & Christmas, Inc. stated:

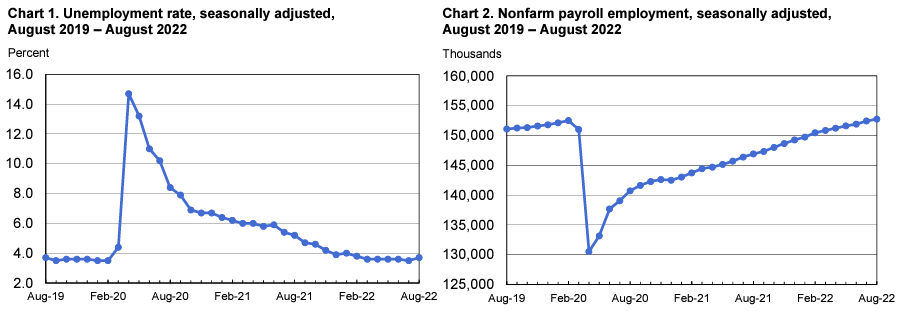

Employment data continue to point to a strong labor market. Job openings are high, layoffs are low, and workers seem to have slowed their resignations. If a recession is imminent, it’s not yet reflected in the labor data.

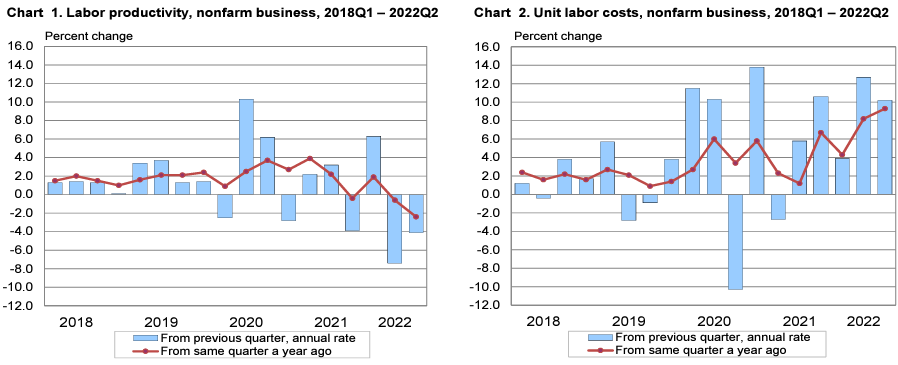

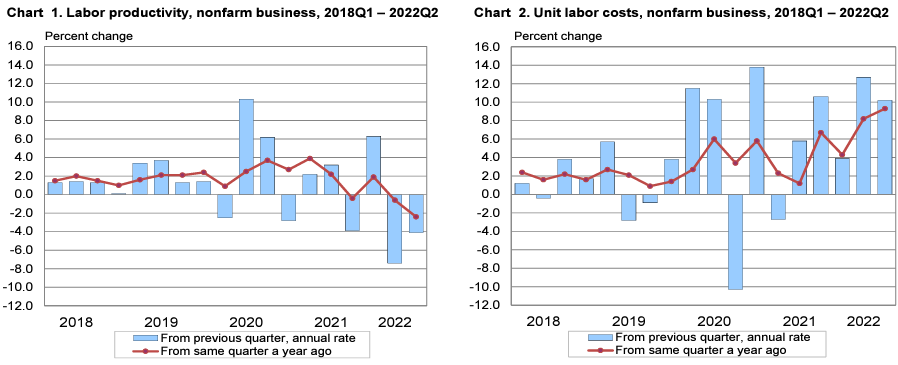

Nonfarm business sector labor productivity decreased 4.1% in the second quarter of 2022 as output decreased 1.4 percent and hours worked increased 2.7 percent. From the same quarter a year ago, nonfarm business sector labor productivity decreased 2.4%. This is the largest decline in the series, which begins in the first quarter of 1948.

In the week ending August 27, the 4-week moving average for initial unemployment claims was 241,500, a decrease of 4,000 from the previous week’s revised average. The unemployment claims recent rise seems to have abated.

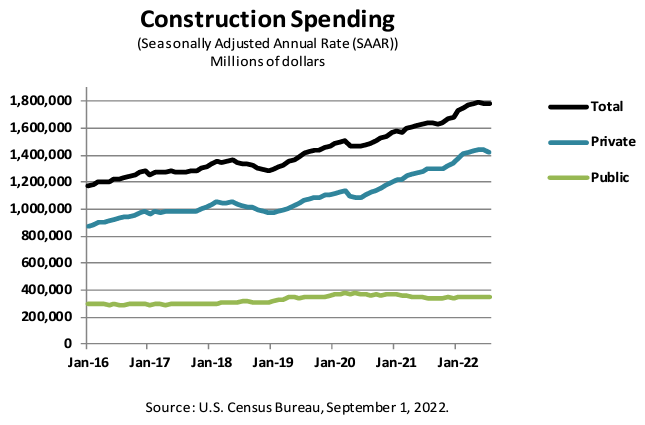

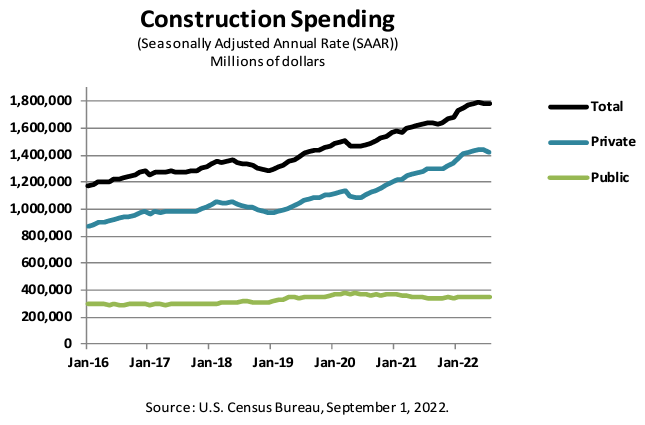

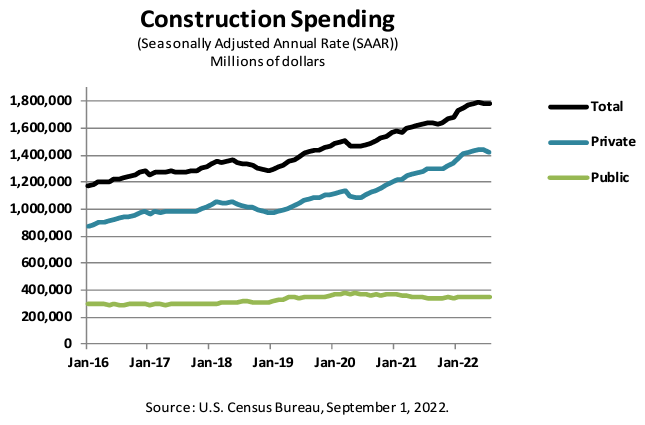

Construction spending during July 2022 was 0.4 % below the revised June estimate. The July figure is 8.5% above July 2021. During the first seven months of this year, construction spending was 10.8% above the same period in 2021.

A summary of headlines we are reading today:

- The Energy Crisis Is Putting Europes Solidarity To The Test

- Turkey Hikes Gas And Power Prices By Up To 50%

- Oil Prices Fall More Than 3% As G7 Discusses Price Cap For Russian Crude

- Chinese EV stocks tank after Li Auto and Xpeng report plunge in August deliveries; Nio ekes out growth

- Flood losses covered by insurance are jumping drastically and only a small fraction of what’s damaged by floods is insured

- Stocks making the biggest moves midday: Nvidia, Okta, Five Below, Bed Bath & Beyond and more

- U.S. health officials brace for another fall Covid surge, but with fewer deaths

These and other headlines and news summaries moving the markets today are included below.