Summary Of the Markets Today:

- The Dow closed down 1,276 points or 3.94%,

- Nasdaq closed down 5.16%,

- S&P 500 down 4.32%,

- WTI crude oil settled at 88 down 1.48% for the week,

- USD $109.82 weakening 1.52%,

- Gold $1713 down 1.59%,

- Bitcoin $20,298 down 9.50% – Session Low 20,104,

- 10-year U.S. Treasury 3.27% little changed

Today’s Economic Releases:

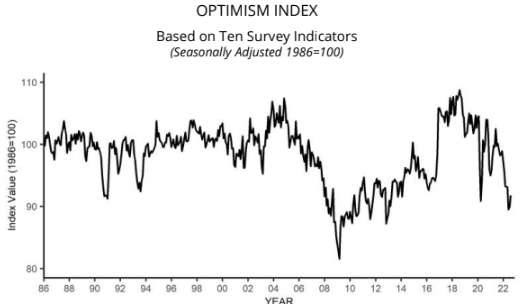

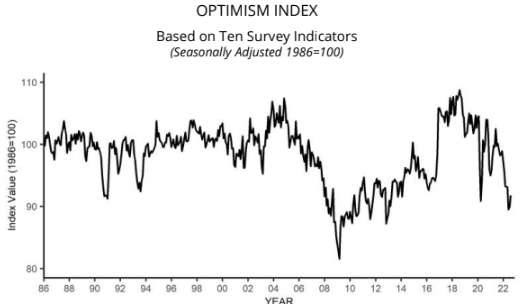

The NFIB Small Business Optimism Index rose 1.9 points in August to 91.8, marking the eighth consecutive month below the 48-year average of 98 but reversing some of the declines in the first half of the year. Per NFIB Chief Economist Bill Dunkelberg:

The small business economy is still recovering from the pandemic while inflation continues to be a serious problem for owners across the nation. Owners are managing the rising costs of utilities, fuel, labor, supplies, materials, rent, and inventory to protect their earnings. The worker shortage is impacting small business productivity as owners raise compensation to attract better workers.

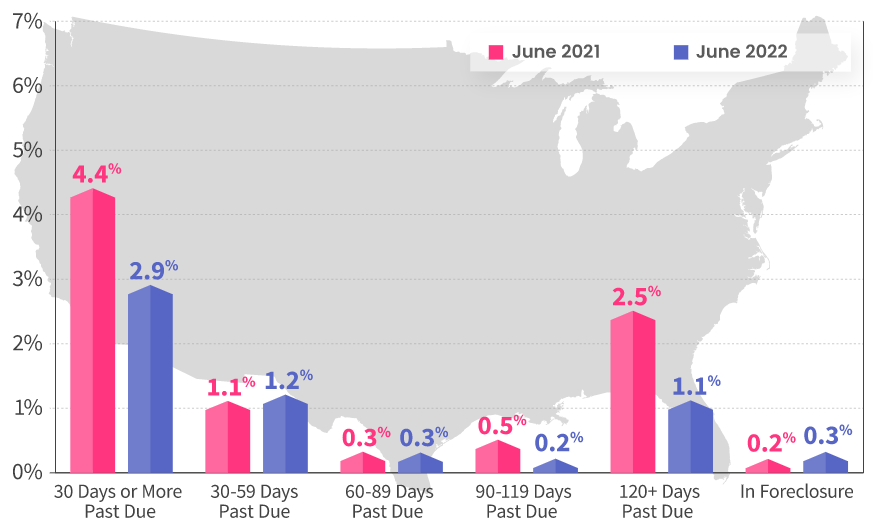

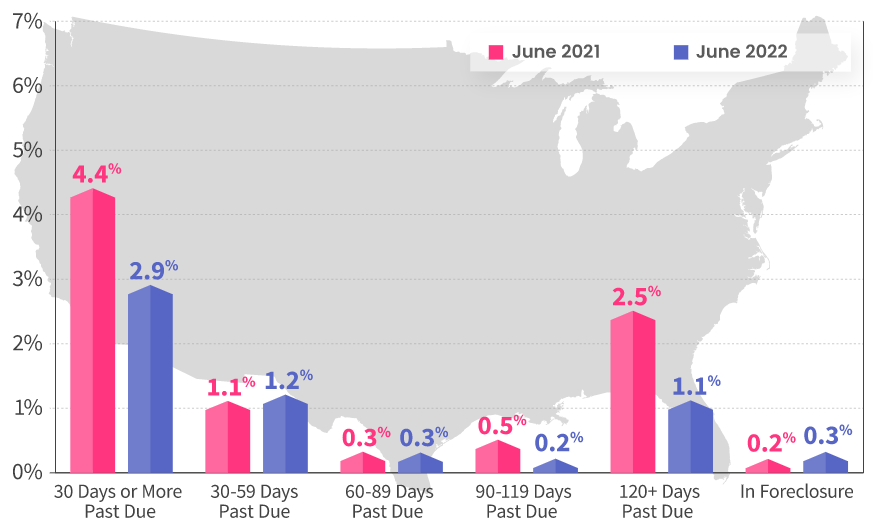

The CoreLogic Loan Performance Insights report shows overall mortgage delinquencies and foreclosure rates remained near two-decade lows in June 2022, with home price growth that remains in double digits and a strong U.S. job market helping to keep mortgage performance healthy. Overall mortgage delinquencies and foreclosure rates remained near two-decade lows.

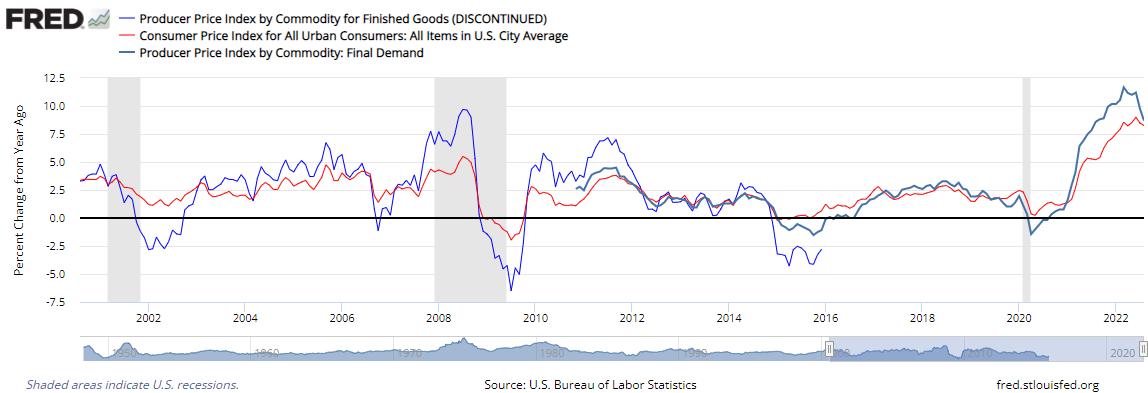

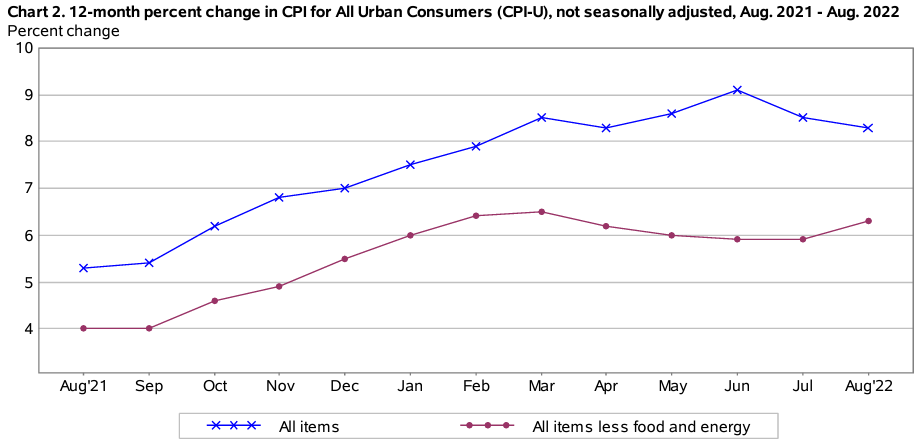

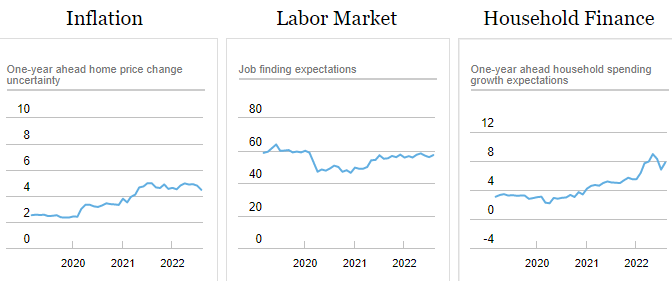

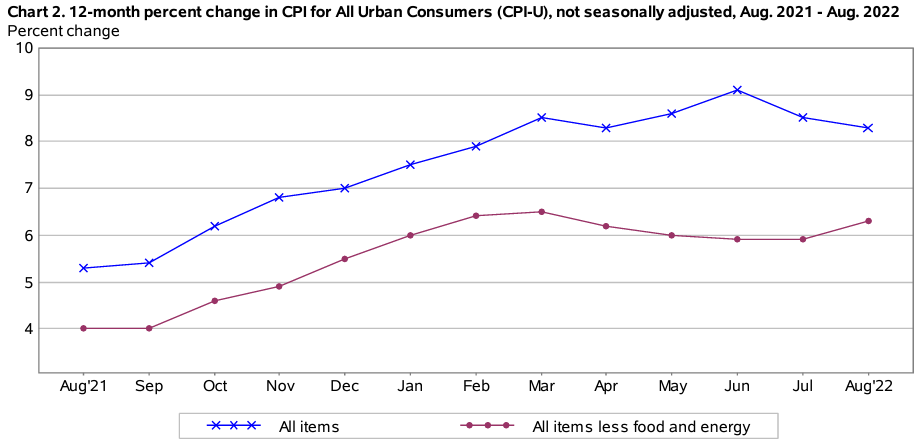

The Consumer Price Index for All Urban Consumers (CPI-U) over the last 12 months was 8.3% – modestly down from the 8.5% posted last month. Shelter, food, and medical care indexes were the largest of many contributors applying upward pressure. These increases were offset by a 10.6-percent decline in the gasoline index. The bottom line is that the core index (removing food and energy) actually increased (red line on the graph below). Note that this extremely modest decline in the CPI keeps the door open for the Federal Reserve to continue to significantly boost the federal funds rate to fight inflation.

The word on the street is, the one stock institutional investors cannot get enough of right now is Berkshire Hathaway. Yes, Warren Buffet’s company. Why? With thousands of “under-the-radar” opportunities available to institutions, why go for the tried-and-true BRK? Because it is tried and true. Because the man running it has been in the markets twice as long as many of today’s investors have been alive. Because experience matters. Elliott Wave International is giving you 4 short excerpts from their August Global Market Perspective. FREE. (Easily a $30 value). We think you will appreciate the insights. It’s EWI’s quick take on markets in the U.S., Europe, and Asia, plus a look at the U.S. dollar. FREE: Get “4 Market Charts You Won’t See Anywhere Else” now.

Child poverty, calculated by the Supplemental Poverty Measure (SPM), fell to its lowest recorded level in 2021, declining 46% from 9.7% in 2020 to 5.2% in 2021, according to U.S. Census Bureau data released today.

A summary of headlines we are reading today:

- Oil Prices Inch Lower On Hot Inflation Data

- Cyberattacks Are A Major Risk For The Worlds Largest Oil Company

- NBA suspends Suns owner Robert Sarver for a year over workplace harassment, use of racial slurs

- Why Toyota – the world’s largest automaker – isn’t all-in on electric vehicles

- Half Of U.S. Workers Are “Quiet Quitters”

- Fed Mouthpiece Speaks: “At LEAST 75bps Next Week” Sends Odds Of 100bps Rate Hike to 47%

- Market Snapshot: Dow down 1,000 points as losses accelerate, stocks face worst session since mid-June

These and other headlines and news summaries moving the markets today are included below.