Summary Of the Markets Today:

- The Dow closed down 107 points or 0.35%,

- Nasdaq closed down 1.37%,

- S&P 500 down 0.84%,

- Gold $1681 up $5,

- WTI crude oil settled at $83 up $0.58,

- 10-year U.S. Treasury 3.704% little changed,

- USD index $110.31 weakening 0.60%,

- Bitcoin $19,350 up 4.80%,

Today’s Economic Releases:

As the 2022 holiday season kicks off, seasonal employers are grappling with possibly falling consumer demand for the holidays, as planned rate increases, inflation, and potential recession fears take hold. Challenger, Gray & Christmas, Inc. predicts Retailers will add 680,000 workers during the 2022 holiday season, down from the 700,000 the firm predicted last year. The 2021 holiday hiring season saw Retailers add 701,400 jobs according to non-seasonally adjusted data from the Bureau of Labor Statistics (BLS).

The

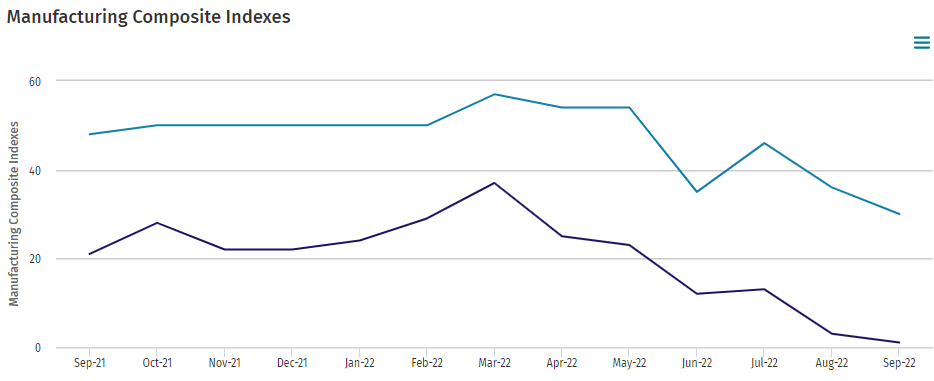

Kansas Fed’s Manufacturing Index continued to decelerate in September 2022, but growth remained slightly positive. Price indexes were still above year-ago levels for most firms, and most firms expected further price increases over the next six months. The month-over-month composite index was 1 in September, the lowest composite reading since July 2020, and down from 3 in August and from 13 in July.

A summary of headlines we are reading today:

- Volkswagen Warns: High Gas Prices Could Impact Car Production

- One Million Puerto Ricans Still Without Power As Grid Crisis Persists

- 14 Coal Plants Have Come Online Since China Vowed To Pull Overseas Support

- Why India Is Suddenly Buying Less Russian Crude

- Amazon averaged 13 million viewers for its ‘Thursday Night Football’ debut, according to Nielsen data

- Powell Contradicts Biden On Inflation: “Running Too High” Rather Than “Hardly At All”

- Here Are Some Things The Fed Will Break If It ‘Contains Inflation’

These and other headlines and news summaries moving the markets today are included below.