Summary Of the Markets Today:

- The Dow closed down 126 points or 0.43%,

- Nasdaq closed up 0.25%,

- S&P 500 down 0.21%,

- WTI crude oil settled at $78 up 2.75%,

- USD $114.25 up $0.14,

- Gold $1635 up $2.00,

- Bitcoin $19,029 down 0.50% – Session Low 18,868,

- 10-year U.S. Treasury 3.988% up 0.108%,

Today’s Economic Releases:

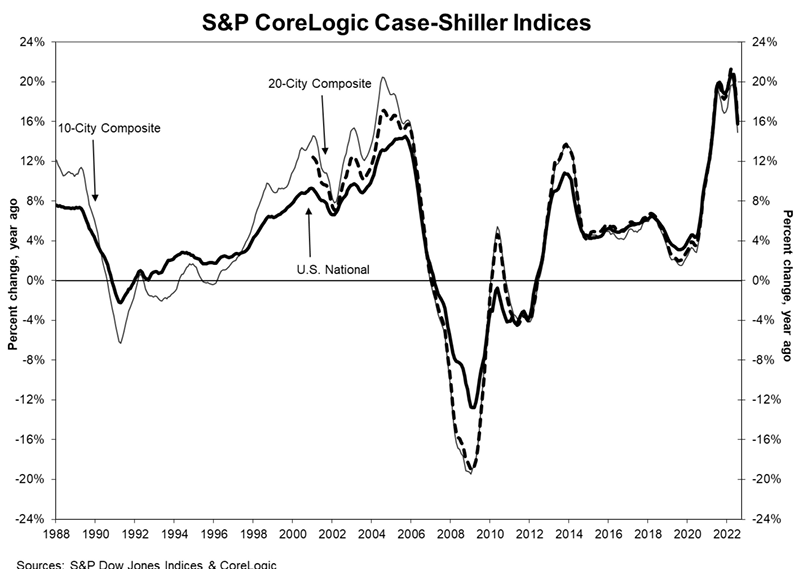

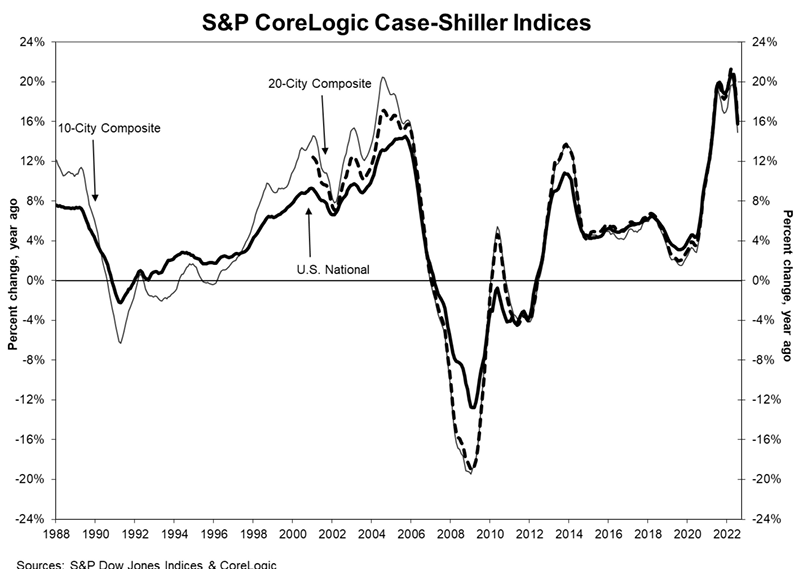

The S&P CoreLogic Case-Shiller 20-City Composite in July 2022 posted a 16.1% year-over-year gain, down from 18.7% in the previous month. CoreLogic Deputy Chief Economist Selma Hepp stated:

In July, the CoreLogic S&P Case-Shiller Index posted an increase of 15.8%, down from a 18.1% gain in June, marking the fourth month of decelerating annual home price appreciation. In addition, month-to-month index turned negative, down 0.3% in July, the first time since late 2018 when the Federal Reserve went through a round of monetary tightening leading to a surge in mortgage rates and subsequent housing market slowdown. Rapid home price deceleration, which is spreading beyond the West Coast markets, was anticipated given the Fed’s actions and will bring home price growth closer in line with income growth. Returning to long-term average of 4-5% annual price growth is closer than initially anticipated – potentially by early 2023.

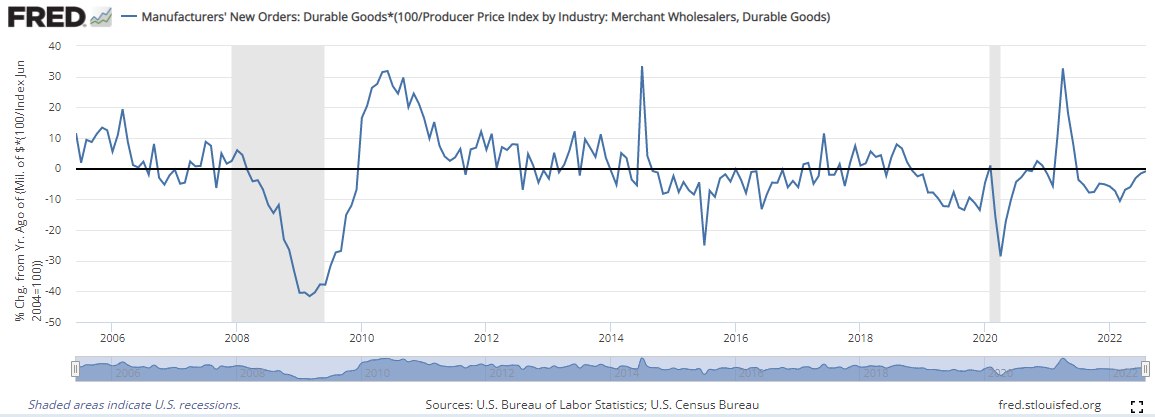

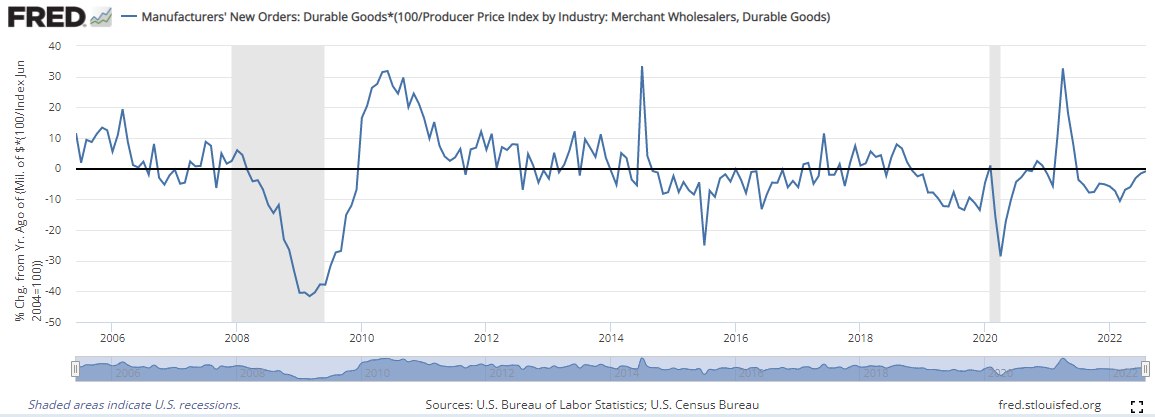

New orders for manufactured durable goods in August 2022, down two consecutive months, decreased 0.2% month-over-month and is up 8.8% year-over-year. Still, when adjusted for inflation, year-over-year growth is down 0.8% (see graph below):

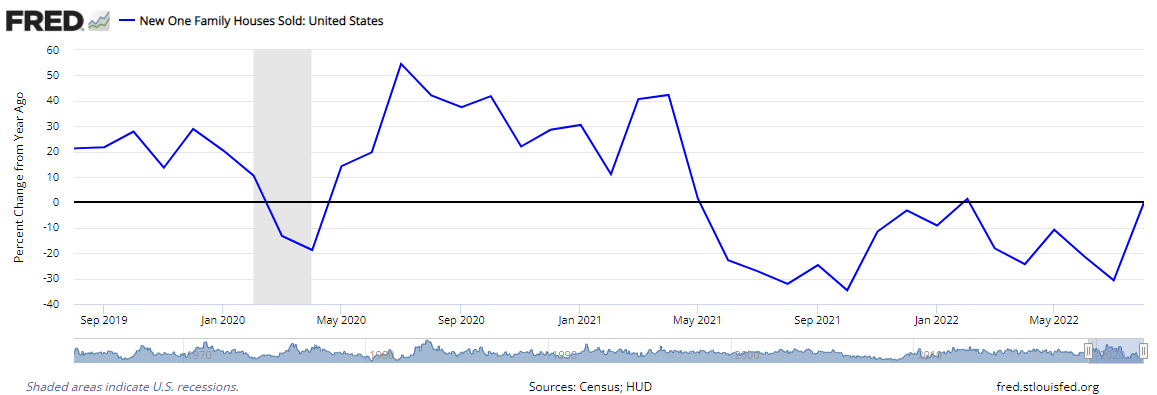

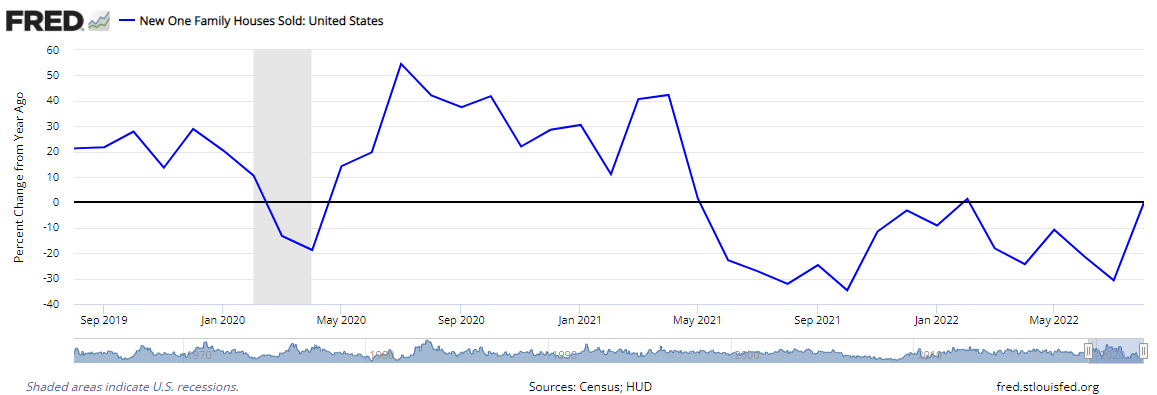

Sales of new single‐amily houses in August 2022 were at a 28.8% above July rate but is 0.1% below August 2021. The median sales price of new houses sold in August 2022 was $436,800. The average sales price was $521,800.

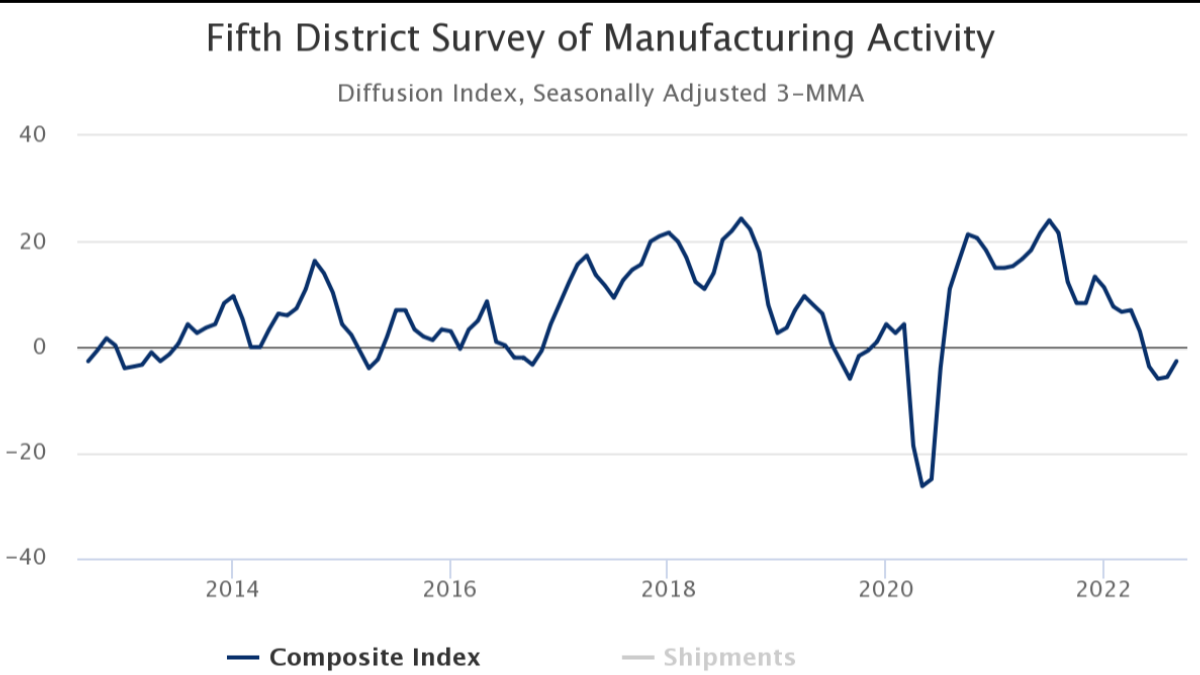

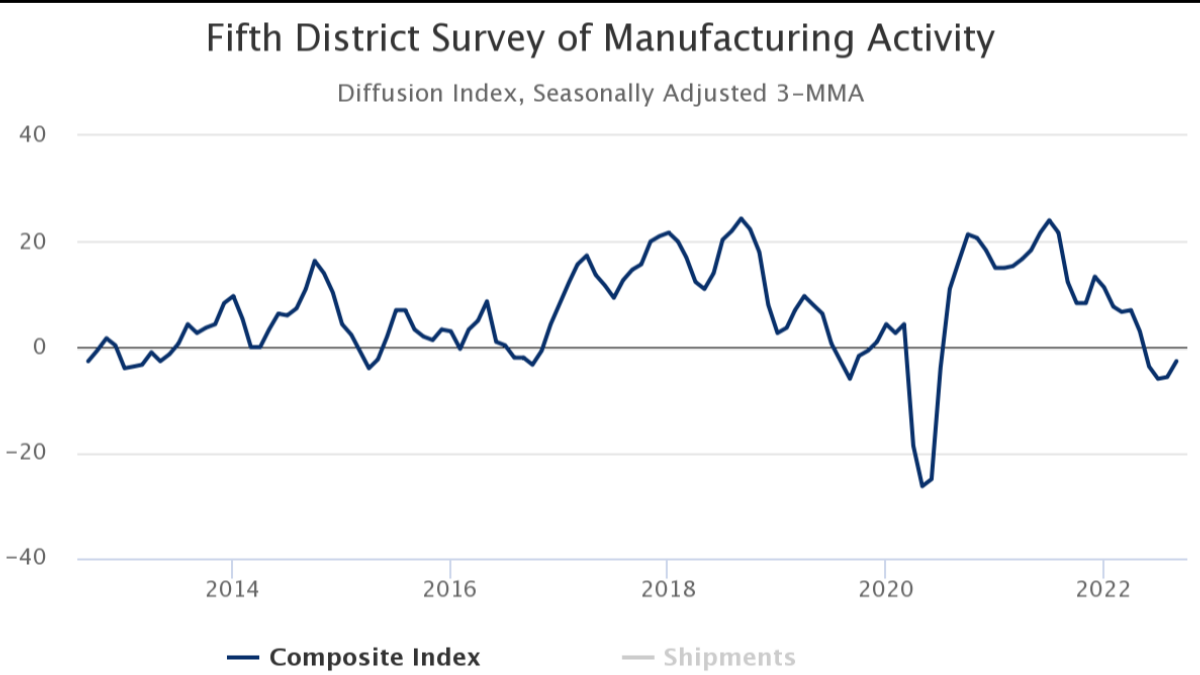

The Federal Reserve Bank of Richmond composite manufacturing index rose fro+m −8 in August to 0 in September, matching its July level.

A summary of headlines we are reading today:

- Strong Dollar Threatens Demand For Industrial Metals

- Solar Cell Breakthrough Could Challenge Silicon Dominance

- Goldman Sachs Drops Oil Price Forecast

- Stock market losses wipe out $9 trillion from Americans’ wealth

- Vanguard To Liquidate And Shutter A U.S. Listed ETF For The First Time In Its History

- CIA Warned Germany Of Possible Nord Stream Pipeline Attack

These and other headlines and news summaries moving the markets today are included below.