18Oct2022 Market Close & Major Financial Headlines: A Good Day For The Markets As Oil Prices Continue To Fall

Summary Of the Markets Today:

- The Dow closed up 338 points or 1.12%,

- Nasdaq closed up 0.9%,

- S&P 500 up 1.14%,

- Gold $1656 down $7.80,

- WTI crude oil settled at $83 down $2.37,

- 10-year U.S. Treasury 3.996% down 0.019%,

- USD index $112.03 little changed,

- Bitcoin $19,373 down $275

Today’s Economic Releases:

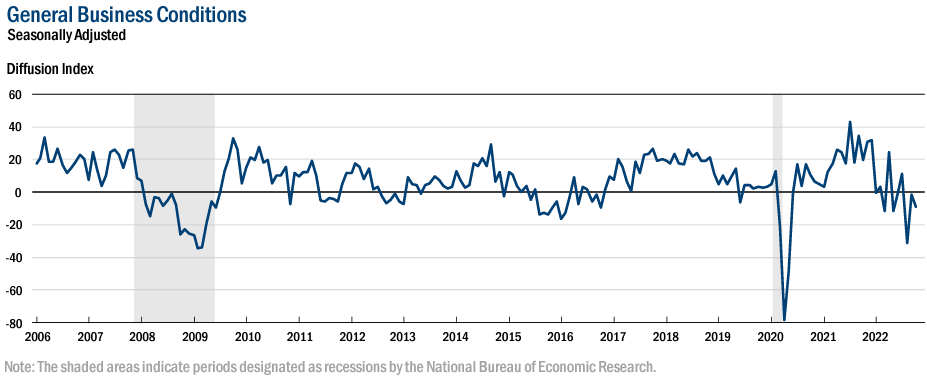

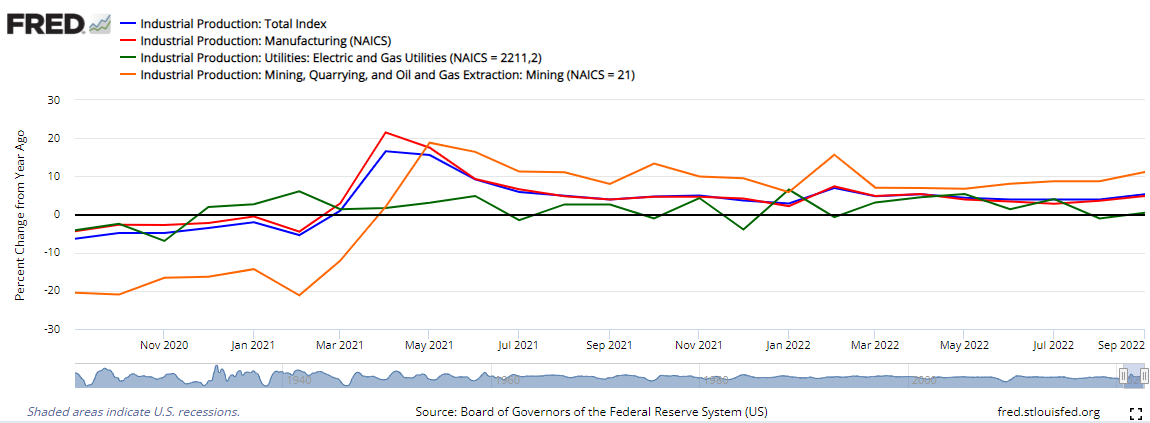

September 2022 Industrial production increased 5.3% year-over-year with the components: manufacturing up 4.8% year-over-year; mining up 11.1% year-over-year; and utilities up 0.5% year-over-year. All components improved over the previous month.

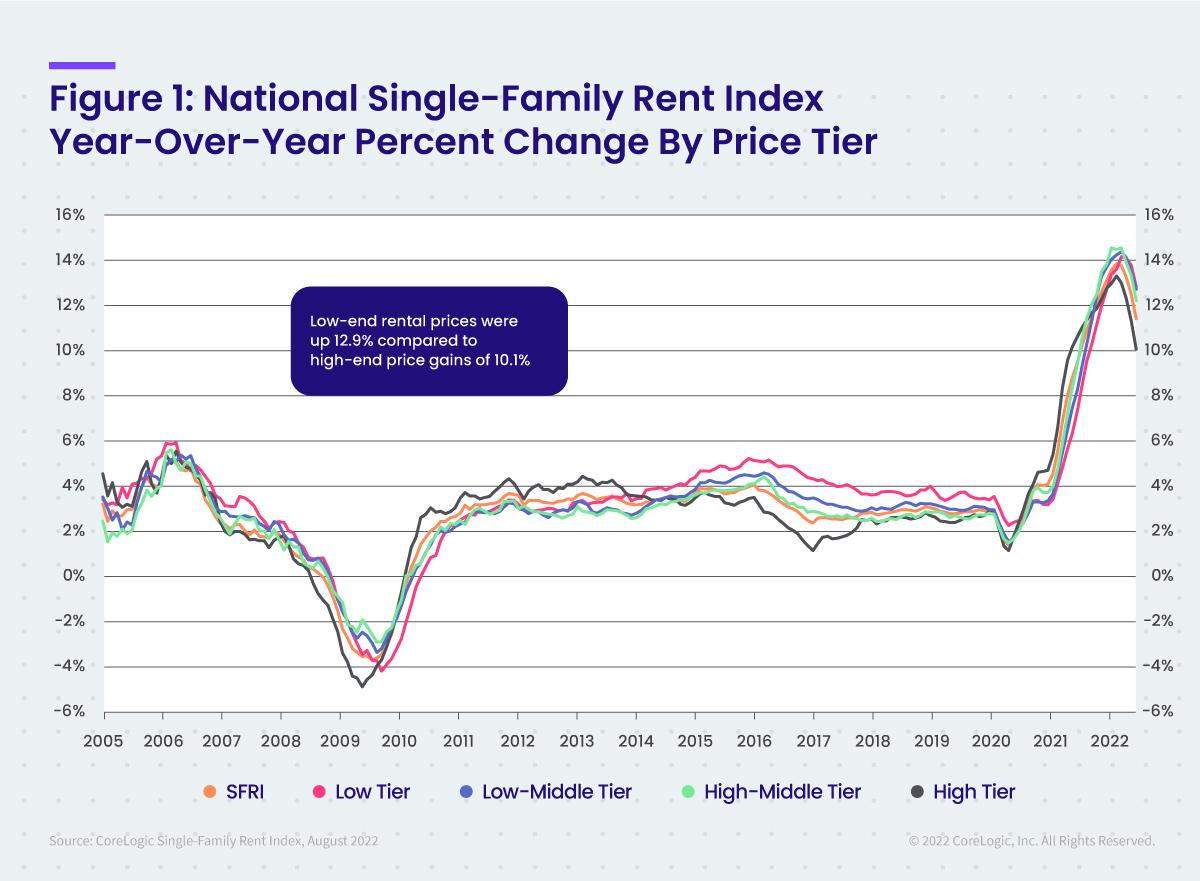

U.S. single-family home rental costs posted an 11.4% year-over-year increase in August 2022, marking the fourth straight month of annual deceleration. Even so, rental costs remained elevated, with annual growth running at about five times the rate than in August 2020 in the midst of the COVID-19 pandemic. A shortage of available rental units continues to fuel price growth, although inflation and worries over a looming recession should begin to temper increases. CoreLogic’s detailed view by rental prices:

- Lower-priced (75% or less than the regional median): 12.9%, up from 7.4% in August 2021

- Lower-middle priced (75% to 100% of the regional median): 12.8%, up from 8.3% in August 2021

- Higher-middle priced (100% to 125% of the regional median): 12.3%, up from 9.4% in August 2021

- Higher-priced (125% or more than the regional median): 10.1%, down from 10.7% in August 2021

A summary of headlines we are reading today:

- Chinese Steel Manufacturers On The Brink Of Bankruptcy

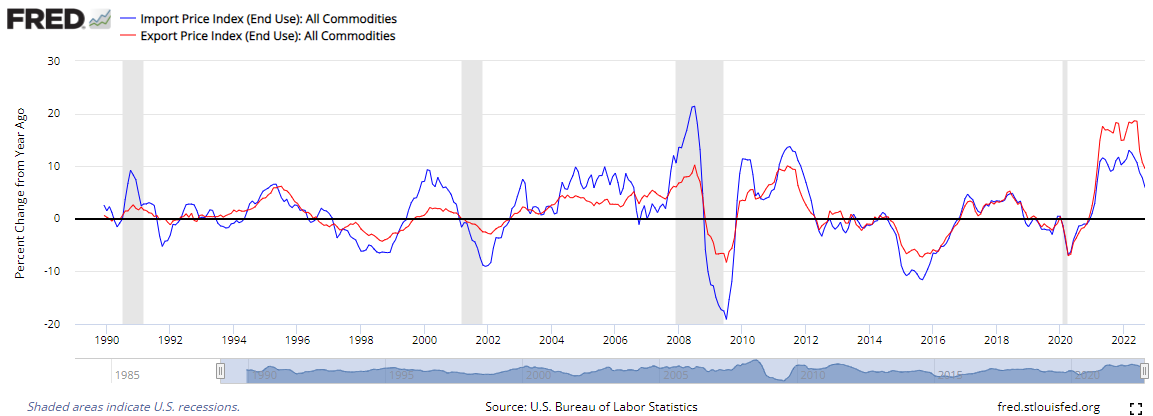

- Rio Tinto Warns Commodity Boom Is Coming To An End As Downside Risks Emerge

- Is The Global Semiconductor Supply Squeeze Finally Coming To An End?

- Oil Prices Continue to Fall To Levels Not Seen In Weeks

- Homebuilder sentiment drops to half of what it was six months ago

- Is Wind Energy Becoming Too Expensive?

These and other headlines and news summaries moving the markets today are included below.