05 NOV 2024 Market Close & Major Financial Headlines: Wall Street’s Small Caps Gapped Up Fractionally At The Opening Bell, By Early Morning Trading The Three Major Indexes Trended Sideways, Finally Closing Moderately Higher In The Green

Summary Of the Markets Today:

- The Dow closed up 427 points or 1.02%,

- Nasdaq closed up 259 points or 1.43%,

- S&P 500 closed up 70 points or 1.23%,

- Gold $2,753 up $6.20 or 0.22%,

- WTI crude oil settled at $72 up $0.65 or 0.09%,

- 10-year U.S. Treasury 4.289 down 0.022 points or 0.164%,

- USD index $103.45 down $0.44 or 0.42%,

- Bitcoin $69,358 up $1,949 or 2.81%, (24 Hours)

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

US stocks closed higher on Election Day as Americans voted in the presidential race between Kamala Harris and Donald Trump. Investors are preparing for potential market volatility, as the election outcome may not be clear for days or weeks if disputed. The dollar retreated further as traders reduced bets on a Trump win. The 10-year Treasury yield dropped 2 basis points. The Federal Reserve is expected to announce a 25 basis point rate cut on Thursday. Boeing shares fell nearly 3% despite workers ending a 7-week strike by voting for a new contract with a 38% pay hike. The S&P 500 is up over 20% year-to-date through October, its best performance in the first 10 months of an election year since at least 1950. Historically, the S&P 500 has risen in 6 of the past 10 election cycles in the month after the election and 8 of 10 cases over the following 3 months. Analysts warn of potential short-term volatility once the election outcome is known, but advise investors to focus on long-term trends.

Click here to read our current Economic Forecast – November 2024 Economic Forecast: Our Index Marginally Declines – We Are Stuck With The Crappy Economy We Have Seen So Far This Year

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The trade deficit has grown 35.6% year-over-year driven by falling export growth of 4.5% year-over-year and rising import growth of 8.9%. Capital goods and consumer goods drove the rise in exports. When I was younger, the saying was that the US was manufacturing nothing – it was not true then but becoming true now.

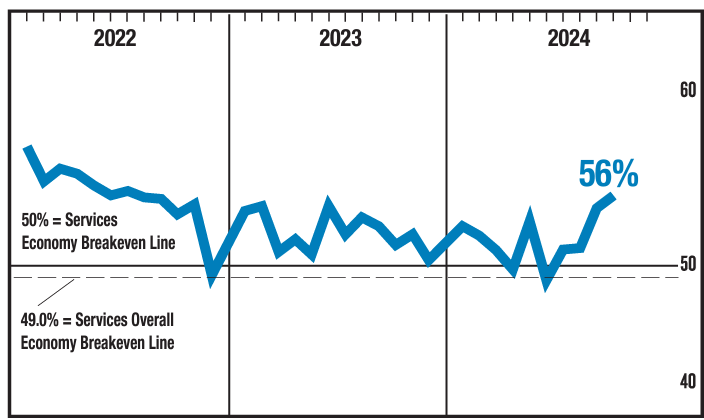

In October, the ISM Services PMI registered 56%, 1.1 percentage points higher than September’s figure of 54.9 percent. The reading in October marked the eighth time the composite index has been in expansion territory this year. The Business Activity Index registered 57.2 percent in October, 2.7 percentage points lower than the 59.9 percent recorded in September, indicating a fourth month of expansion after a contraction in June. The New Orders Index decreased to 57.4 percent in October, 2 percentage points lower than September’s figure of 59.4 percent. If I had only one index to look at to understand the economy, it would be this ISM services index even though this is a survey [I dislike most surveys]. It is showing moderate expansion.

U.S. home price growth continued to cool, slowing to 3.4% year-over-year in September 2024. Compared with the month prior, home prices rebounded to post a very slight uptick (0.02%). Taken together, home price levels have been relatively flat since late summer. Home prices are subject to the laws of supply and demand – and there are a bunch of buyers currently priced out because of high mortgage rates. So if the mortgage rates moderate – home price inflation will increase.

Here is a summary of headlines we are reading today:

- NATO Flexes Military Muscle with Extensive Drills in Northern Finland

- Australia’s Rare Earth Supply Chain Faces Major Disruptions

- Iran’s Oil Supply to China Most Expensive in Five Years As Loadings Fall

- Foreign Interference Threatens U.S. Election Integrity, Officials Warn

- Dow rallies 400 points, S&P 500 gains 1% as traders await U.S. election results: Live updates

- Coinbase’s big election bet is about to be tested

- Nvidia passes Apple as world’s most valuable company

- Palantir shares jump 23% to record on uplifting guidance

- Boeing machinists end strike after approving labor contract with 38% raises

- Protests Explode In Tel Aviv After Netanyahu Fires Defense Minister Gallant

- How Markets Reacted To Each US Election Since 2000

- Ukraine Announces First Direct Clashes With North Korean Troops

- 10-year Treasury yield ends lower after strong auction as investors await election results

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.