Summary Of the Markets Today:

- The Dow closed up 57 points or 0.17%,

- Nasdaq closed up 1.45%,

- S&P 500 up 0.87%,

- WTI crude oil settled at $87 up $0.85,

- USD $106.52 down $0.15,

- Gold $1783 up $5.90,

- Bitcoin $16,821 up 3.46% – Session Low 16,272,

- 10-year U.S. Treasury 3.781% down 0.086%

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases:

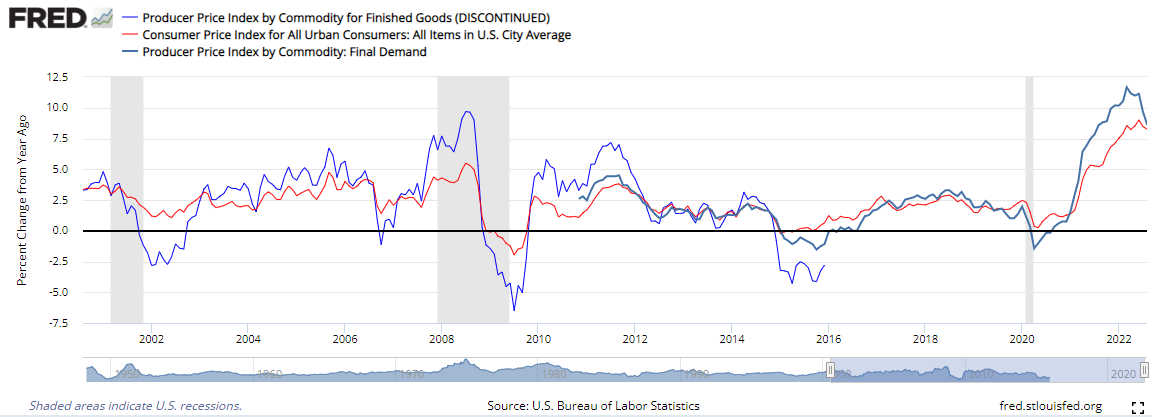

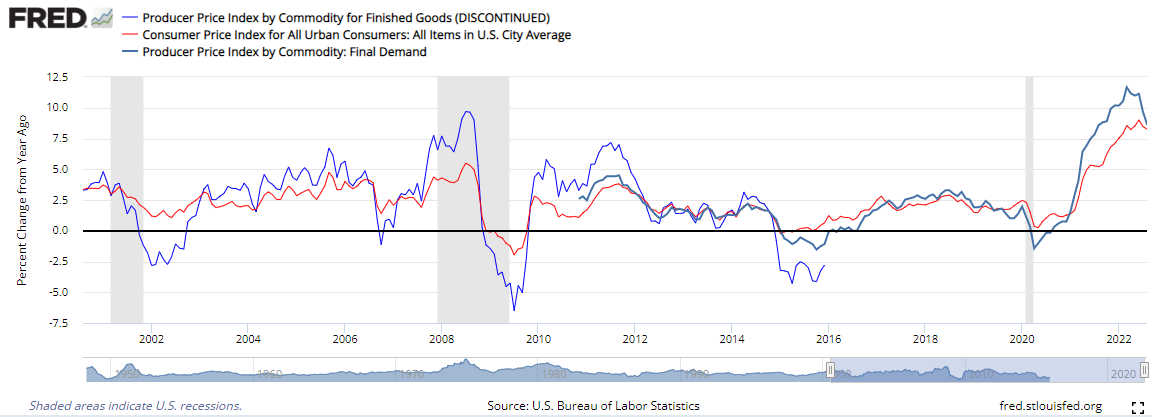

The Producer Price Index for final demand increased by 8.0% for the 12 months that ended in October 2022. This is down from last month”s 8.4% and the lowest PPI inflation rate in a year. Some pundits believe this takes the pressure off of the Federal Reserve to continue to raise the federal funds rate – however, 8.0% is still a very large number and I believe the rate has to fall below 5% to take the pressure off.

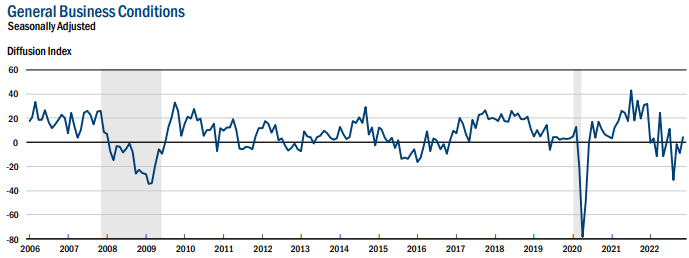

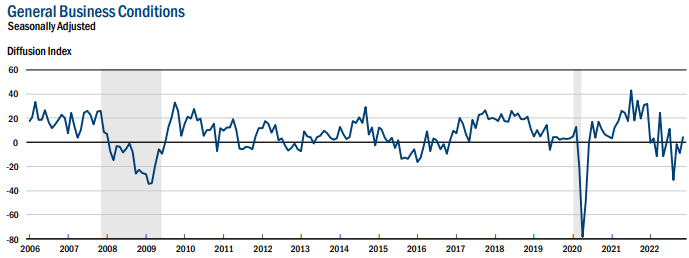

The November 2022 Empire State Manufacturing Survey’s headline general business conditions index climbed fourteen points to 4.5 – and is now in positive territory.

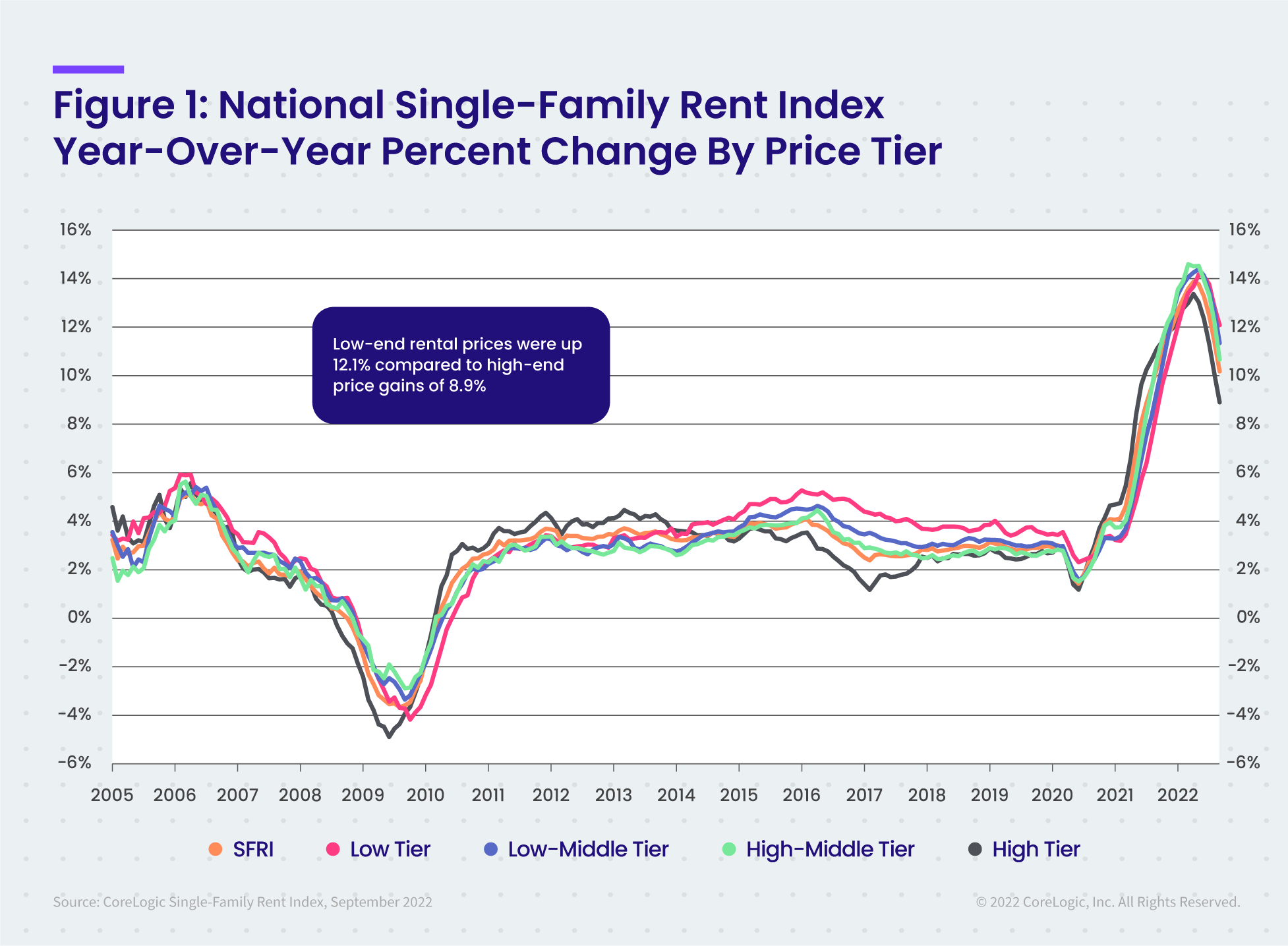

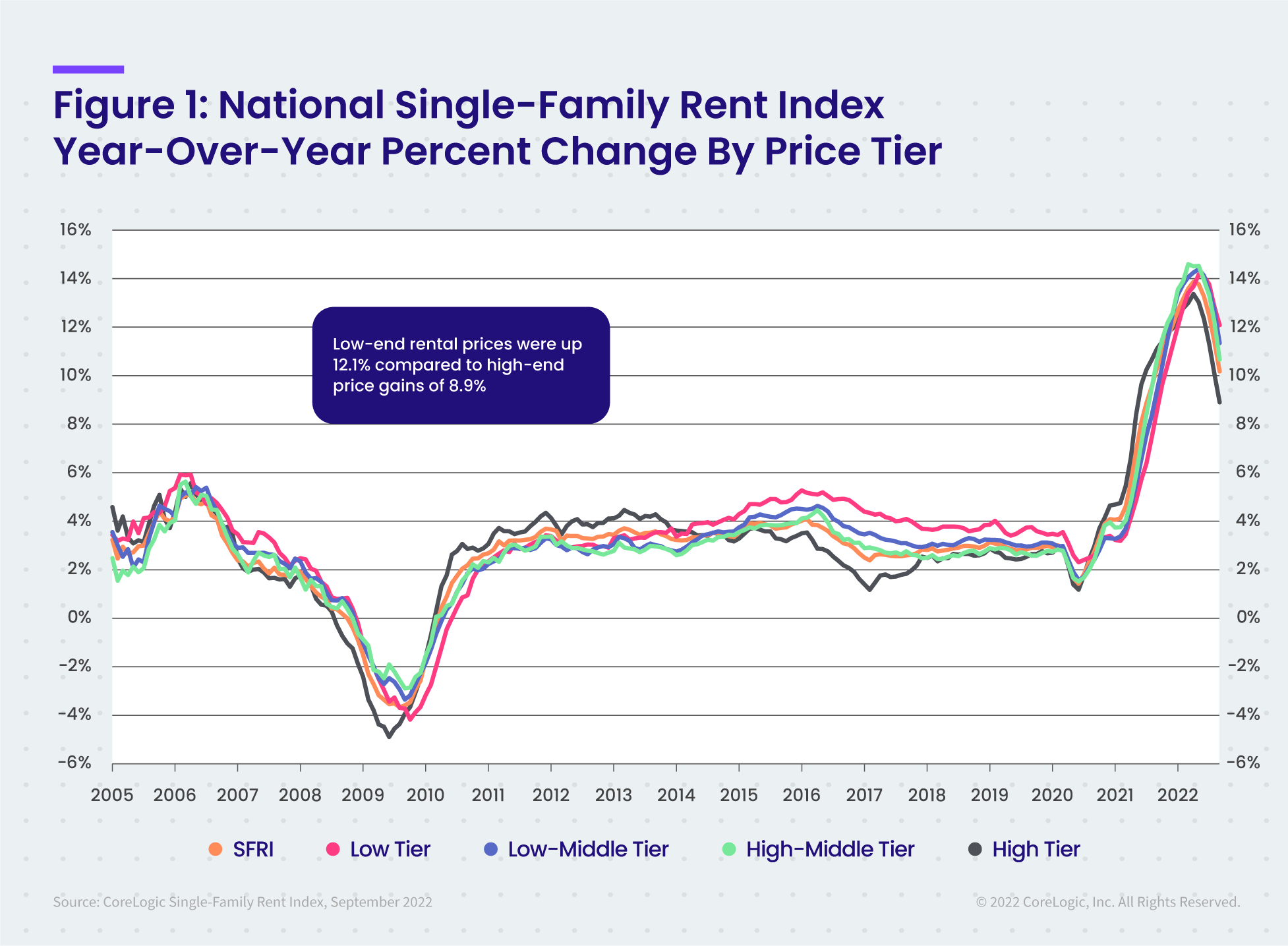

Single-family rents increased 10.2% year-over-year in September, down from 13.9% in April 2022. Low-priced rent growth continued at record double-digit annual gains, up 12.1%, while higher-priced rent growth decelerates at the fastest pace since the April peak. Florida metros saw the highest single-family rent growth, with Miami posting a year-over-year increase of 20.1%.

Here is a summary of headlines we are reading today:

- How The Price Cap On Russian Oil Could Cripple Indias Crude Imports

- IEA: Stubbornly High Diesel Prices May Lead To Lower Demand In 2023

- Oil Prices Rise After Stray Rockets Land In Poland, Killing Two

- Ford says making its own parts for electric vehicles could offset job losses

- Walmart raises outlook as groceries boost sales, inventory glut recedes

- Home Depot posts better-than-expected quarter despite inflation

- Nickel Jumps As Tesla-Backed Miner Sparks Supply Fears

- Record wage rises still outpaced by soaring inflation

- Mark Hulbert: Energy stocks are in a bubble — and here’s when they’re likely to crash

These and other headlines and news summaries moving the markets today are included below.