29Nov2022 Market Close & Major Financial Headlines: Stocks Mostly Down As The Market Awaits Powell’s Speech Tomorrow

Summary Of the Markets Today:

- The Dow closed up 3 points or 0.01%,

- Nasdaq closed down 0.59%,

- S&P 500 closed down 0.16%,

- Gold $1747 up $6.80,

- WTI crude oil settled at $78 up $1.19,

- 10-year U.S. Treasury 3.757% uo 0.057%,

- USD index $106.85 up $0.17,

- Bitcoin $16,479 up $273.00

Today’s Economic Releases:

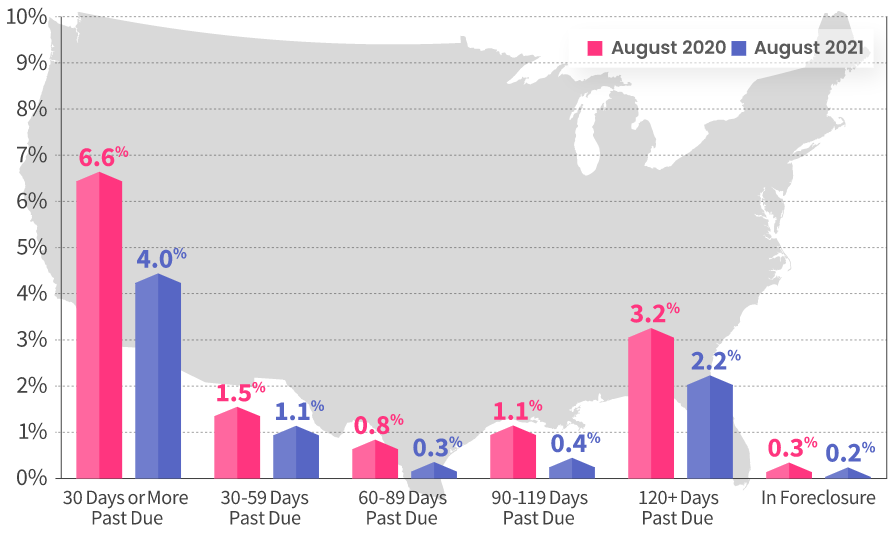

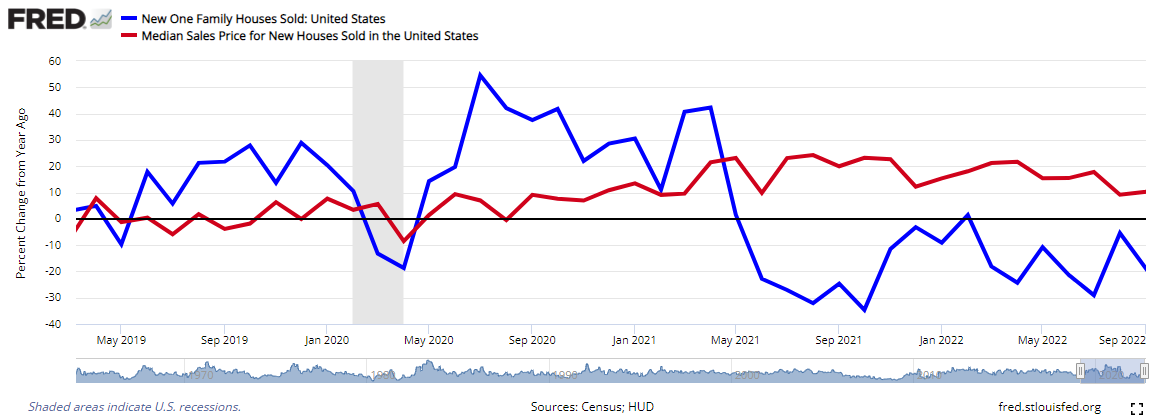

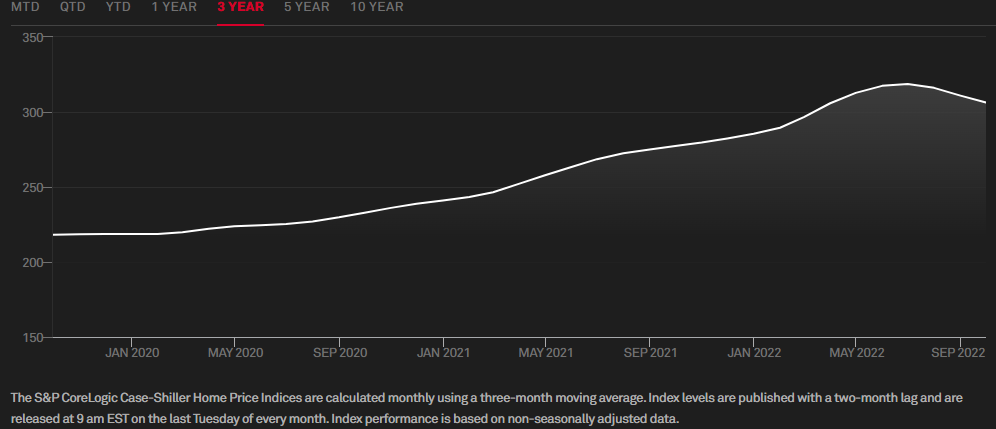

The S&P CoreLogic Case-Shiller 20-City Composite posted a 10.4% year-over-year gain, down from 13.1% in the previous month. CoreLogic Deputy Chief Economist Selma Hepp said:

In September, the CoreLogic S&P Case-Shiller Index gains continued to quickly approach single digits, posting a 10.6% year-over-year increase — marking the sixth straight month of decelerating annual home price growth and the slowest since December 2020. Compared to the 2022 spring peak, home prices are down 3% nationally, with over 10% declines in San Francisco and Seattle. Historically, home prices have increased by about 1% from spring to September. Housing markets continue to face a loss of consumer confidence and the ongoing standoff between buyers and sellers. Potential buyers are held back by the rapidly rising cost of homeownership and fears of price declines. At the same time, potential sellers continue to contend with the lock-in effect of notably lower mortgage rates than the current market rates, which financially disincentivizes them from moving. For the remainder of the year, housing market activity will continue to be depressed, both due to seasonality and fall’s vast surge in mortgage rates, which will keep the home price growth rate moving closer to low single digits.

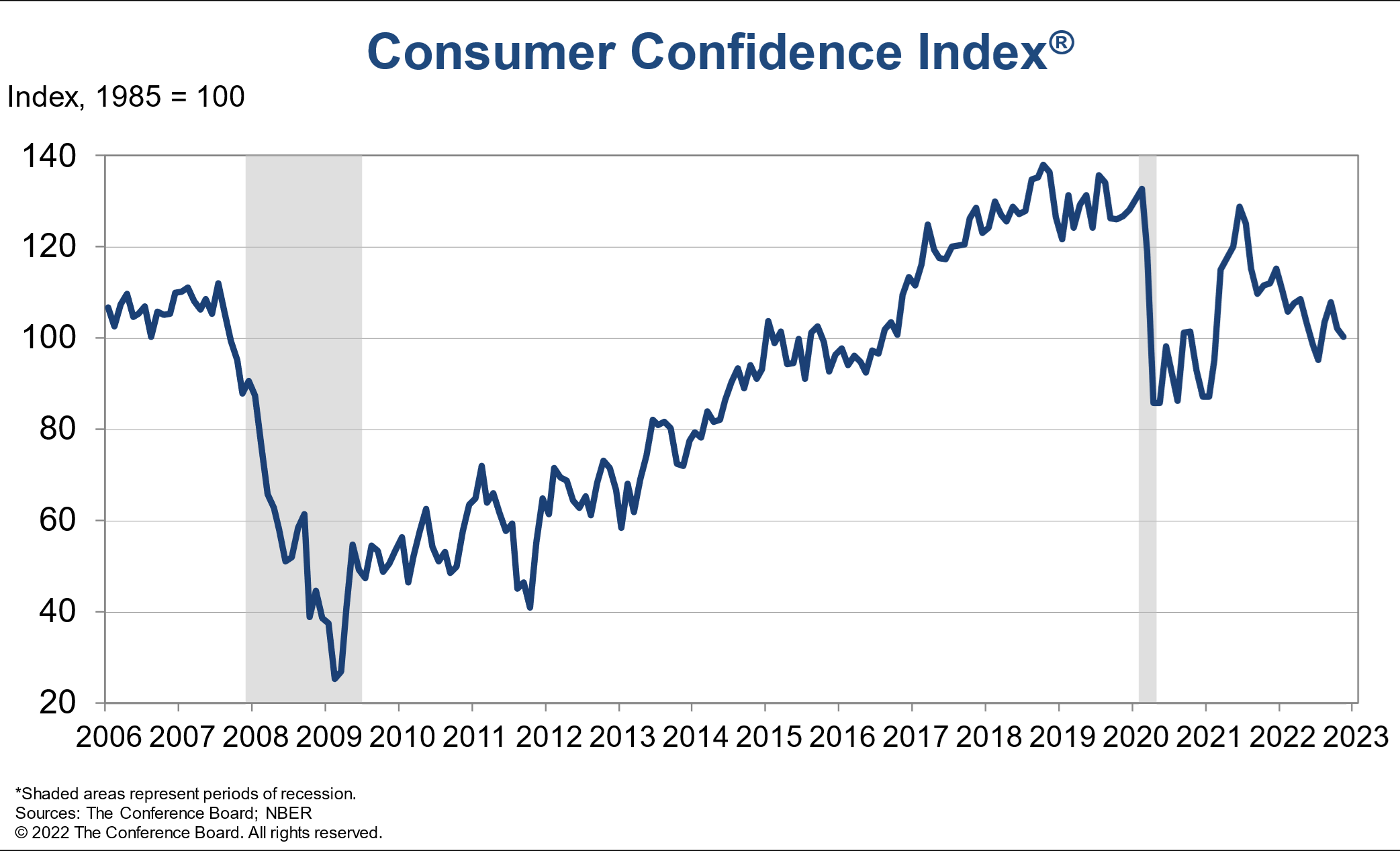

The Conference Board Consumer Confidence Index decreased in November after also losing ground in October. Said Lynn Franco, Senior Director of Economic Indicators at The Conference Board:

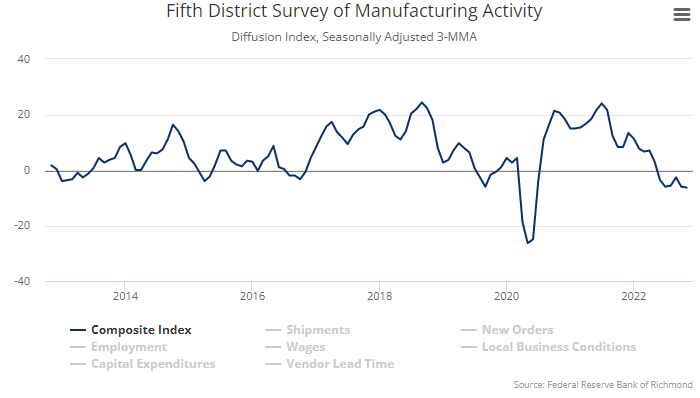

Consumer confidence declined again in November, most likely prompted by the recent rise in gas prices. The Present Situation Index moderated further and continues to suggest the economy has lost momentum as the year winds down. Consumers’ expectations regarding the short-term outlook remained gloomy. Inflation expectations increased to their highest level since July, with both gas and food prices as the main culprits. Intentions to purchase homes, automobiles, and big-ticket appliances all cooled. The combination of inflation and interest rate hikes will continue to pose challenges to confidence and economic growth into early 2023.

A summary of headlines we are reading today:

- White House Changes Plan To Refill SPR At $70 Per Barrel

- Russia’s Pipeline Oil Exports To China Flat So Far This Year

- Volatile Metal Prices To Persist As China Grapples With Covid Spike

- Amazon used AWS on a satellite in orbit to speed up data analysis in ‘first-of-its kind’ experiment

- Stocks Cower Ahead Of Powell’s Speech Tomorrow But It Is The Blackout Period Right After That Matters More

- Unions Furious As Biden, Pelosi Push Bill To Avert Rail Strike

- A Fed rate-hike cycle never hit stocks this hard before. Here’s what’s different this time.

These and other headlines and news summaries moving the markets today are included below.