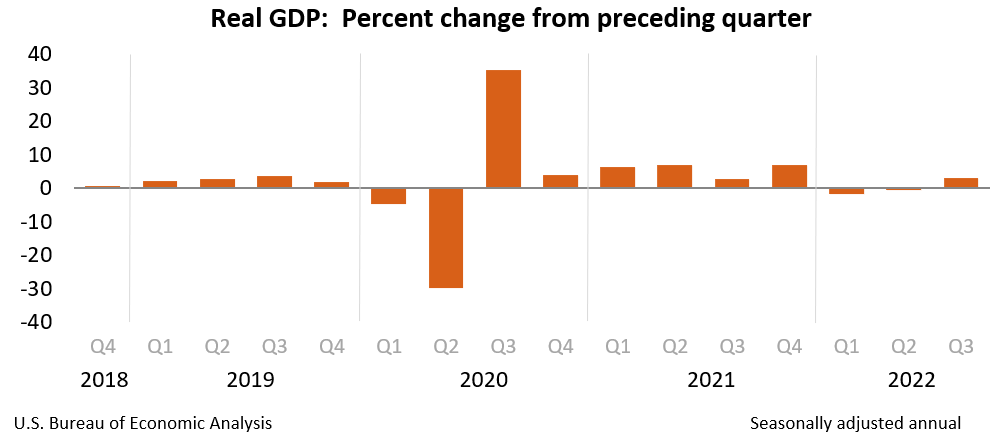

05Dec2022 Market Close & Major Financial Headlines: Wall Street Equities Opened Lower And Trended Down To Close Near Session Bottom As Economic Soft Landing Hopes Fade

Summary Of the Markets Today:

- The Dow closed down 483 points or 1.40%,

- Nasdaq closed down 1.93%,

- S&P 500 down 1.79%,

- WTI crude oil settled at 77 down $2.67,

- USD $105.32 uo $0.78,

- Gold 1780 down $29.70,

- Bitcoin $16,945 down 1.45% – Session Low 16,895,

- 10-year U.S. Treasury 3.588% up 0.085%

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for December 2022

Today’s Economic Releases:

Join in celebrating the holidays with EWI’s 12 Days of Elliott! Each day will reveal a new premium resource to help you build confidence in the markets using a tried and true method. December 1-12 Yes, it’s FREE!

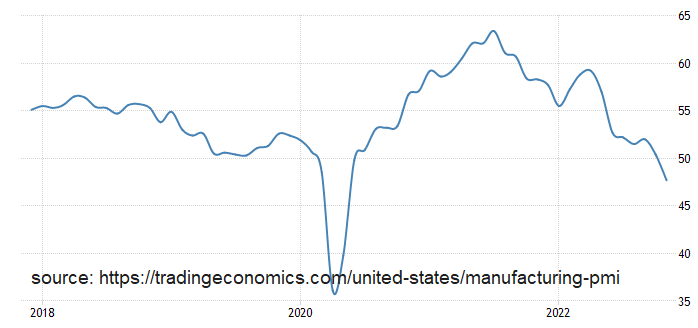

New orders for manufactured goods in October 2022, up twelve of the last thirteen months, increased by 1.0%, the U.S. Census Bureau reported today. In perspective, inflation-adjusted sales (red line on the graph below) – continue in contraction year-over-year.

A summary of headlines we are reading today:

- Gasoline Prices Continue To Plummet In The U.S.

- Apple Ramps Up Efforts To Move Production Of Out China

- North Face owner VF Corp. falls 10% after guidance cut, CEO steps down

- DHL buying Ford E-Transit cargo vans showcases the automaker’s electric vehicle strategy

- Los Angeles bans oil and gas drilling within city limits

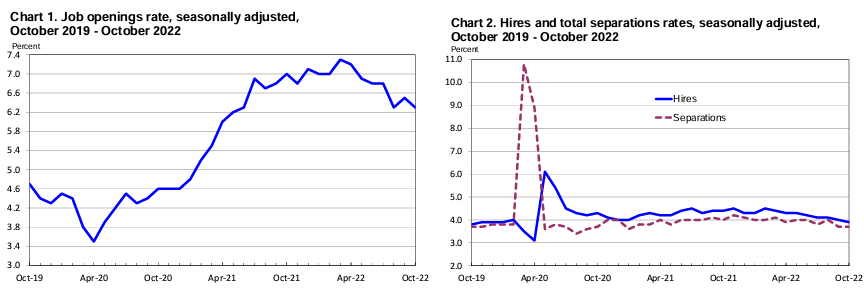

- Stocks, Bonds, Bullion, & Black Gold Battered As ‘Soft Landing’ Hopes Fade

- Iranians Skeptical That Morality Police Actually Disbanded After Surprise Announcement

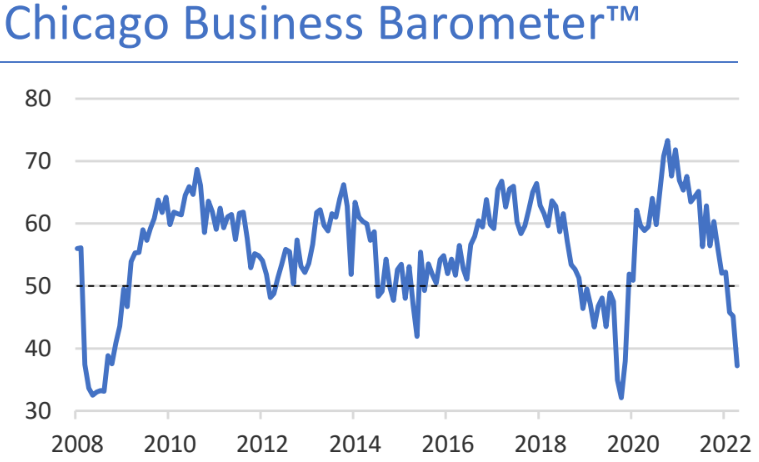

- FA Center: This little-known but spot-on economic indicator says recession and lower stock prices are all but certain

These and other headlines and news summaries moving the markets today are included below.