09Dec2022 Market Close & Major Financial Headlines: Wall Street Indexes Traded Along The Unchanged Line, Diving Sharply During The Last 30 Minutes To Close At The Session Bottom

Summary Of the Markets Today:

- The Dow closed down 305 points or 0.90%,

- Nasdaq closed down 0.70%,

- S&P 500 down 0.73%,

- WTI crude oil settled at $71 down $0.06,

- USD $104.97 up $0.20,

- Gold $1808 up $6.10,

- Bitcoin $17,105 down 0.50% – Session Low 17,098,

- 10-year U.S. Treasury 3.575% up 0.83%

- Baker Hughes Rig Count: U.S. -4 to 780 Canada + 7 to 202

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for December 2022

Today’s Economic Releases:

The Producer Price Index for final demand moderated to 7.4% for the 12 months ended in November. One would expect the Consumer Price Index to come in next week around the same level.

October 2022 sales of merchant wholesalers, except manufacturers’ sales branches and offices, after adjustment for seasonal variations and trading day differences but not for price changes, were up 11.9% from the revised October 2021 level. Total inventories were up 21.9% from the revised October 2021 level. The October inventories/sales ratio for merchant wholesalers was 1.32. The October 2021 ratio was 1.21. Sales to inventory ratio is the proper way to look at wholesale trade as it does not need to be adjusted for inflation. A rising ration normally signals a slowing economy.

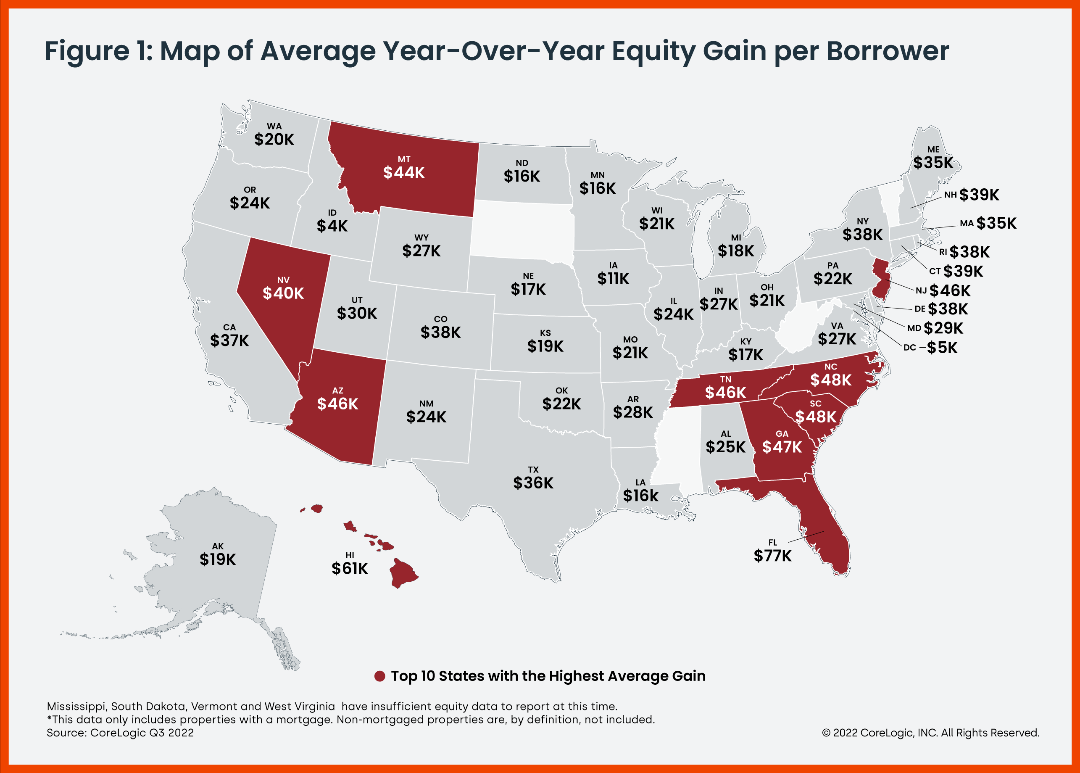

CoreLogic today released the Homeowner Equity Report (HER) for the third quarter of 2022. The report shows that U.S. homeowners with mortgages (which account for roughly 63% of all properties) saw equity increase by 15.8% year over year, representing a collective gain of $2.2 trillion, for an average of $34,300 per borrower, since the third quarter of 2021. Annual home equity gains began to slow in the third quarter of 2022, with the average borrower netting $34,300, compared with the nearly $60,000 year-over-year gain recorded in the second quarter.

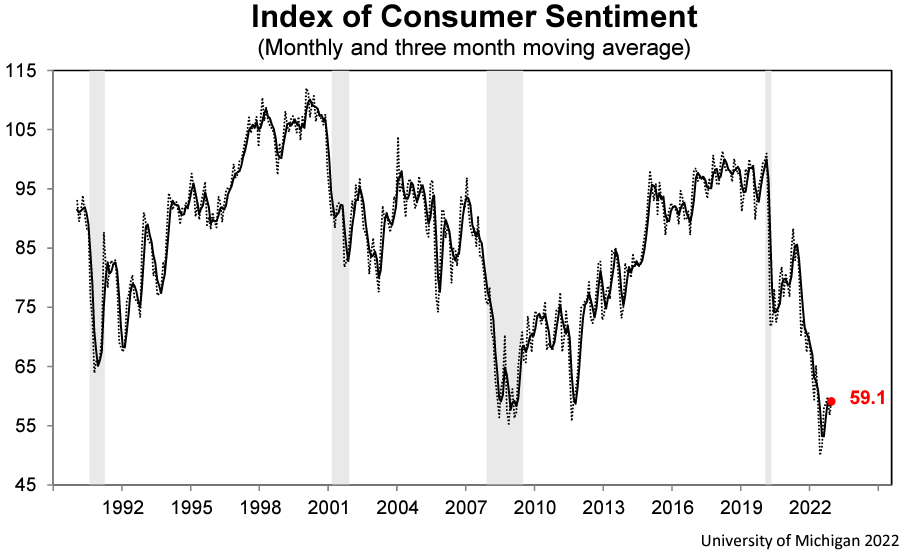

The University of Michigan Preliminary consumer sentiment for December 2022 rose 4% above November, recovering most of the losses from November but remaining low from a historical perspective. All components of the index lifted, with one-year business conditions surging 14% and long-term business conditions increasing a more modest 6%.

A summary of headlines we are reading today:

- Battery Metal Prices Slide Sideways

- JPMorgan’s Kolanovic: Sell Oil Stocks Now

- U.S. Oil And Gas Rig Count Falls Slightly

- Stellantis to indefinitely idle Jeep plant, lay off workers to cut costs for EVs

- Marijuana industry sales slow down after pandemic surge

- Covid and flu hospitalizations increase as holidays approach, while RSV retreats in some states

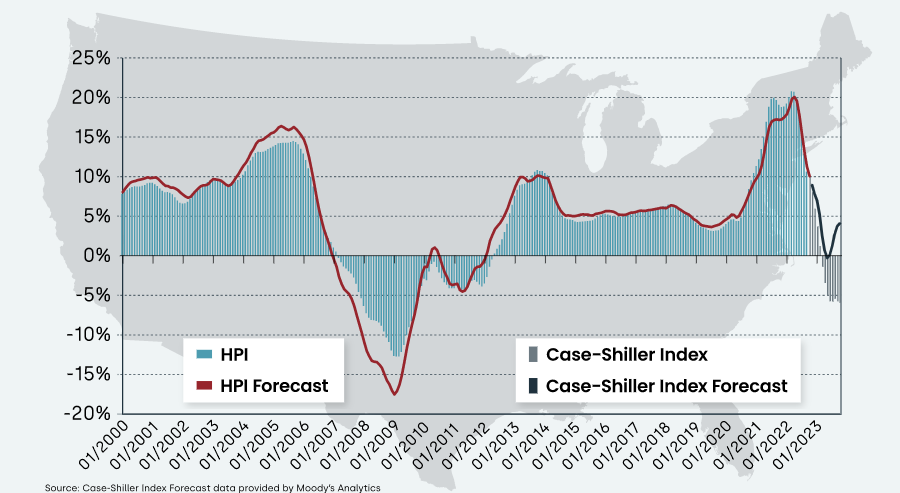

- “There Is No Soft Landing” – RH CEO Warns Housing Market “Looks More Like A Crash-Landing”

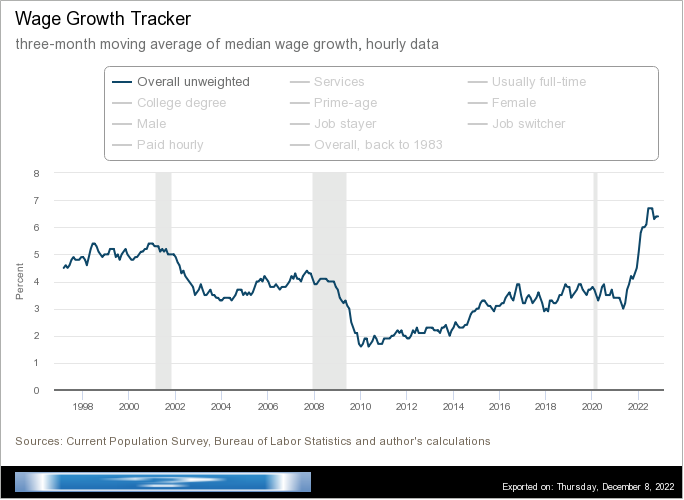

- The Jobs “Boom” Isn’t So Hot When We Remember Nearly Six Million Men Are Missing From The Workforce

- Store Credit Cards Hit 30% Interest Rates As Consumer Balances Rise

- Foreclosure activity rose 64% from a year ago in November and was highest in these U.S. cities

These and other headlines and news summaries moving the markets today are included below.