Summary Of the Markets Today:

- The Dow closed down 764 points or 2.25%,

- Nasdaq closed down 3.23%,

- S&P 500 down 2.49%,

- WTI crude oil settled at $76 down $1.16,

- USD $104.60 up $0.83,

- Gold $1787 down $31.60,

- Bitcoin $17,428 down $394 – Session Low 17,351,

- 10-year U.S. Treasury 3.45% down 0.053%

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases:

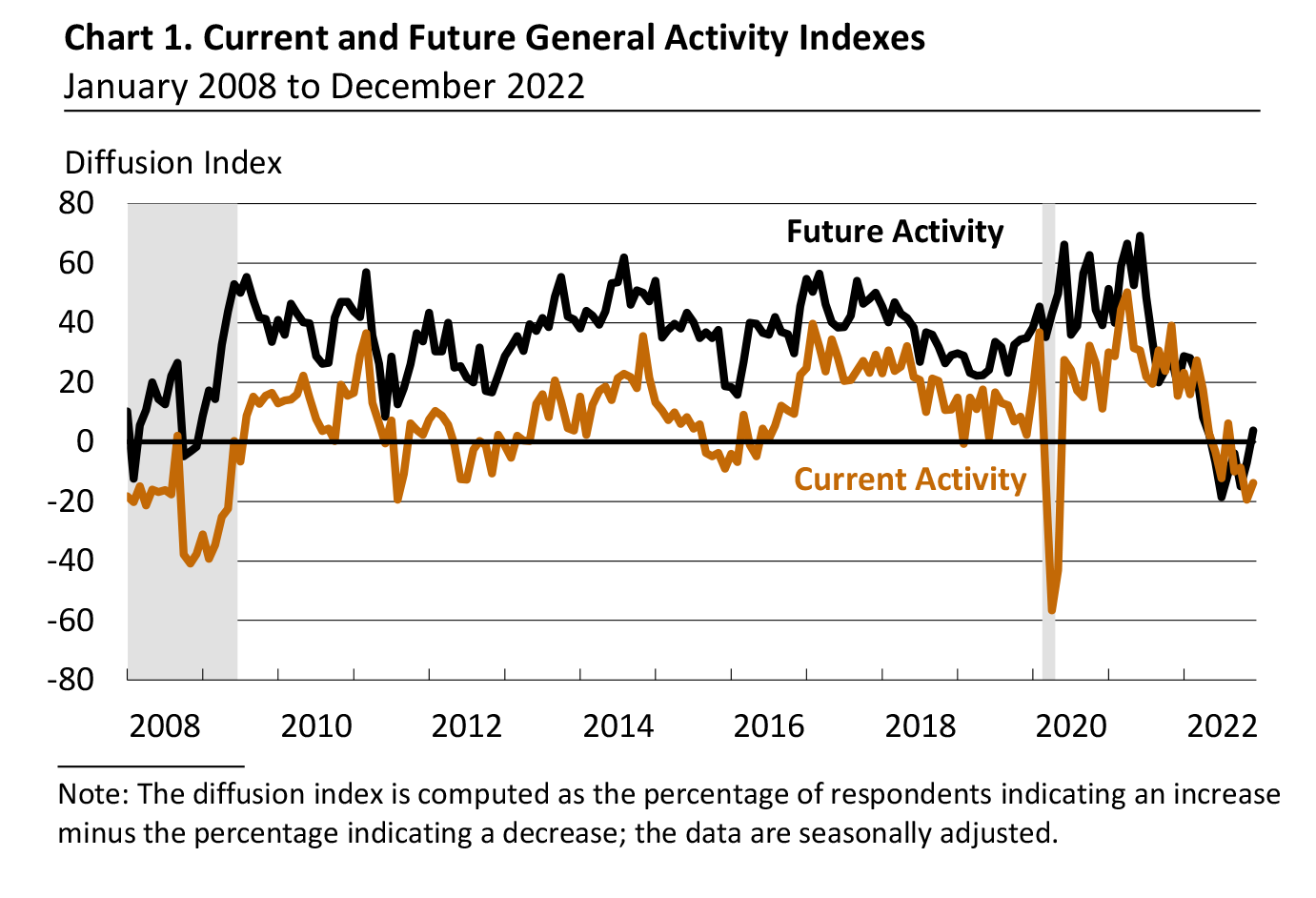

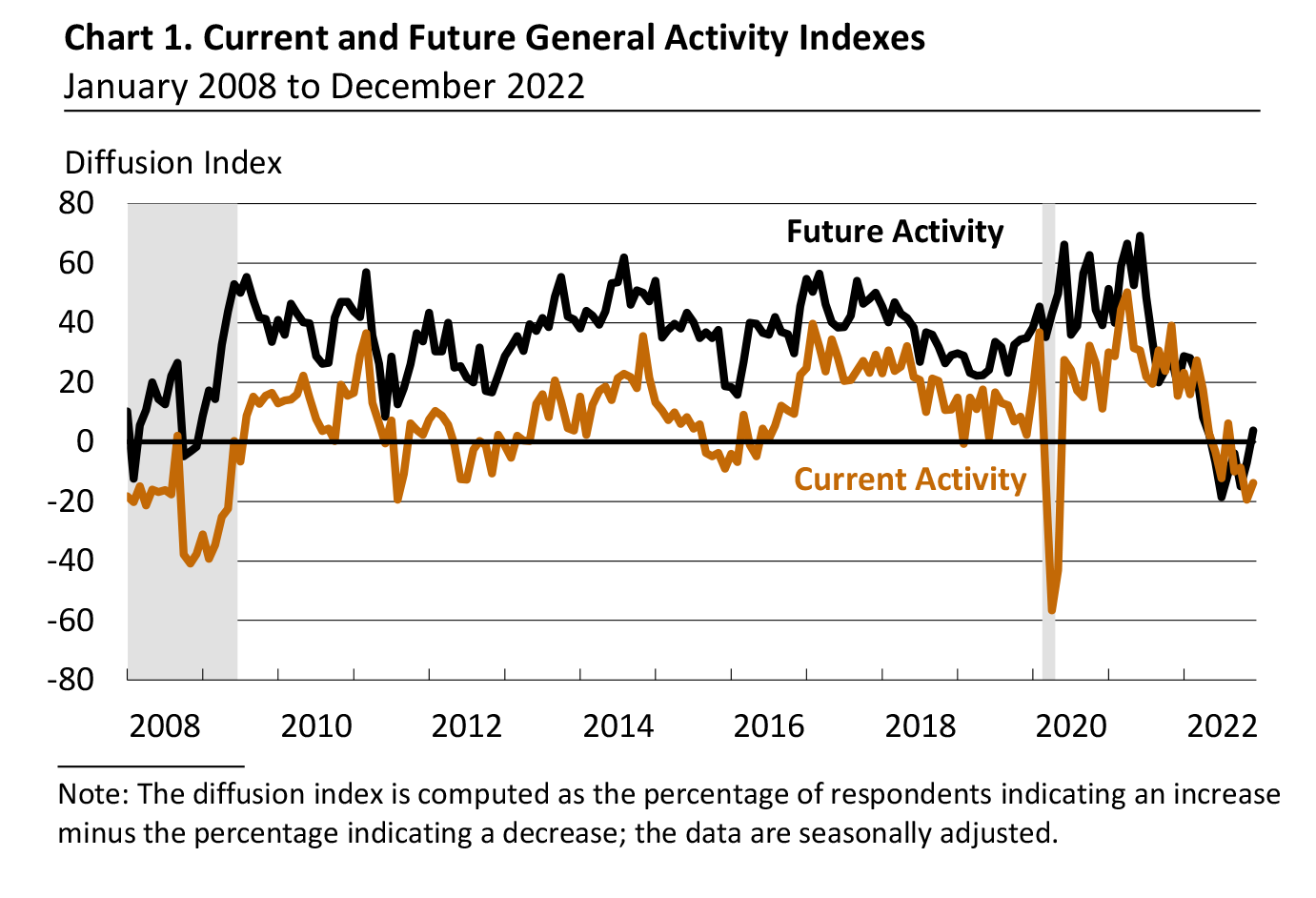

The Philadephia Fed’s manufacturing index remained negative in December 2022 but rose 6 points to -13.8 this month (see Chart 1). This is its fourth consecutive negative reading and sixth negative reading in the past seven months. Thirty-one percent of the firms reported declines in activity, while 17 percent reported increases. The majority (51 percent) reported no change.

Advance estimates of U.S. retail and food services sales for November 2022 are up 6.5% above November 2021 – however, inflation-adjusted growth declined 0.7% year-over-year which suggests a modest decline in economic growth.

The combined value of manufacturers’ and trade sales (business sales) for October 2022 was up 10.1% from October 2021. Manufacturers and trade inventories (business inventories) for October were up 16.5% from October 2021. The total business inventories/sales ratio was 1.33 (blue line on the graph below) – The October 2021 ratio was 1.25. A growing ratio suggests a slowing economy.

Industrial production declined to 2.5% year-over-year (blue line in the graph below) in November 2022. Year-over-year for the components: manufacturing (declined to 1.0% – red line in the graph below), mining (declined to 3.6% – orange line in the graph below), utilities (increased to 2.6% – green line in the graph below). Capacity utilization moved down 0.2 percentage points in November to 79.7 percent, a rate that is 0.1 percentage points above its long-run (1972–2021) average.

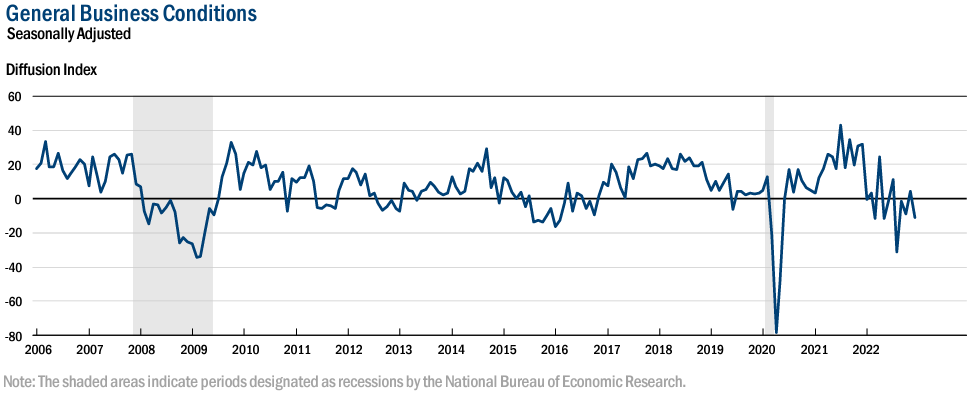

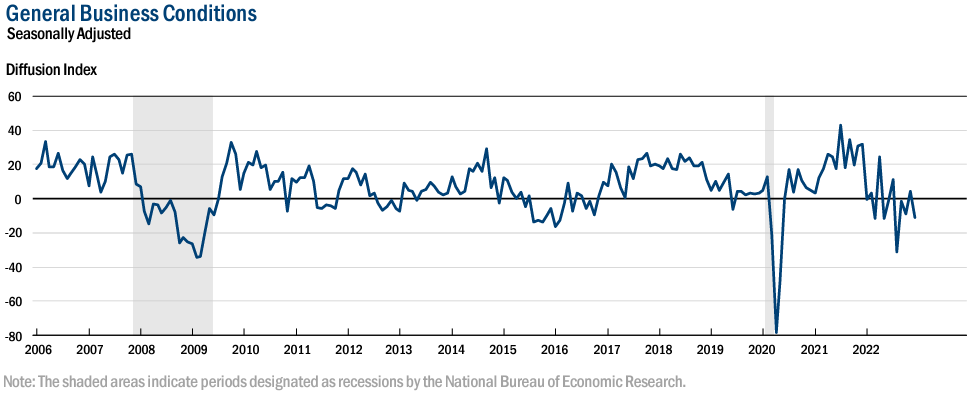

Business activity declined in New York State, according to firms responding to the December 2022 Empire State Manufacturing Survey. The headline general business conditions index fell sixteen points to -11.2. New orders moved slightly lower, while shipments edged higher.

In the week ending December 10, the unemployment insurance initial claims 4-week moving average was 227,250, a decrease of 3,000 from the previous week’s revised average. The previous week’s average was revised up by 250 from 230,000 to 230,250.

A summary of headlines we are reading today:

- Sydney Based Researchers Announce Lithium Ion Battery Rival

- Germany Greenlights Purchase Of U.S. Fighter Jets

- FuboTV hit with cyberattack during World Cup semifinal match

- Long Covid medical costs average $9,500 in the first six months, as patients become ‘health-system wanderers’

- Where Walmart CEO Doug McMillon expects inflation to stick around in 2023

- Delta expects 2023 earnings to nearly double thanks to ‘robust’ travel demand

- Vote Recount Flips Massachusetts Midterm Race From Republican To Democrat By 1 Vote

- Bond Report: Flight-to-safety trade sends 10- and 30-year Treasury yields to one-week lows

- Market Snapshot: Dow down over 700 points in the final hour of trade as stocks head for the biggest decline in 3 months

These and other headlines and news summaries moving the markets today are included below.

Sponsor For Today’s Newsletter

Investment Opportunity – Our #1 Pick

Only invest in defense contractors that have actual defense contracts.

This way, you know the technology is solid and they’ve been properly vetted to provide cutting-edge technology to the military.

This company has won government contracts and is our #1 pick.

Click here |