- The Dow closed down 1 points or 0.00%, (Closed at 43,729, New Historic high 43,823)

- Nasdaq closed up 286 points or 1.51%, (Closed at 19,269, New Historic high 19,302)

- S&P 500 closed up 44 points or 0.74%, (Closed at 5,973, New Historic high 5,984)

- Gold $2,712 up $36.30 or 1.33%,

- WTI crude oil settled at $72 up $0.30 or 0.43%,

- 10-year U.S. Treasury 4.332 down 0.094 points or 2.079%,

- USD index $104.35 down $0.74 or 0.07%,

- Bitcoin $76,510 up $390 or 0.51%, (24 Hours) , – New Bitcoin Historic high 76,874.36)

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

The S&P 500 and Nasdaq Composite reached new record highs on Thursday, driven by a tech-led rally. This came as investors processed two major events – Federal Reserve interest rate cut and Donald Trump’s election victory: Trump’s win on Wednesday had already sent stock indices to record levels, with his proposed corporate tax cuts and deregulation fueling economic optimism. Nvidia and Amazon shares reached new all-time highs The Magnificent Seven stocks (Apple, Alphabet, Microsoft, Amazon, Meta, Tesla, and Nvidia) outperformed the broader market, with their ETF rising over 8% in the past five days compared to the S&P 500’s 4.69% gain. Fed Chair Jerome Powell addressed questions about the potential impact of Trump’s election on Fed policy, stating that in the near term, the election would not affect their decisions.

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

September 2024 sales of merchant wholesalers were down 0.4 percent (±0.9 percent)* from the revised September 2023 level. Total inventories of merchant wholesalers were up 0.3% from the revised September 2023 level. The September inventories/sales ratio for merchant wholesalers was 1.34. The September 2023 ratio was 1.33. Honestly, I am not sure why I consider this a significant release anymore. We need more wholesalers because companies have become only assemblers – and need to outsource more and more components. Combine this with more and more assemblers moving overseas – and this chaos makes understanding WTF is going on close to impossible.

In the week ending November 2, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 227,250, a decrease of 9,750 from the previous week’s revised average. The previous week’s average was revised up by 500 from 236,500 to 237,000. No sign of recession in these numbers.

Nonfarm business productivity is up 2.0% year-over-year with costs up 3.4%. When costs rise faster than productivity, you are becoming less competitive. And honestly, the way productivity is calculated by the BLS is incorrect anyway. It takes a detailed analysis of each persons motion in a company and not a broad brush analysis of hours to produce a product.

The Federal Reserve’s FOMC meeting concluded today with the expected 0.25 point reduction of the federal funds rate. The meeting statement:

Recent indicators suggest that economic activity has continued to expand at a solid pace. Since earlier in the year, labor market conditions have generally eased, and the unemployment rate has moved up but remains low. Inflation has made progress toward the Committee’s 2 percent objective but remains somewhat elevated.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. The Committee judges that the risks to achieving its employment and inflation goals are roughly in balance. The economic outlook is uncertain, and the Committee is attentive to the risks to both sides of its dual mandate.

In support of its goals, the Committee decided to lower the target range for the federal funds rate by 1/4 percentage point to 4-1/2 to 4-3/4 percent. In considering additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities. The Committee is strongly committed to supporting maximum employment and returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

According to the Federal Reserve,

consumer credit increased in September at an annual rate of 1.4%.

My take is that total consumer credit is up 2.2% year-over-year, nonrevolving credit (like car and student loans) is up 1.3% year-over-year, and revolving loans (say credit cards) is up 5.0% year-over-year. Revolving credit growth continues to decline – and consider with inflation that the real growth of revolving credit is under 3%. There is no indication in these numbers that economic growth is constrained by credit availability.

Here is a summary of headlines we are reading today:

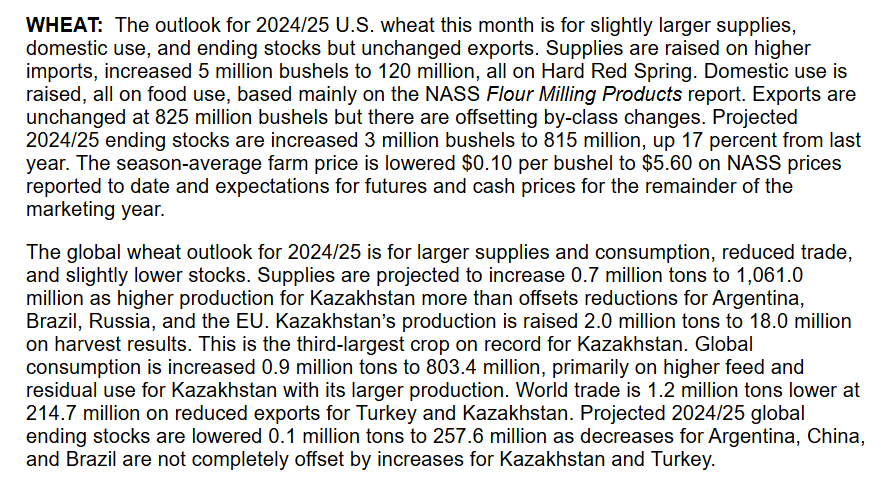

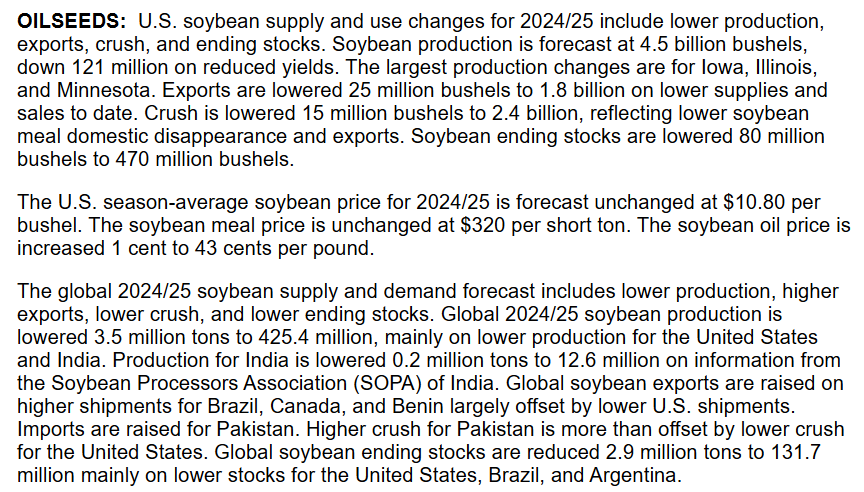

- Duke Energy’s Hurricane Restoration Costs Could Hit $2.9 Billion

- 17 Gulf Oil Platforms Evacuated Under Approach of Hurricane Rafael

- Bank of England Cuts Interest Rates

- Weaker U.S. Fracking Drags Halliburton Earnings Below Estimates

- Big Oil CEOs Voice Concern Over Geopolitical Tensions

- Fed meeting recap: Powell ‘feeling good’ about economy, says Trump can’t legally fire him

- S&P 500, Nasdaq close at records and extend postelection rally as Fed cuts rates: Live updates

- Airbnb stock up as revenue jumps

- Rivian significantly misses Wall Street’s third-quarter revenue expectations

- Former Treasury Secretary Mnuchin says Trump’s top priorities will be tax cuts, Iran sanctions and tariffs

- The Federal Reserve cuts interest rates by a quarter point after election. Here’s what that means for you

- Interest rates cut but Bank hints fewer falls to come

- The bull market is ‘still an infant’: Why Evercore sees the S&P 500 at 6,600 by mid-2025

- Powell sends one crystal clear message to Trump: Firing me is ‘not permitted under the law’

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

![[Image of cumulative wind history]](https://www.nhc.noaa.gov/storm_graphics/AT18/refresh/AL182024_wind_history+png/084448_wind_history.png)