22Dec2022 Market Close & Major Financial Headlines: Wall Street Opened Sharply Lower, Don’t Expect A Santa Claus Rally This Week

Summary Of the Markets Today:

- The Dow closed down 349 points or 1.05%,

- Nasdaq closed down 2.18%,

- S&P 500 down 1.45%,

- WTI crude oil settled at $78 down $0.20,

- USD $104.38 up $0.22,

- Gold $1800 down $25.30,

- Bitcoin $16,782 flat 0.00% – Session Low 16,573,

- 10-year U.S. Treasury 3.679% down 0.004%

- Baker Hughes Rig Count: U.S. +3 to 779 Canada -103 to 96

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for December 2022

Today’s Economic Releases:

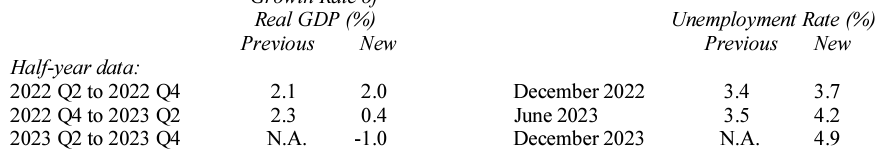

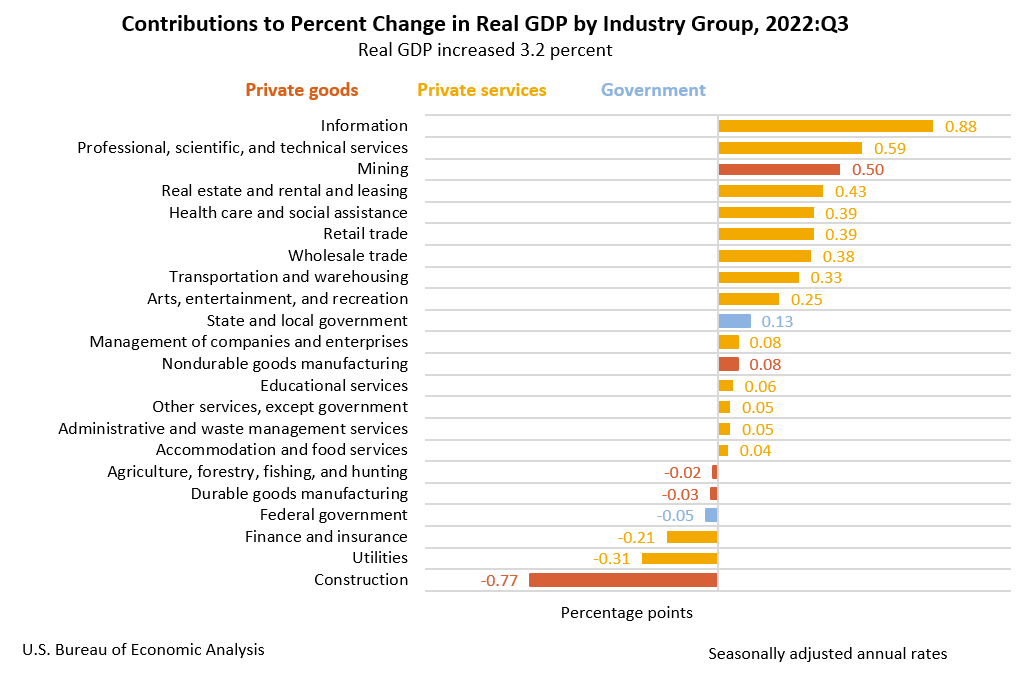

The third estimate of real gross domestic product (GDP) for 3Q2022 increased at an annual rate of 3.2 percent in the third quarter of 2022. I prefer to look at growth from the same quarter one year ago which shows GPP increased by 1.9%. In the second quarter, real GDP decreased 0.6 percent. In the second estimate 0f 3Q2022 GDP, the increase in real GDP was 2.9 percent. The updated estimates primarily reflected upward revisions to consumer spending and nonresidential fixed investment that were partly offset by a downward revision to private inventory investment.

In the week ending December 17, the advance figure for unemployment insurance initial claims 4-week moving average was 221,750, a decrease of 6,250 from the previous week’s revised average. The previous week’s average was revised up by 750 from 227,250 to 228,000.

A summary of headlines we are reading today:

- U.S. Consumers Get Cheap Gasoline For Christmas

- Deflating The Bubble: Teslas Market Cap Is Silently Imploding

- NFL ‘Sunday Ticket’ goes to YouTube in seven-year, $2 billion annual deal

- AMC plunges after theater company announces capital raise, proposes a reverse stock split

- Under Armour picks Marriott exec Stephanie Linnartz to be new CEO after a seven-month search

- The $52 billion plan to save New York’s low-lying areas from sea level rise and storm surges

- ICE Prepares To Release Illegal Immigrants In Tennessee

- $1.7 Trillion Omnibus Spending Package Passed By Senate

- US stocks open lower as economic data renew rate hike worries

- Market Snapshot: Dow falls 500 points, stocks off session lows in the final hour of trade after strong economic data, bearish comments by David Tepper

These and other headlines and news summaries moving the markets today are included below.