31Jan2023 Market Close & Major Financial Headlines: Wall Street Main Indexes Shot Upwards And Closed Higher As Fed Meeting Gets Underway

Summary Of the Markets Today:

- The Dow closed up 369 points or 1.09%,

- Nasdaq closed up 1.67%,

- S&P 500 up 1.46%,

- Gold 1944 up $4.60,

- WTI crude oil settled at 79 up 1.21,

- 10-year U.S. Treasury 3.503% down 0.048,

- USD $102.07 down $0.20,

- Bitcoin $22,971 up $183.84 – Session Low 22,631

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for February 2023

Today’s Economic Releases:

The Conference Board Consumer Confidence Index® decreased in January following an upwardly revised increase in December 2022. The Index now stands at 107.1 (1985=100), down from 109.0 in December (an upward revision). The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—fell to 77.8 (1985=100) from 83.4 partially reversing its December gain. The Expectations Index is below 80 which often signals a recession within the next year. Both present situation and expectations indexes were revised up slightly in December. Ataman Ozyildirim, Senior Director, Economics at The Conference Board stated:

Consumer confidence declined in January, but it remains above the level seen last July, lowest in 2022. Consumer confidence fell the most for households earning less than $15,000 and for households aged under 35.

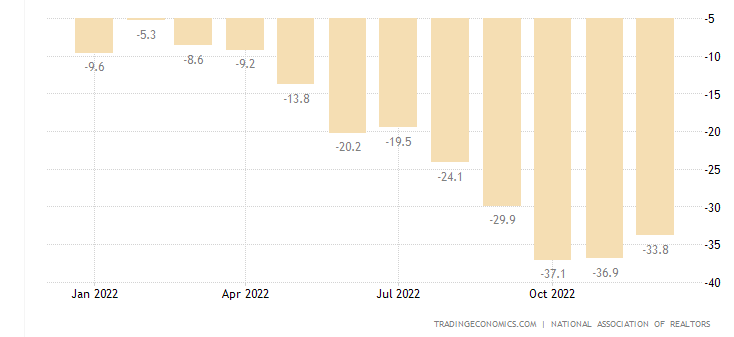

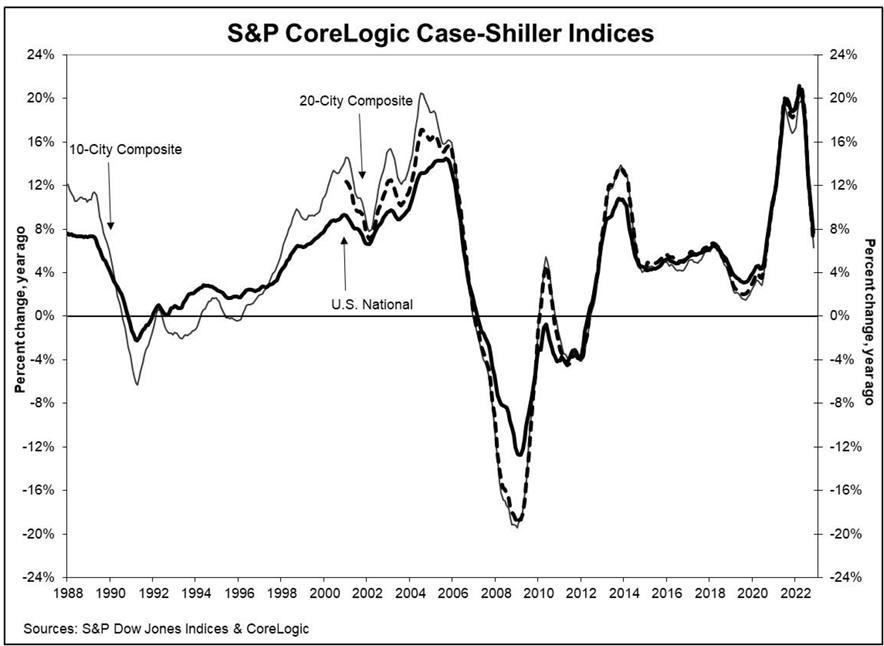

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 7.7% annual gain in November, down from 9.2% in the previous month. The 10-City Composite annual increase came in at 6.3%, down from 8.0% in the previous month. The 20-City Composite posted a 6.8% year-over-year gain, down from 8.6% in the previous month. CoreLogic Chief Economist Selma Hepp stated:

Housing market conditions deteriorated considerably at the end of 2022 as mortgage rates hit a 20-year high in November, wiping out a considerable portion of homebuyers purchase power. As a result, the November CoreLogic S&P Case-Shiller Index continued to cool off posting a 7.7% year-over-year increase, marking the seventh straight month of slowing home price growth and the slowest increase since September 2020.

San Francisco was first to post an annual decline with prices down about 2% year-over-year. At the same time, pandemic boomtowns, such as Phoenix, Las Vegas and Seattle are now experiencing the largest waning in price growth from last year, while home prices in cities in the Northeast and Midwest such as New York and Boston, Chicago and Detroit, are more resilient given a lesser upswing in price growth seen in those areas during the pandemic.

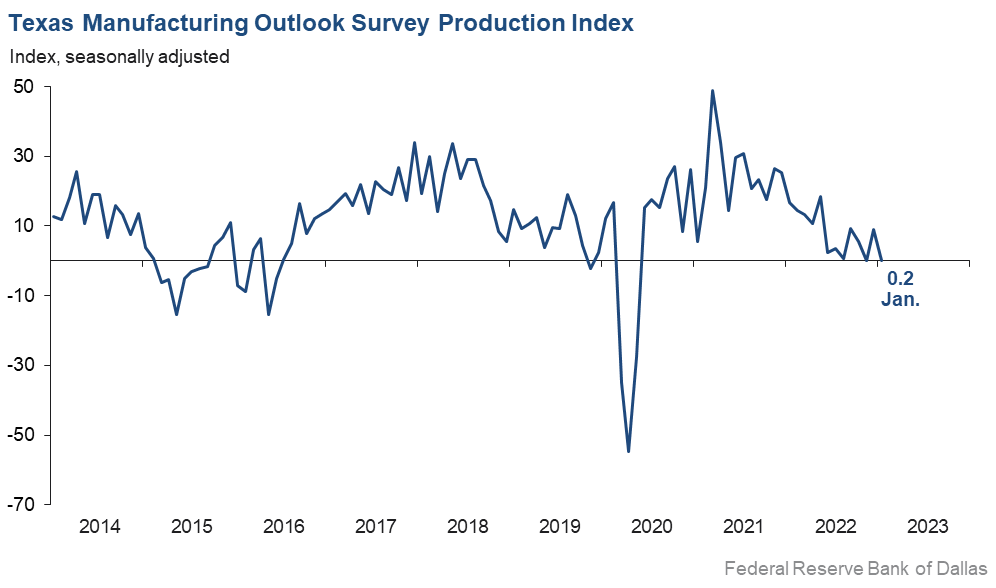

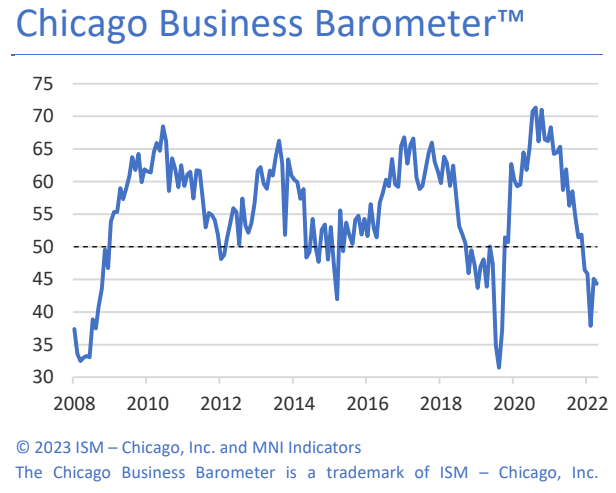

The Chicago Business Barometer moderated by -0.8 points to 44.3 in January; the fifth consecutive month below 50. This follows a December rebound to signal a softer downturn. This barometer is used by pundits to predict the national ISM manufacturing levels.

A summary of headlines we are reading today:

- BP Taps Deep Gas Reservoirs In Azerbaijan’s Caspian Sea

- China’s Low Aluminum Production Worsens Supply Chain Challenges

- Russian Oil Companies Told To Comply With Ban On Oil, Oil Product Exports

- Traders Turn Bullish On Oil As Majors Report Earnings

- Russia’s Pipeline Gas Exports To Europe Slump To Record Low

- General Motors doesn’t expect significant U.S. production of EVs until the second half of the year

- Dow closes more than 350 points higher, S&P 500 caps best January in four years

- PayPal to lay off 2,000 employees in coming weeks, about 7% of the workforce

- Market Extra: Coinbase stock poised to record the best month in history. Can the rally continue?

These and other headlines and news summaries moving the markets today are included below.