Summary Of the Markets Today:

- The Dow closed up 7 points or 0.02%,

- Nasdaq closed up 2.00%,

- S&P 500 up 1.05%,

- Gold $1968 up $22.50,

- WTI crude oil settled at $77 down $1.91,

- 10-year U.S. Treasury 3.413% down 0.114 points,

- USD $101.17 down $0.93,

- Bitcoin $23,741 up $750.42 – Session Low 22,853

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases:

The

ADP National Employment Report shows employers created 106,000 jobs in January 2023 and annual pay was up 7.3% year-over-year. 106,000 is a very weak number but ADP said that weather-related disruptions on employment during their reference week likely negatively impacted the gains this month – significantly impacting business with 1 to 19 employees.

Construction spending during December 2022 was 7.7% above December 2021. However, when construction spending is inflation adjusted, it is DOWN 9.2% year-over-year. Construction is paying the price for the Fed’s inflation-fighting increase of the federal funds rate – and is a drag on the economy.

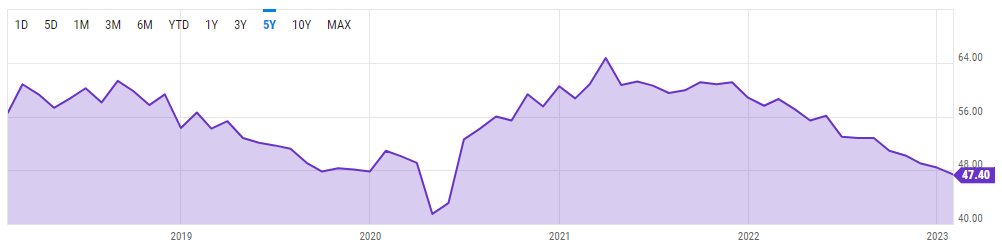

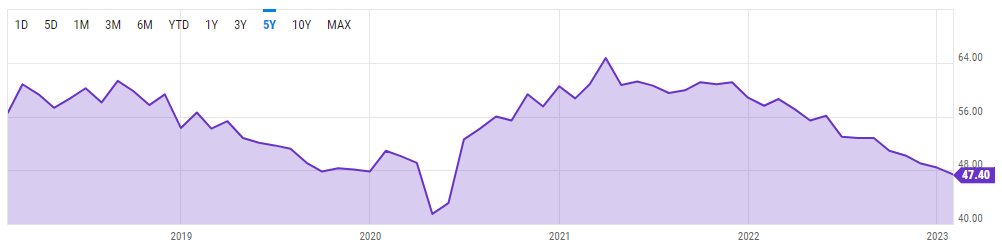

The January 2023 Manufacturing PMI registered 47.4%, 1 percentage point lower than the seasonally adjusted 48.4% recorded in December. Regarding the overall economy, this figure indicates a second month of contraction after a 30-month period of expansion. The Manufacturing PMI figure is the lowest since May 2020, when it registered a seasonally adjusted 43.5%. The New Orders Index remained in contraction territory at 42.5%, 2.6 percentage points lower than the seasonally adjusted figure of 45.1% recorded in December. The Production Index reading of 48% is a 0.6-percentage point decrease compared to December’s seasonally adjusted figure of 48.6%. Yes, manufacturing is currently a drag on the economy.

graph source: https://ycharts.com/indicators/us_pmi

The number of job openings increased to 11.0 million on the last business day of December 2022. Over the month, the number of hires and total separations changed little at 6.2 million and 5.9 million, respectively. This is a sign of continued strength in employment. The graph below shows that the number of job openings (red line) continue to far exceed the number of jobs being added (blue line).

The Fed FOMC meeting statement hiked the federal funds rate by 25bps as fully expected to a range of 4.5%-4.75%..

A summary of headlines we are reading today:

- Germany’s Largest Gas Storage Facility Can’t Store Gas

- U.S. Manufacturing PMI Hits Lowest Since May 2020

- Nuclear Power Is Entering A New Era

- Space Politics: A Battle For Lunar Minerals Is Unfolding

- Oil Prices Inch Lower After EIA Confirms Crude Build

- Goldman: The Fed Is Approaching A “Critical Inflection Point”

- Full recap of the Federal Reserve’s rate hike and Chairman Jerome Powell’s news conference

- S&P 500 closes higher on Wednesday, Nasdaq adds 2% as investors look past Fed’s rate hike

- FedEx is laying off 10% of its officers and directors amid cooling demand

- Here’s what the Federal Reserve’s 25 basis point interest rate hike means for your money

- Stocks, Bonds, & Gold Soar As Powell Shrugs Off Loosening Financial Conditions

- The Fed: Fed lifts interest rates by a quarter percentage point and signals ‘ongoing increases’

These and other headlines and news summaries moving the markets today are included below.