Summary Of the Markets Today:

- The Dow closed down 431 points or 1.26%,

- Nasdaq closed down 1.78%,

- S&P 500 closed down 1.38%,

- Gold $1847 up $1.40,

- WTI crude oil settled at $78 down $0.55,

- 10-year U.S. Treasury 3.867% up 0.06 points,

- USD $104.03 up $0.10,

- Bitcoin $24,472 – 24H Change up $355.46 – Session Low $24,067

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases:

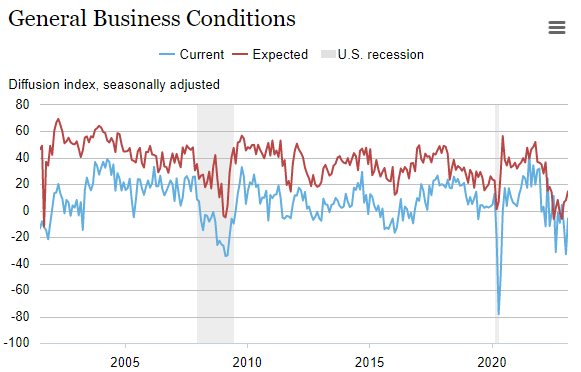

The Philly Fed’s Manufacturing Business Outlook Survey shows manufacturing activity in the region continued to decline. The diffusion index for current activity fell from a reading of -8.9 last month to -24.3 this month. The new orders index remained negative, and the shipments index remained positive but low. The employment index declined but remained positive, and the price indexes continued to suggest overall increases but were in line with long-run averages. Most of the survey’s future indicators were positive but low, suggesting tempered expectations for growth over the next six months.

The Producer Price Index (PPI) for final demand rose 6.0% for the 12 months that ended January 2023 – down from 6.5% last month. In January, a 1.2% rise in prices for final-demand goods led to an advance in the final demand index. Prices for final demand services also moved higher, increasing by 0.4%. The Consumer Price Index (CPI) and the PPI are at nearly the same level. This data shows inflation is not going away quickly.

Privately‐owned housing units authorized by building permits in January 2023 were 27.3% below the January 2022 rate – up from -27.2% last month. Privately‐owned housing starts are 21.4% below the January 2022 rate – up from -22.5% last month. Privately‐owned housing completions are 12.8% above the January 2022 rate – up from the 5.0% last month. These improvements are considered modest, and unsure if this is the beginning of new trends.

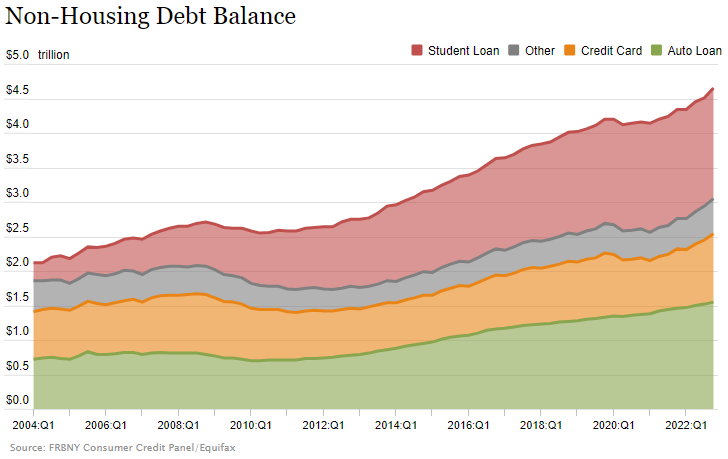

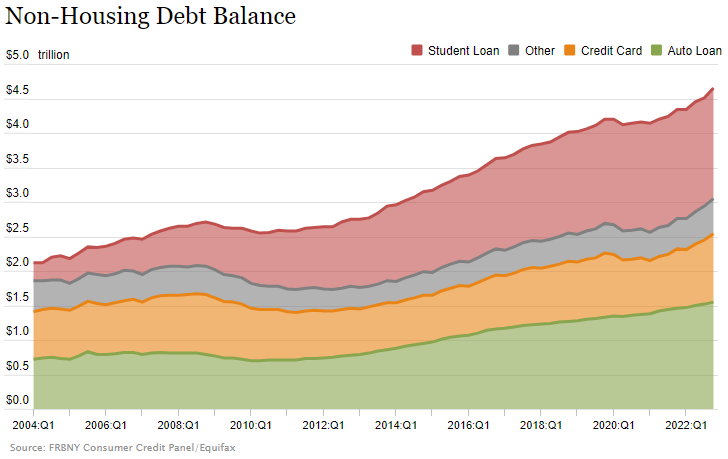

The Federal Reserve Bank of New York’s Center for Microeconomic Data today issued itsQuarterly Report on Household Debt and Credit. The Report shows an increase in total household debt in the fourth quarter of 2022, increasing by $394 billion (2.4%) to $16.90 trillion. Balances now stand $2.75 trillion higher than at the end of 2019, before the pandemic recession. The report is based on data from the New York Fed’s nationally representative Consumer Credit Panel.

In the week ending February 11, 4-week moving average was 189,500, an increase of 500 from the previous week’s revised average. The previous week’s average was revised down by 250 from 189,250 to 189,000.

A summary of headlines we are reading today:

- Electric Trucks Are Catching Up With Other EVs

- China Sanctions U.S. Defense Companies Over Taiwan Gun Sales

- Rising Metal And Mineral Prices Could Derail The Energy Transition

- Rising Metal And Mineral Prices Could Derail The Energy Transition

- Higher Gasoline Prices Drive U.S. Producer Price Index Higher

- Stocks close lower, Dow sheds 400 points after another hot inflation report raises rate hike fears: Live updates

- Bruce Willis’ ‘condition has progressed’ to frontotemporal dementia, his family says

- Hawkish FedSpeak Hammers Stocks; Bitcoin Bid After ‘Bad’ Data

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.