Of course, the market decline today was caused by the realization that the federal funds rate will remain elevated longer and likely higher than the markets desire – see today’s economic releases below.

Summary Of the Markets Today:

- The Dow closed down 575 points or 1.72%,

- Nasdaq closed down 1.25%,

- S&P 500 closed down 1.53%,

- Gold $1819 down $36.40,

- WTI crude oil settled at $77 down $3.04,

- 10-year U.S. Treasury 3.972% down 0.011 points,

- USD $105.61 up $1.26,

- Bitcoin $22,060 – 24H Change down $273.69 – Session Low $22,032

*Stock data, cryptocurrency, and commodity prices at the market closing.

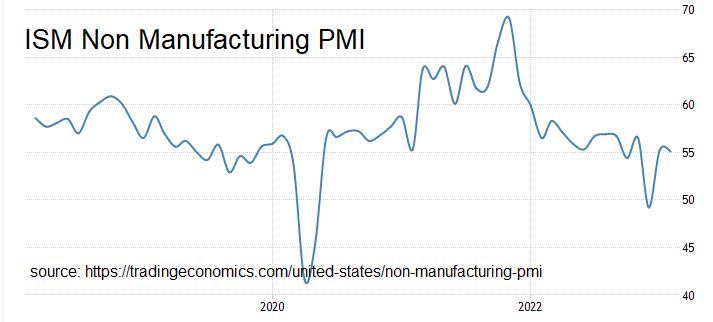

Today’s Economic Releases:

Federal Reserve Chairman Jerome Powell said interest rates are likely to head higher than central bank policymakers had expected. If the totality of the data were to indicate that faster tightening is warranted, the Federal Reserve would be prepared to increase the pace of rate hikes. The markets were hoping for a quick end to the federal funds rate increases and this speech seems to be geared to dampen this hope. Powell said the current trend shows that the Fed’s inflation-fighting job is not over and stated:

The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated. If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes.

The CoreLogic Home Price Insights report shows home prices continued their gradual free fall in January 2023, with the 5.5% annual gain down for the ninth straight month and the lowest recorded since June 2020. Deceleration was particularly noticeable in the Western U.S. and other states and metro areas that saw substantial appreciation over the past few years. Three Northwestern states (along with Washington, D.C.) posted at least slight annual declines as migration patterns that began during the pandemic shifted, slowing demand and driving price decreases.

January 2023 sales of merchant wholesalers were up 1.0% from the revised December level and were up 3.6% (non-inflation adjusted) from the revised January 2022 level. Total inventories of merchant wholesalers were down 0.4% from the revised December level. Total inventories were up 15.8% from the revised January 2022 level. The January inventories/sales ratio for merchant wholesalers was 1.34. The January 2022 ratio was 1.20. This shows that inventory levels are elevated relative to sales (green line on the graph below) but this ratio is headed in the right direction as sales growth is improving and inventory growth is declining.

A summary of headlines we are reading today:

- EIA Lowers Forecast For Natural Gas Prices

- U.S. Oil Production To Grow Just 500,000 Bpd This Year

- Analysts See Upside In China Despite Conservative Growth Target

- The First New U.S. Nuclear Reactor Since 2016 Begins Splitting Atoms

- Oil Prices Remain Rangebound Despite A String Of Predictions

- Dow closes 570 points lower, turns negative for 2023 as Powell ignites higher rate fears: Live updates

- ‘You ain’t seen nothing yet:’ Florida Gov. Ron DeSantis touts state record and fuels 2024 speculation

- Goldman Expects Nearly 1 Million Drop In Tomorrow’s Job Openings

- Gold outlook: Fed commentary on rate hike to keep bullion on edge this week

- Futures Movers: Oil prices posts first loss in 6 sessions after disappointing China import data, Powell’s remarks

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.