03 April 2023 Market Close & Major Financial Headlines: Wall Street’s Three Main Indexes Opened Fractionally Lower, But Finally Closed Mixed

Summary Of the Markets Today:

- The Dow closed up 327 points or 0.98%,

- Nasdaq closed down 0.27%,

- S&P 500 closed up 0.37%,

- Gold $2,002 up $16.30,

- WTI crude oil settled at $80 up $4.74,

- 10-year U.S. Treasury 3.411% down 0.077 points,

- USD $102.02 down $0.49,

- Bitcoin $28,047 up $60,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for April 2023

Today’s Economic Releases:

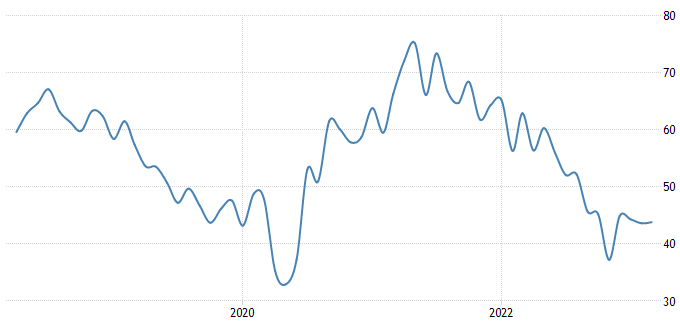

The ISM Manufacturing PMI decreased to 46.3 in March of 2023, the lowest since May of 2020, and compared to 47.7 in February and a consensus of 47.5 implying that rising interest rates and growing recession fears are starting to weigh on businesses. The reading pointed to a fifth straight month of contraction in factory activity, as companies continue to slow outputs to better match the demand for the first half of 2023 and prepare for growth in the late summer/early fall period.

source: trading economics

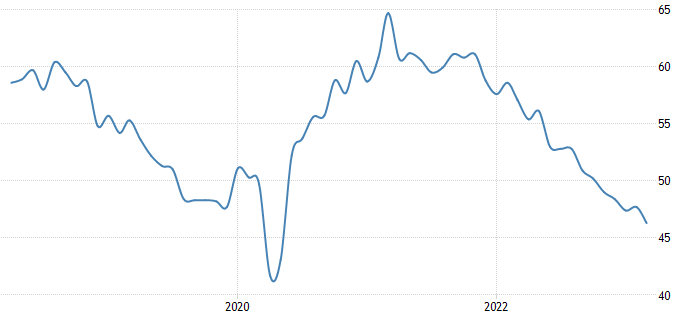

Construction spending during February 2023 was up 5.2% from February 2022. Unfortunately, after adjusting for inflation, construction spending is DOWN 9.5% year-over-year and is continuing to slow.

A summary of headlines we are reading today:

- U.S. Natural Gas Prices Are “Begging For Supply Cuts”

- Renewables Projected To Overtake Coal Worldwide By 2027

- Traders Predict 25-Point Rate Hike After OPEC+ Surprise Oil Output Cut

- Tesla Smashes Q1 Delivery Record Thanks To Price Cuts

- Citi Doesn’t See $100 Oil Despite Shock OPEC+ Cuts

- Google to cut down on employee laptops, services and staplers for ‘multi-year’ savings

- Dow closes 300 points higher to begin April’s trading, S&P 500 notches fourth day of gains: Live updates

- JPMorgan says more banks could run out of reserves like SVB if the pace of this deposit flight continues

- U.S. passport delays may be four months long — and could get worse. Here’s what to know

- Home prices suddenly jump after several months of declines

- Oil prices surge after a surprise move to cut output

- Metals Stocks: Gold settles above $2,000 as the dollar retreats after OPEC+ surprise output cuts

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.