Summary Of the Markets Today:

- The Dow closed down 144 points or 0.42%,

- Nasdaq closed down 0.35%,

- S&P 500 closed down 0.21%,

- Gold $2,020 down $36,

- WTI crude oil settled at $83 up $0.44,

- 10-year U.S. Treasury 3.517% up 0.066 points,

- USD $101.58 up $0.56,

- Bitcoin $30,347 down $5,

- Baker Hughes Rig Count: U.S. -3 to 748 Canada -16 to 111

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases:

The Advance Estimates of U.S. Retail and Food Services Sales for March 2023 show that sales were down 1.0 percent from the previous month, but up 2.9 percent from March 2022 – after inflation adjustment retail sales is down 0.3% year-over-year. It appears the consumer continues to marginally slow its purchases.

Industrial production rose 0.5 percent year-over-year in March 2023 (blue line in the graph below). Components manufacturing declined 0.9% year-over-year (red line on the graph below), mining output improved 5.4% percent year-over-year (orange line on the graph below), and utilities jumped to 4.2% percent year-over-year (green line on the graph below). Capacity utilization moved up to 79.8 percent in March, a rate that is 0.1 percentage points above its long-run (1972–2022) average. There is little evidence of a manufacturing resurgence.

In a bit of good news for consumers, U.S. import prices decreased 4.6% year-over-year in March 2023 (blue line on the graph below). Lower March prices for nonfuel industrial supplies and materials; consumer goods; foods, feeds, and beverages; capital goods; and automotive vehicles all contributed to the overall decrease in nonfuel import prices. Nonfuel import prices declined 1.5 percent from March 2022 to March 2023, the first 12-month drop since June 2020. And export prices also declined to 4.8% year-over-year (red line on the graph below).

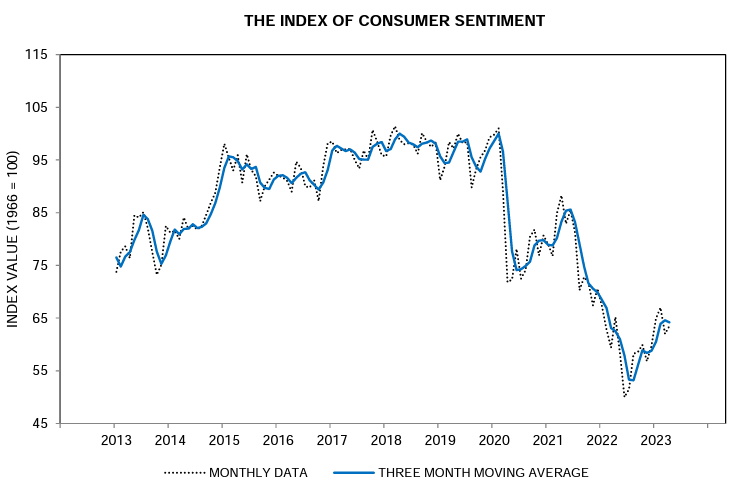

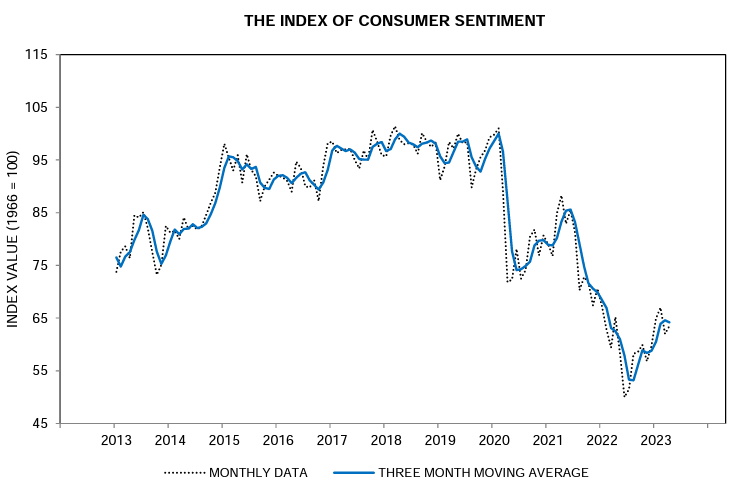

The University of Michigan’s Consumer Sentiment Index for April 2023 is 65.2, down from 67.2 in March. This is the lowest level since August 2011. The index’s decline was driven by a drop in all three of its components: current conditions, expectations, and buying plans.

The current conditions index fell to 70.7 from 73.2 in March. This suggests that consumers are feeling less optimistic about the current state of the economy. The expectations index fell to 64.7 from 68.1 in March. This suggests that consumers are less optimistic about the future of the economy. The buying plans index fell to 52.9 from 56.0 in March. This suggests that consumers are less likely to make major purchases in the near future.

A summary of headlines we are reading today:

- U.S. Sends Delegation To Saudi Arabia To Discuss Energy And Security

- U.S. Drilling Activity Slips Further

- Auto Manufacturers To Brace For Turmoil Amid Supply Chain Disruptions

- Oil Prices Rise As Traders Brush Off OPEC Demand Warnings

- Dow sheds more than 100 points Friday, but notches fourth straight positive week: Live updates

- Jamie Dimon issues warning on rates: ‘It will undress problems in the economy’

- Nvidia’s top A.I. chips are selling for more than $40,000 on eBay

- Recession Odds Jump As The Fed Crushes Consumers

- Market Extra: ‘Fed-is-going-to-stop-soon’ trade peters out in stocks, bonds amid prospect of at least one more rate hike

- Market Snapshot: U.S. stocks retreat from mid-February high as traders digest bank earnings, retail sales and Fed comments

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.