25 April 2023 Market Close & Major Financial Headlines: Wall Street Opened Lower, Continued To Trend Lower Finally Closing At Session Bottom as earnings, recession worries weigh

Summary Of the Markets Today:

- The Dow closed down 345 points or 1.02%,

- Nasdaq closed down 1.98%,

- S&P 500 closed down 1.58%,

- Gold $2,009 up $8.20,

- WTI crude oil settled at $77 down $1.67,

- 10-year U.S. Treasury 3.392% down 0.123 points,

- USD $101.86 up $0.520,

- Bitcoin $27,634 up $248,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for April 2023

Today’s Economic Releases:

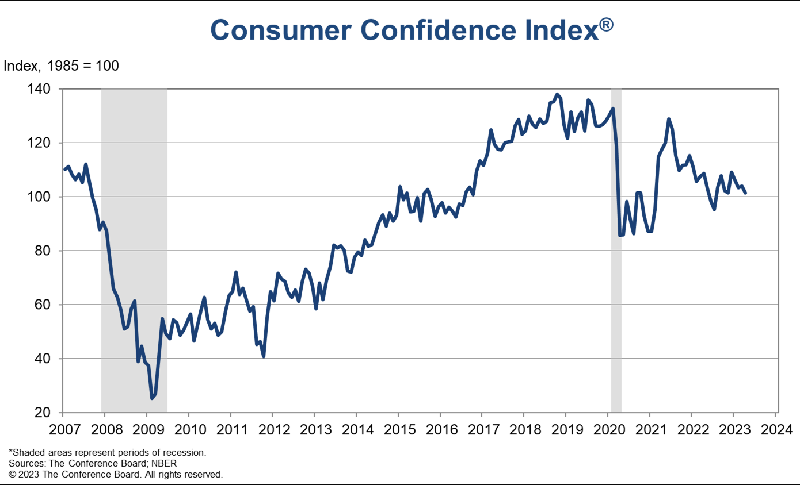

The Conference Board Consumer Confidence Index® fell in April to 101.3, down from 104.0 in March. This is the lowest reading since July 2022. The decline was driven by a darkening outlook that augers a recession beginning in the near future. The decline in consumer confidence was widespread, with all major demographic groups reporting lower readings in April. The biggest declines were among consumers under 55 years of age and for households earning $50,000 and over. The Federal Reserve is closely monitoring consumer confidence and other economic indicators. The decline was driven by a number of factors, including:

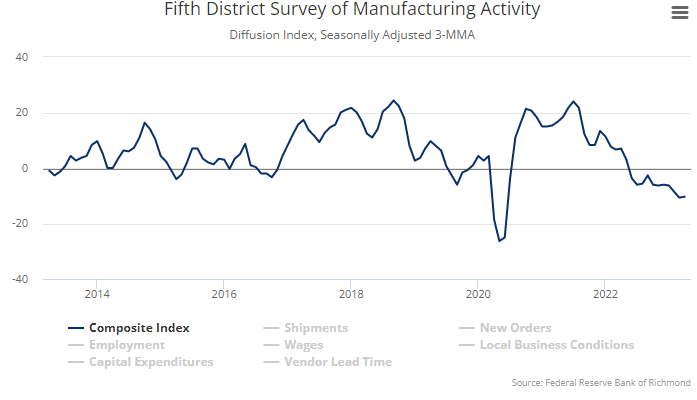

The Fifth District Manufacturing Report for April 2023 showed that manufacturing activity continued to contract in April. The headline index fell to -10 from -5 in March, and two of its three component indexes — shipments and new orders — declined.

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 2.0% annual gain in February, down from 3.7% in the previous month. The 10-City Composite annual increase came in at 0.4%, down from 2.5% in the previous month. The 20-City Composite posted a 0.4% year-over-year gain, down from 2.6% in the previous month. Miami, Tampa, and Atlanta again reported the highest year-over-year gains among the 20 cities in February.

The U.S. Census Bureau reported that sales of new single-family houses in the United States increased 9.6% to a seasonally adjusted annual rate of 683,000 in March 2023. This is 3.4% below the March 2022 estimate of 707,000. The median sales price of new houses sold in March 2023 was $449,800. The average sales price was $562,400. The seasonally‐adjusted estimate of new houses for sale at the end of March 2023 was 432,000. This represents a supply of 7.6 months at the current sales rate.

A summary of headlines we are reading today:

- More Banking Trouble Pushes Oil Prices Down Another 2%

- Nigeria Completes Gas Pipeline Without Chinese Funds

- Credit Suisse Reports Alarming Magnitude Of Losses And Outflows

- Halliburton Earnings Beat Estimates In Tight Oilfield Services Market

- U.S. Net Debt To Exceed 110% By 2028 As Decarbonization Costs Mount

- First Republic falls nearly 50% to a record low after reporting a massive deposit drop

- Stocks close lower Tuesday as investors’ bank fears return, Dow sheds more than 300 points: Live updates

- Alphabet earnings are out — here are the numbers

- Japanese ispace moon landing attempt falls short at ‘very end,’ CEO says

- Market Extra: What’s next for the stock market as small-cap index suffers its first ‘death cross’ since January 2022

- Movers & Shakers: First Republic stock tanks, UPS shares weaken, Spotify shares advance, and more stocks on the move

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.