26 NOV 2024 Market Close & Major Financial Headlines: The Dow And The S&P 500 Set New Historic Highs, But The S&P 500 Took A Steep Nosedive Ending Today’s Session Only Fractionally Higher In The Green

Summary Of the Markets Today:

- The Dow closed up 124 points or 0.28%, (Closed at 44,293, New Historic high 44,903)

- Nasdaq closed up 119 points or 0.63%,

- S&P 500 closed up 35 points or 0.57%, (Closed at 6,001, New Historic high 6,021)

- Gold $2,632 up $13.10 or 0.50%,

- WTI crude oil settled at $69 down $0.29 or 0.42%,

- 10-year U.S. Treasury 4.296 up 0.035 points or 0.821%,

- USD index $106.95 up $0.13 or 0.12%,

- Bitcoin $91,333 down $2,325 or 3.79%, (24 Hours)

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights

US stocks showed resilience on Tuesday despite President-elect Donald Trump’s threat to impose new tariffs on China, Canada, and Mexico. Both the Dow and S&P500 closed at record levels. Markets initially reacted negatively to Trump’s late Monday announcement of plans to implement significant tariffs on the US’s largest trading partners on his first day in office. This announcement reignited trade war concerns and dampened Wall Street’s expectations that Treasury Secretary nominee Scott Bessent would moderate any extreme actions by the new administration. Carmaker stocks, both domestic and international, experienced declines following Trump’s “America First” stance. The Mexican peso and Canadian dollar dropped sharply as the US dollar rallied. Investors also analyzed the minutes from the recent Federal Open Market Committee meeting, which indicated a preference for gradual interest rate cuts if the economy remains stable. Some officials noted that persistent inflation or a labor market downturn could lead to a pause in the easing cycle.

Click here to read our current Economic Forecast – November 2024 Economic Forecast: Our Index Marginally Declines – We Are Stuck With The Crappy Economy We Have Seen So Far This Year

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Sales of new single-family houses in October 2024 were 9.4% below October 2023. The median sales price of new houses sold in October 2024 was $437,300. The average sales price was $545,800. The seasonally-adjusted estimate of new houses for sale at the end of October was 481,000. This represents a supply of 9.5 months at the current sales rate. New home sales are declining due to high mortgage rates and high home prices.

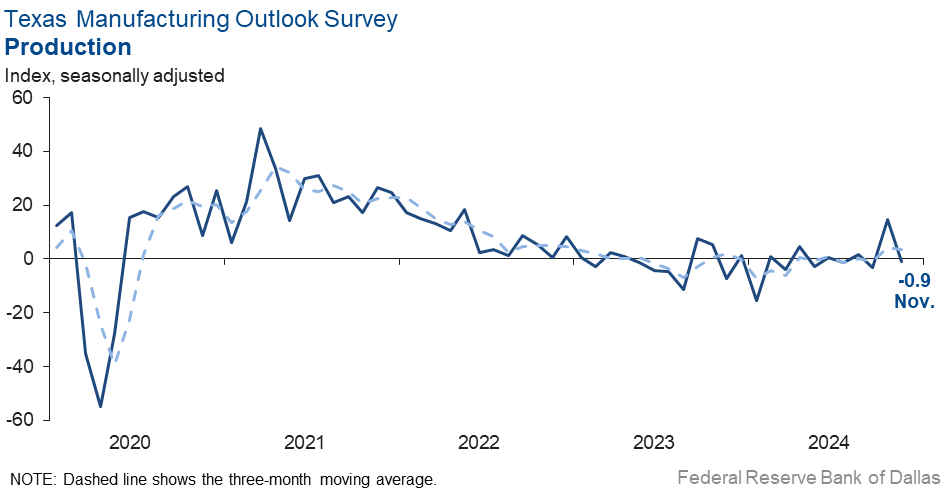

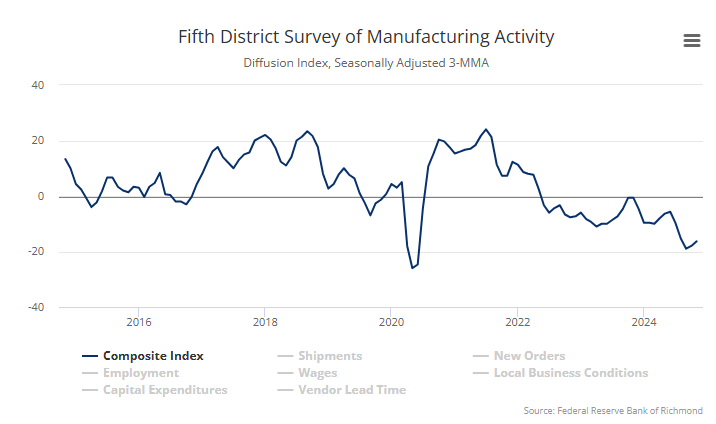

Richmond Fed manufacturing activity remained sluggish in November 2024. The composite manufacturing index remained at −14 in November. Of its three component indexes, shipments decreased from −8 to −12, new orders edged down from −17 to −19, and employment increased from −17 to −10. Manufacturing remains in a recession in the US.

The S&P CoreLogic Case-Shiller 20-City Composite posted a year-over-year increase of 4.6%, dropping from a 5.2% increase in the previous month. Home prices seem to be slightly moderating but home prices increasing do not make housing more affordable. I would expect further slowdown of existing home sales volumes.

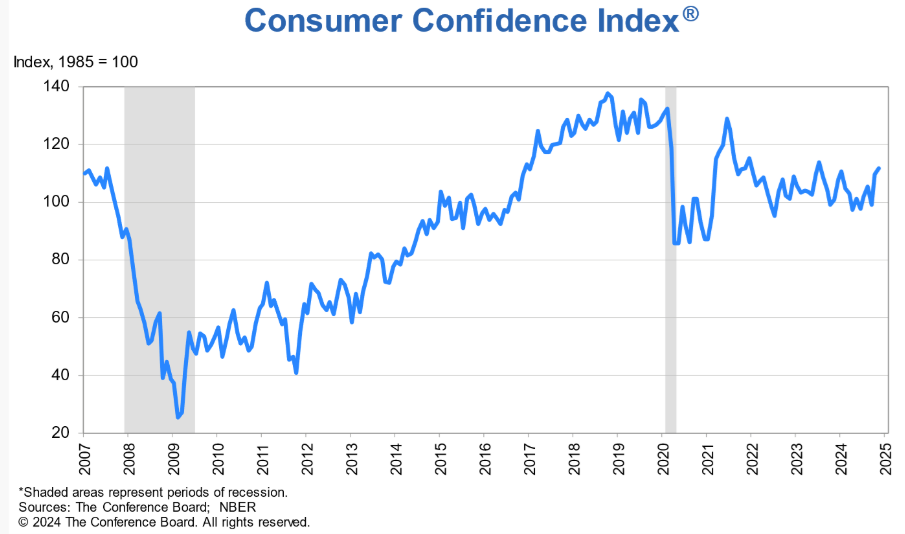

The Conference Board Consumer Confidence Index® increased in November 2024 to 111.7 (1985=100), up 2.1 points from 109.6 in October. Likely the results of the election pushed this OPINION index higher but I am not a fan of opinion. In the case of consumer confidence, it is generally believed that higher consumer confidence results in consumers spending more. Dana M. Peterson, Chief Economist at The Conference Board added:

Consumer confidence continued to improve in November and reached the top of the range that has prevailed over the past two years. November’s increase was mainly driven by more positive consumer assessments of the present situation, particularly regarding the labor market. Compared to October, consumers were also substantially more optimistic about future job availability, which reached its highest level in almost three years.

The Federal Reserve issued meeting minutes for the Federal Open Market Committee meeting on November 6–7, 2024. I did not find any surprises in the meeting minutes. The following are a summary of the participants’ observations and evaluations:

- Inflation has significantly decreased from its peak, although core inflation remains elevated. Most participants believe that inflation is on track to return sustainably to 2% despite expected month-to-month volatility. Disinflationary trends are evident across a broad range of core goods and services, with price increases now closer to historical stability rates. Participants noted increased consumer price sensitivity and reluctance from firms to raise prices.

- While housing service prices are still high, expectations are that these will slow as rent increases for new tenants stabilize.

- Recent data indicates solid labor market conditions, although temporary fluctuations have occurred due to strikes and natural disasters. Job vacancies and turnover rates are declining, suggesting easing labor demand. Nominal wage growth is decreasing, with job switchers facing a reduced wage premium. Participants noted that wage increases are unlikely to contribute to inflationary pressures in the near term. Businesses are becoming more selective in hiring due to a larger pool of qualified applicants willing to accept moderate wages.

- Economic activity remains strong, supported by a robust labor market and rising household wealth. However, low-income households face financial strains, which could impact their spending behavior.

- Favorable supply developments continue to support business expansion. However, there is uncertainty regarding the sustainability of recent productivity gains attributed to various factors including technology integration.

- Participants agreed to lower the federal funds rate target range by 25 basis points to 4.5%-4.75%. This adjustment aims to sustain economic strength while progressing toward inflation goals. Future monetary policy decisions will depend on economic data trends and risks associated with employment and inflation goals. Participants emphasized the need for a balanced approach in adjusting policies based on evolving economic conditions.

- Participants noted vulnerabilities in the financial system, particularly concerning commercial real estate (CRE) and potential risks from unrealized losses on bank assets. Cyber risks and rising delinquency rates among low-income households were also highlighted as areas needing close monitoring.

Here is a summary of headlines we are reading today:

- Don’t Underestimate Trump’s Impact on U.S. LNG

- U.S. Gas Drillers Saddle Up for Data Center-Fueled Demand Ride

- U.S. Oil Output Hits Record High in August

- Exxon: Don’t Expect ‘Drill, Baby, Drill’ Under Trump

- China Set to Import Record-High Volume of Coal in November

- Fed officials see interest rate cuts ahead, but only ‘gradually,’ meeting minutes show

- Israel-Lebanon permanent ceasefire has been accepted, Biden says

- Stocks rise Tuesday, Dow and S&P 500 close at records: Live updates

- Small caps historically outperform even the Santa Claus rally, starting before Thanksgiving

- Senate report slams airlines for raking in billions in seat fees

- Bitcoin drops to $91,000 level as crypto markets slump: CNBC Crypto World

- FOMC Minutes Show “Many” Members Suddenly Favor More Gradual Rate-Cutting-Cycle

- 10-year Treasury yield logs biggest gain in 2 weeks after Fed minutes point to slower rate cuts

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.