Summary Of the Markets Today:

- The Dow closed up 86 points or 0.25%,

- Nasdaq closed up 1.15%,

- S&P 500 closed up 0.74%,

- Gold $1,964 up $26.90,

- WTI crude oil settled at $76 up $1.15,

- 10-year U.S. Treasury 3.867% down 0.115 points,

- USD Index $100.55 down $1.19,

- Bitcoin $30,288 down $300,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

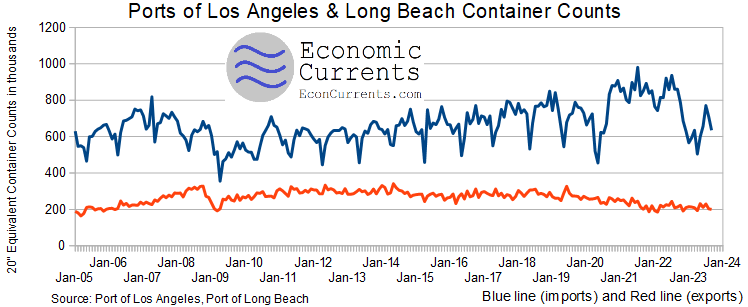

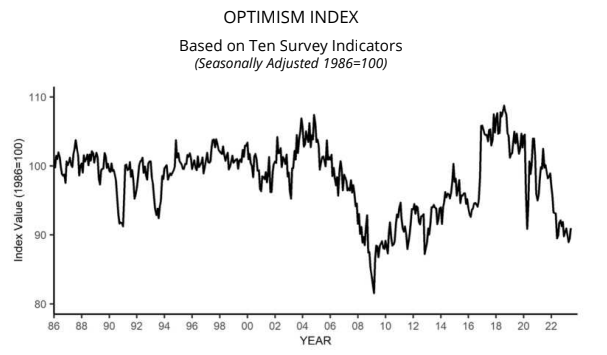

The Consumer Price Index for All Urban Consumers (CPI-U) rose 3.0% over the last 12 months. The all items less food and energy index rose 4.8% over the last 12 months. The index for shelter was the largest contributor to the monthly all-items increase, accounting for over 70% of the increase, with the index for motor vehicle insurance also contributing. This data was better than expectations which were 3.1% year-over-year for the all-items index and 5.0% for the all-items less food and energy. The federal funds rate is now slightly above both the all-items and all items less food and energy. I believe the federal funds rate must be higher than the inflation rate to begin a more permanent moderation of inflation. The future issues remain energy (which is currently in another up cycle) and labor costs (labor costs are currently growing well above the federal funds rate).

According to the July 12, 2023 Beige Book:

Overall economic activity increased slightly since late May. Five Districts reported slight or modest growth, five noted no change, and two reported slight and modest declines. Reports on consumer spending were mixed; growth was generally observed in consumer services, but some retailers noted shifts away from discretionary spending. Tourism and travel activity was robust, and hospitality contacts expected a busy summer season. Auto sales remained unchanged or exhibited moderate growth across most Districts. Manufacturing activity edged up in half of the Districts and declined in the other half. Transportation activity was down or flat in most Districts that reported on it, as some contacts reported reduced demand due to high inventory levels and others noted continued challenges from labor shortages. Banking conditions were mostly subdued, as lending activity continued to soften. Despite higher mortgage rates, demand for residential real estate remained steady, although sales were constrained by low inventories. Construction for both residential and commercial units was slightly lower on balance. Agricultural conditions were mixed geographically but softened slightly on balance, with some contacts expecting further softening for the remainder of 2023. Energy activity decreased. Overall economic expectations for the coming months generally continued to call for slow growth.

Here is a summary of headlines we are reading today:

- Ecuador’s Energy Imports Exceed Exports For First Time In 50 Years

- Coal-Addicted South Africa Unlikely To Hit Renewables Targets

- Brent Oil Price Rises Above $80 Per Barrel As Supply Tightens

- Toyota: Explosive Growth In EV Production Could Spark Mineral Shortage

- Heatwave Forces French Nuclear Power Plants To Curb Output

- Inflation rose just 0.2% in June, less than expected as consumers get a break from price increases

- S&P 500, Nasdaq close at highest levels since April 2022, buoyed by cooler-than-expected inflation report: Live updates

- Amazon’s Prime Day off to a strong start, early data shows

- US inflation rises at slowest pace in two years

- Futures Movers: Oil prices settle at highest since late April, buoyed by a weaker dollar and supply cuts

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

![]()