17 July 2023 Market Close & Major Financial Headlines: Markets Opened Mixed, Trended Higher Closing Near Session Highs For Sixth Straight Session

Summary Of the Markets Today:

- The Dow closed up 76 points or 0.22%,

- Nasdaq closed up 0.93%,

- S&P 500 closed up 0.39%,

- Gold $1,959 down $5.90,

- WTI crude oil settled at $74 down $1.33,

- 10-year U.S. Treasury 3.807% down 0.013 points,

- USD Index $99.85 up $0.07,

- Bitcoin $29,954 down $335,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for July 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

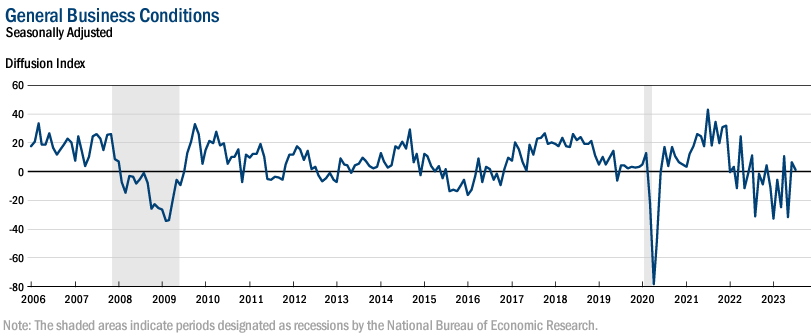

Empire State Manufacturing Survey fell six points to 1.1. New orders inched up and shipments expanded. Delivery times shortened and inventories continued to decline. Employment levels edged higher, though the average workweek was little changed. Input and selling price increases continued to moderate. Some pundits are making a big deal that this index remained in positive territory but overall manufacturing remains in a recession.

Here is a summary of headlines we are reading today:

- Unpacking Ukraine’s Gains And Losses At The NATO Summit

- Rising Seas, Rising Rates: The Impact Of Climate Change On Insurance

- Gasoline Prices Inch Up As Crude Soars

- Wheat Prices Soar As Russia Suspends Black Sea Grain Deal

- China’s Q2 Miss Sends Shivers Through Oil And Equities Markets

- Oil Demand Jumped By 3 Million Bpd In May To Near-Record Levels

- Dow rises for sixth straight day, closes at highest level in 2023: Live updates

- Solar and wind are set to produce a third of global electricity in 7 years. How to invest behind it

- Cotton: Secret Service Didn’t Even Talk To Hunter Biden About White House Cocaine

- Market Snapshot: Dow up 100 points, stocks set to extend last week’s gains ahead of busy week of earnings

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

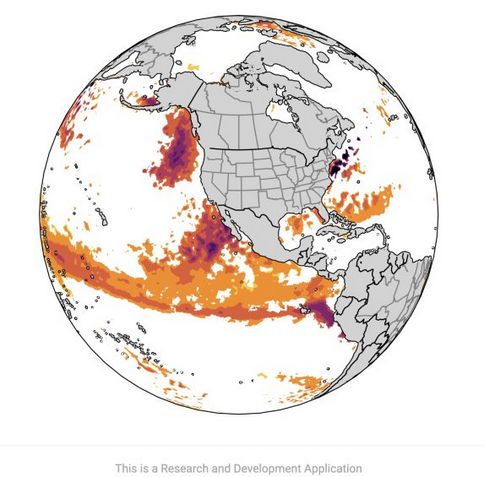

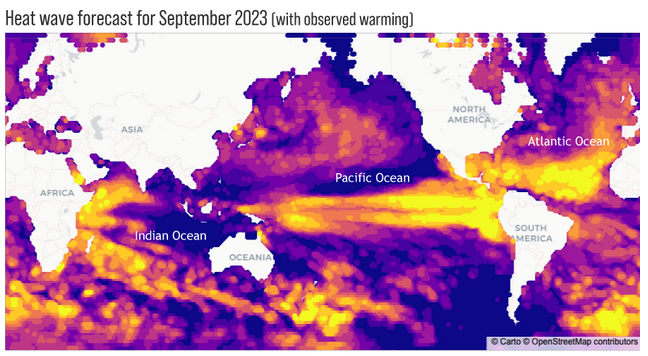

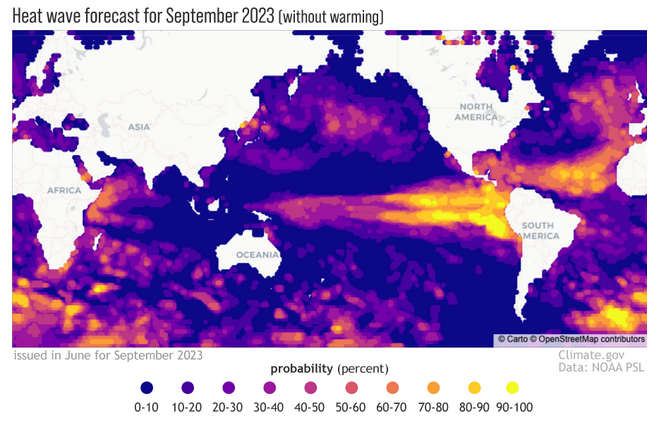

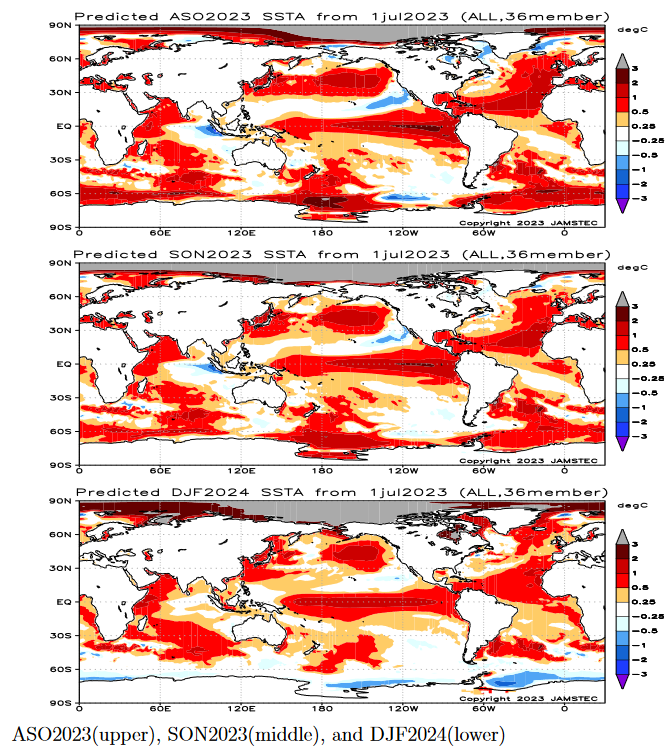

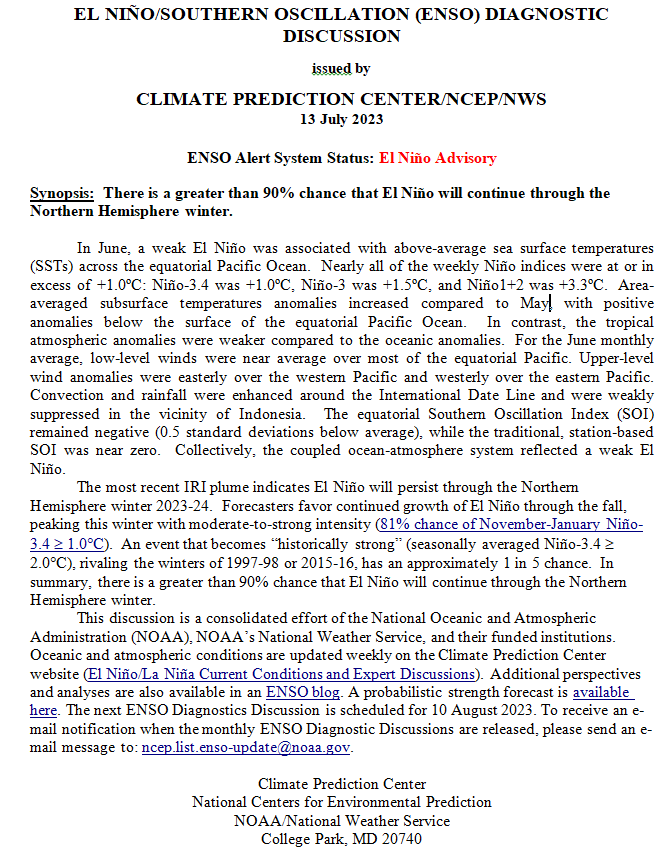

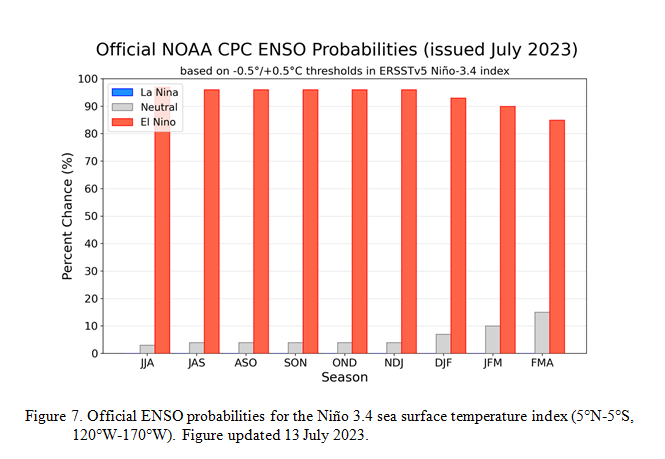

This is a somewhat confusing post that appeared in the NOAA Climate Blog which is intended to be informative and also announce a new NOAA website which you can access

This is a somewhat confusing post that appeared in the NOAA Climate Blog which is intended to be informative and also announce a new NOAA website which you can access