Summary Of the Markets Today:

- The Dow closed up 164 points or 0.47%,

- Nasdaq closed down 2.05%,

- S&P 500 closed down 0.68%,

- Gold $1,973 down $7.90,

- WTI crude oil settled at $76 up $0.28,

- 10-year U.S. Treasury 3.848% up 0.106 points,

- USD Index $100.82 up $0.54,

- Bitcoin $29,745 down $310,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

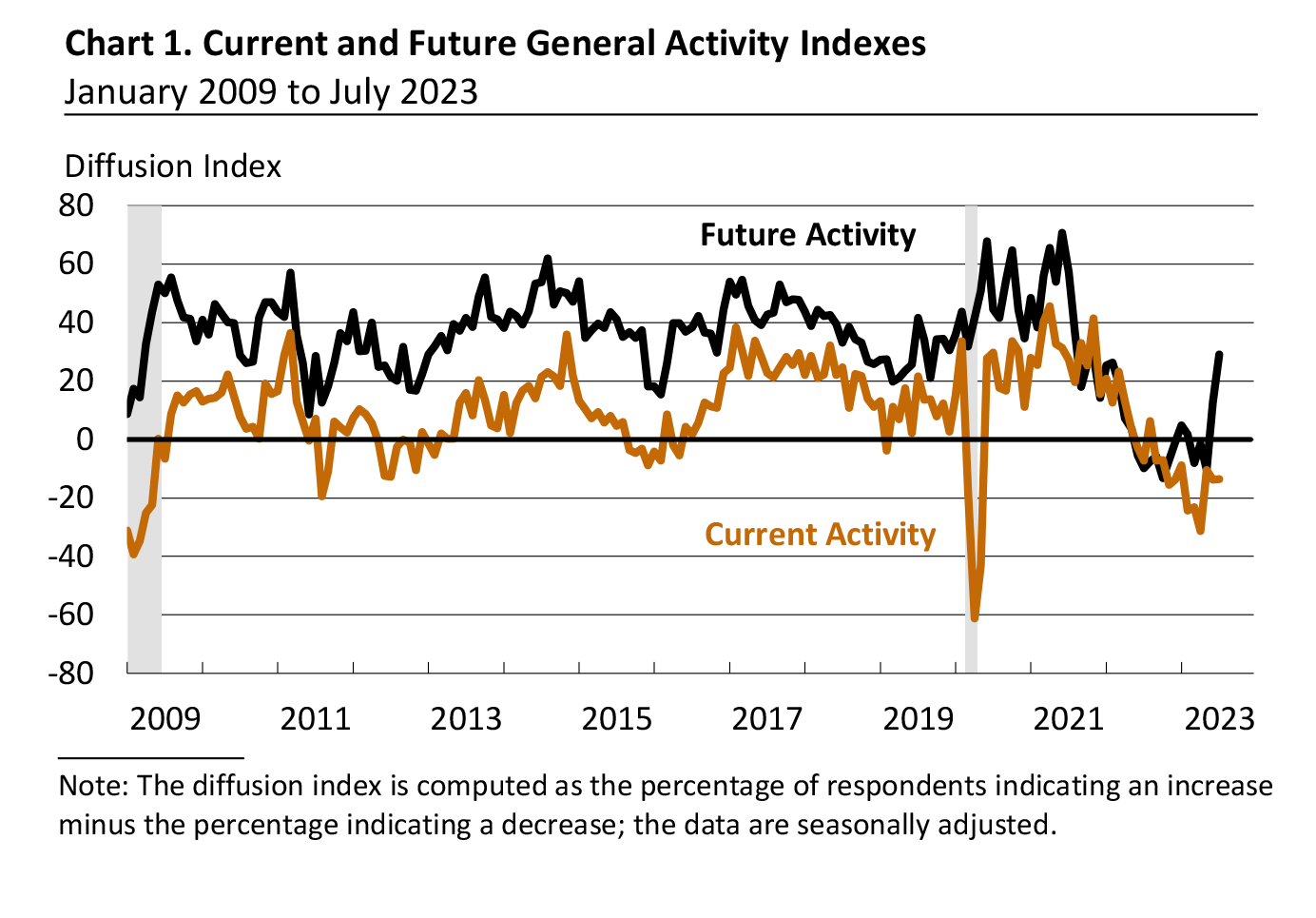

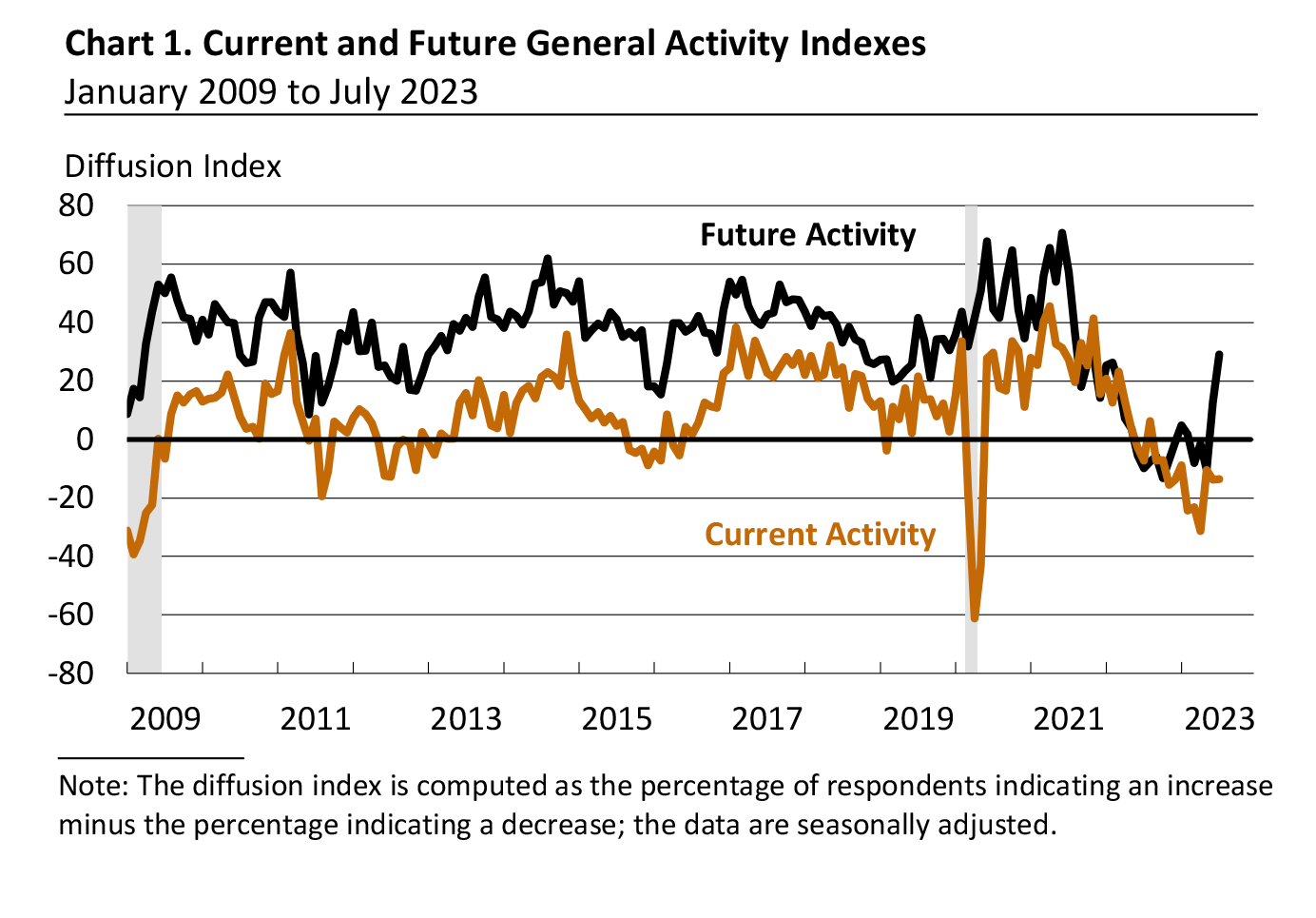

The Philly Fed July 2023 Manufacturing Business Outlook Survey was little changed at a reading of -13.5, its 11th consecutive negative reading. The survey’s indicators for general activity and new orders remained negative. Furthermore, the index for shipments declined and turned negative. The employment index suggests mostly steady employment overall. The prices paid index remained below its long-run average, while the prices received index rose. Most future indicators improved, suggesting more widespread expectations for overall growth over the next six months. The manufacturing sector remains in a recession.

Total existing-home sales fell 18.9% year-over-year. The median existing-home price3 for all housing types in June was $410,200, the second-highest price of all time and down 0.9% from the record-high of $413,800 in June 2022. NAR Chief Economist Lawrence Yun stated:

The first half of the year was a downer for sure with sales lower by 23%. Fewer Americans were on the move despite the usual life-changing circumstances. The pent-up demand will surely be realized soon, especially if mortgage rates and inventory move favorably.

In the week ending July 15, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 237,500, a decrease of 9,250 from the previous week’s unrevised average of 246,750.

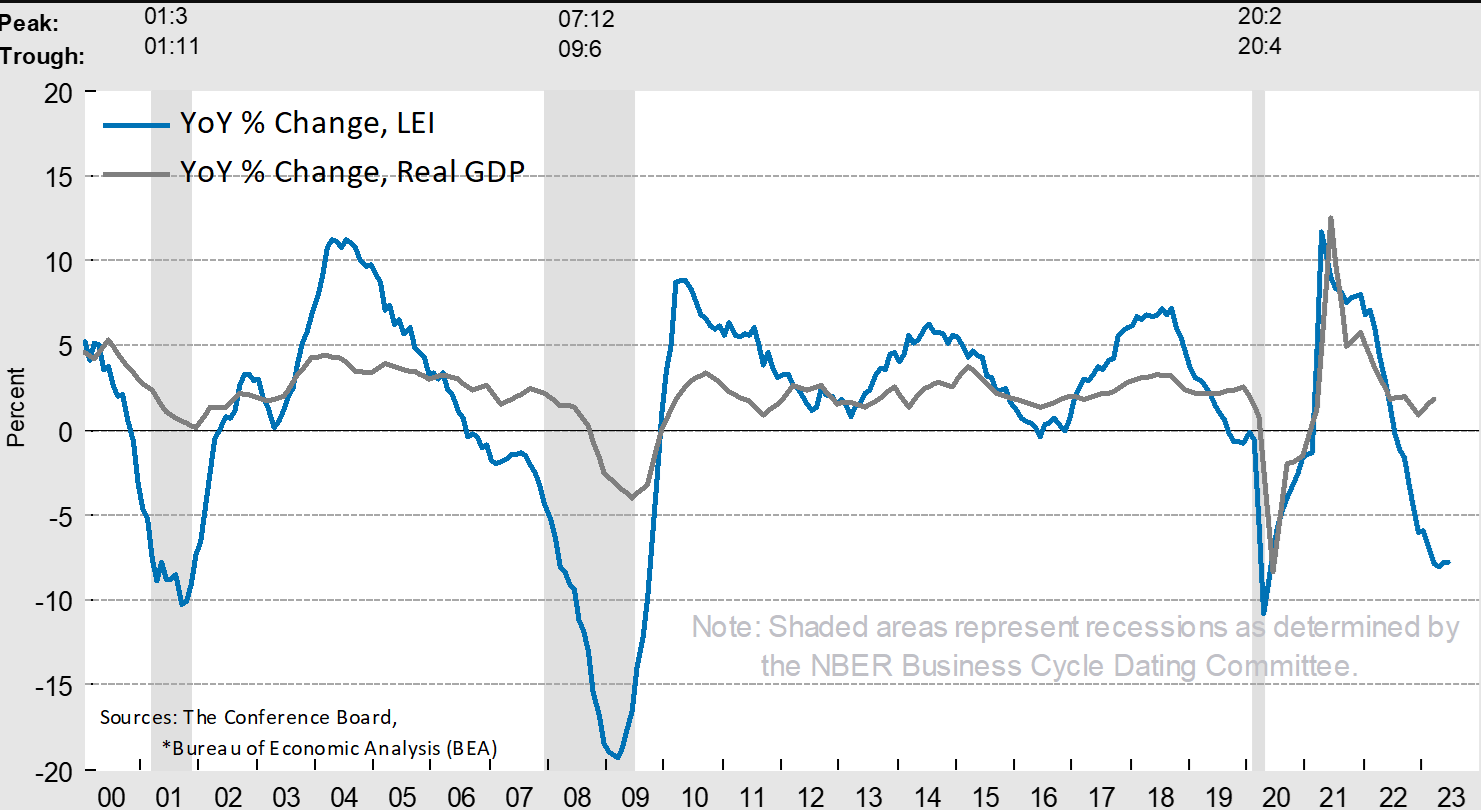

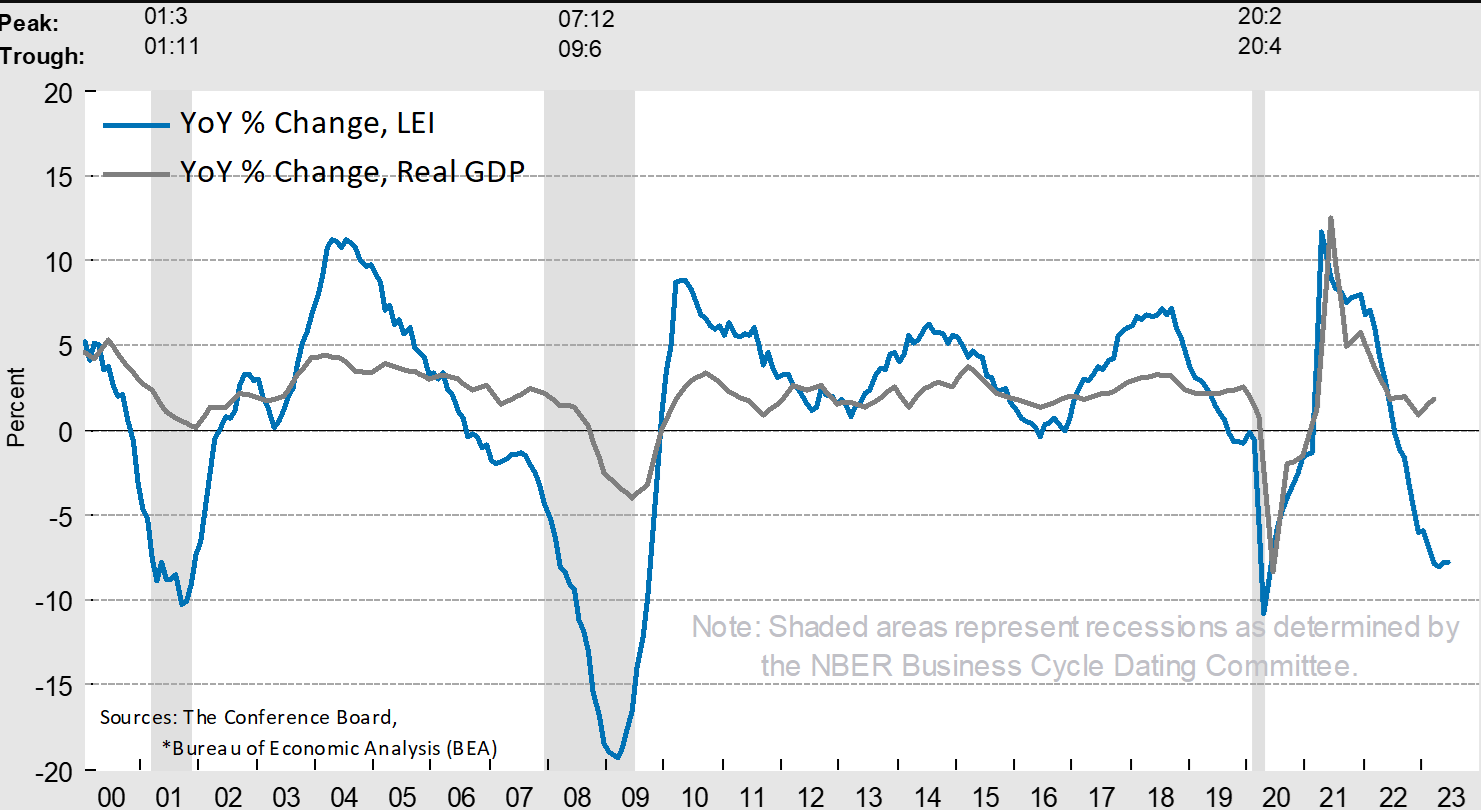

The Conference Board Leading Economic Index® (LEI) for the U.S. declined by 0.7 percent in June 2023 to 106.1 (2016=100), following a decline of 0.6 percent in May. The LEI is down 4.2 percent over the six-month period between December 2022 and June 2023—a steeper rate of decline than its 3.8 percent contraction over the previous six months (June to December 2022). Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board added:

The US LEI fell again in June, fueled by gloomier consumer expectations, weaker new orders, an increased number of initial claims for unemployment, and a reduction in housing construction. The Leading Index has been in decline for fifteen months—the longest streak of consecutive decreases since 2007-08, during the runup to the Great Recession. Taken together, June’s data suggests economic activity will continue to decelerate in the months ahead. We forecast that the US economy is likely to be in recession from Q3 2023 to Q1 2024. Elevated prices, tighter monetary policy, harder-to-get credit, and reduced government spending are poised to dampen economic growth further.

Here is a summary of headlines we are reading today:

- Russia Recycling Used Cooking Oil To Make Marine Fuel

- New EV Innovations Put A Dent In Copper Demand

- European Warehouses Are Overflowing With Chinese Solar Panels

- California Consumes Nearly All Renewable Diesel In The U.S.

- Heatwave Shows That Biden’s Better Grid Initiative Is Woefully Underfunded

- Tesla shares down on slimming margins, Cybertruck concerns

- Netflix stock sinks as Wall Street looks for clarity on revenue growth

- AMC drops plan to charge more for better seats at the movies

- June home sales drop to the slowest pace in 14 years as short supply chokes the market

- Futures Movers: Oil prices finish higher with traders’ attention ‘shifting between demand and supply’

- The Tell: Why U.S. economy is heading to a soft landing, and its stocks may be a better bet than those in China and Europe, says Goldman Sachs

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.