04 Aug 2023 Market Close & Major Financial Headlines: Jobs Report Sent The Dow Up 175 Points, But Tripped While Celebrating And Closed Down Over 150 points

Summary Of the Markets Today:

- The Dow closed down 150 points or 0.43%,

- Nasdaq closed down 0.36%,

- S&P 500 closed down 0.53%,

- Gold $1,977 up $7.70,

- WTI crude oil settled at $83 up $1.07,

- 10-year U.S. Treasury 4.050% down 0.139 points,

- USD Index $102.04 down $0.50,

- Bitcoin $28,984 down $308,

- Baker Hughes Rig Count: U.S. -5 to 659 Canada -5 to 188

*Stock data, cryptocurrency, and commodity prices at the market closing.

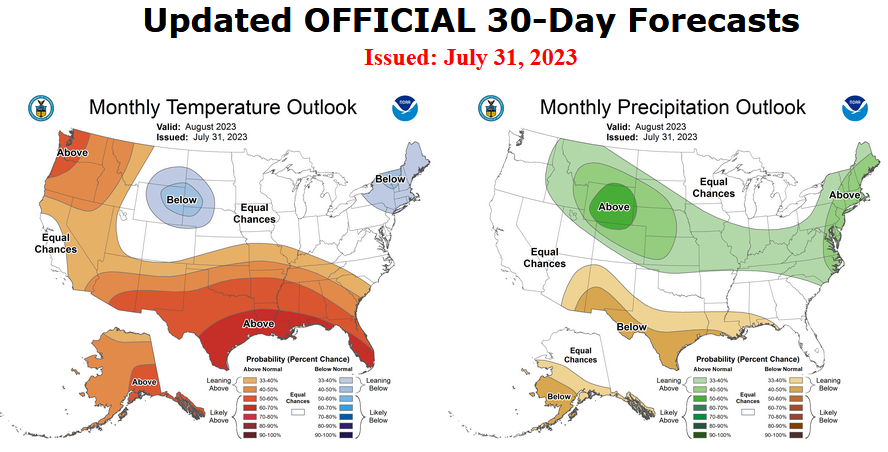

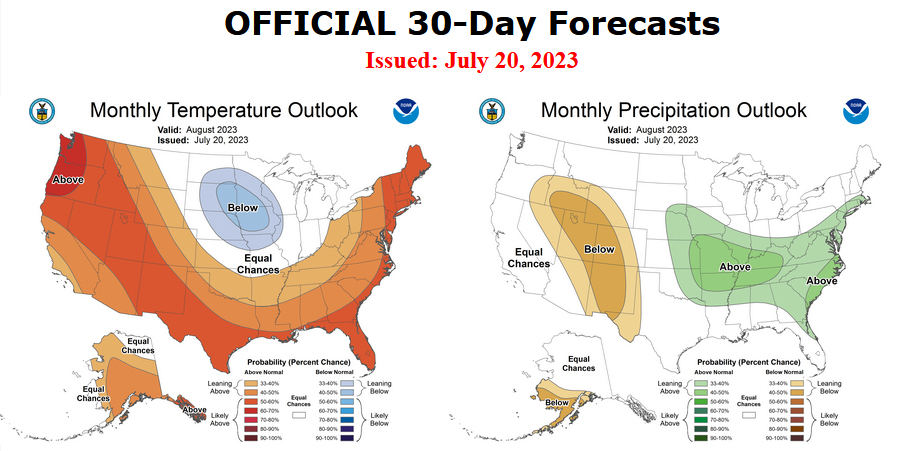

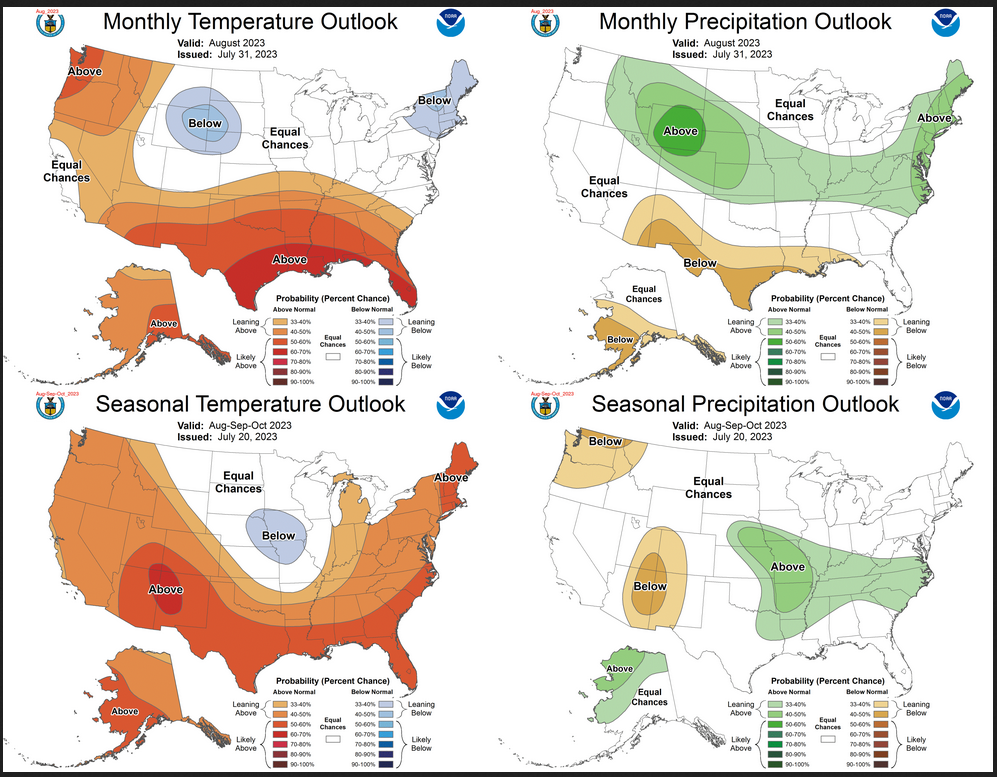

Click here to read our Economic Forecast for August 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

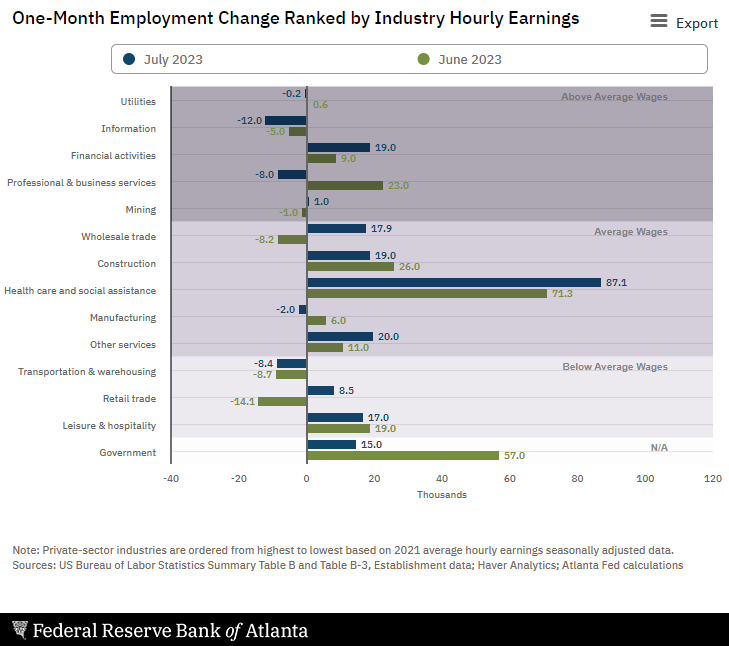

Total nonfarm payroll employment rose by 187,000 in July 2023, and the unemployment rate changed little at 3.5%. The employment gains show a continued cooling of the jobs sector – but still not bad. The household survey shows employment gains of 268,000 against the establishment survey’s 187,000. Health care growth accounted for nearly half of the gains. The leisure and hospitality sector has really cooled off and shows only 17,000 gains.

Here is a summary of headlines we are reading today:

- OPEC’s Production Drops More Than 1 Million Bpd In July: Argus

- Oil Products Accounted For 57% Of 2021 U.S. Energy Expenditure

- Oil Prices Continue To Climb As Pace Of Drilling Continues To Slow

- Amazon stock rallies after blowout quarter

- JPMorgan backs off recession call even with ‘very elevated’ risks

- S&P 500 and Nasdaq tumble for four straight days, both notch worst weeks since March: Live updates

- Here’s where the jobs are for July 2023 — in one chart

- US jobs market holds steady despite rate rises

- Inflation among top 10 factors affecting fixed income market

- Market Snapshot: Stocks turn lower, S&P 500 heads for fourth straight day of losses

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.