28Sep2023 Market Close & Major Financial Headlines: An Up Day For The Markets With Oil Prices Moderating

Summary Of the Markets Today:

- The Dow closed up 116 points or 0.35%,

- Nasdaq closed up 0.83%,

- S&P 500 closed up 0.59%,

- Gold $1884 down $7.40,

- WTI crude oil settled at $92 down $1.93,

- 10-year U.S. Treasury 4.557% down 0.049 points,

- USD index $106.16 up $0.50,

- Bitcoin $27,132 up $775

Click here to read our Economic Forecast for September 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

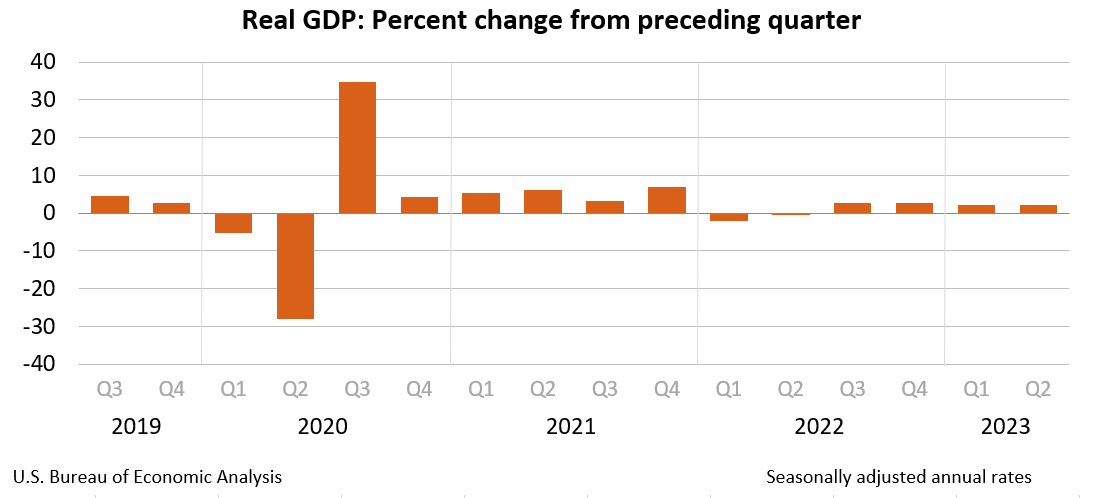

The third estimate of 2Q2023 real gross domestic product (GDP) was unchanged showing GDP grew at an annual rate of 2.1%. In the first quarter, real GDP increased 2.2% (revised). The third estimate primarily reflected a downward revision to consumer spending that was partly offset by upward revisions to nonresidential fixed investment, exports, and inventory investment. Imports, which are a subtraction in the calculation of GDP, were revised down. There was also no change to the PCE price index which is 2.5%.

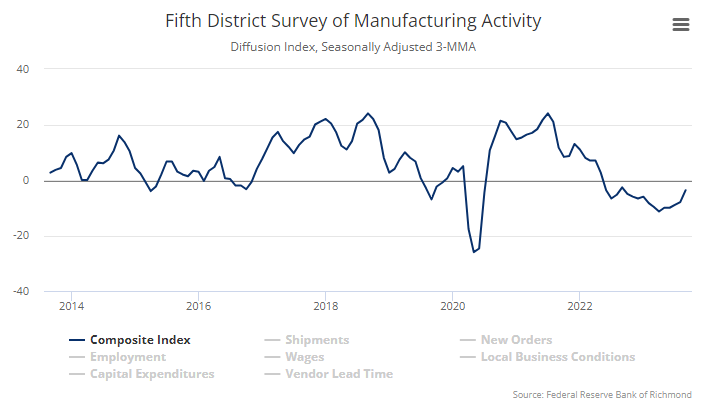

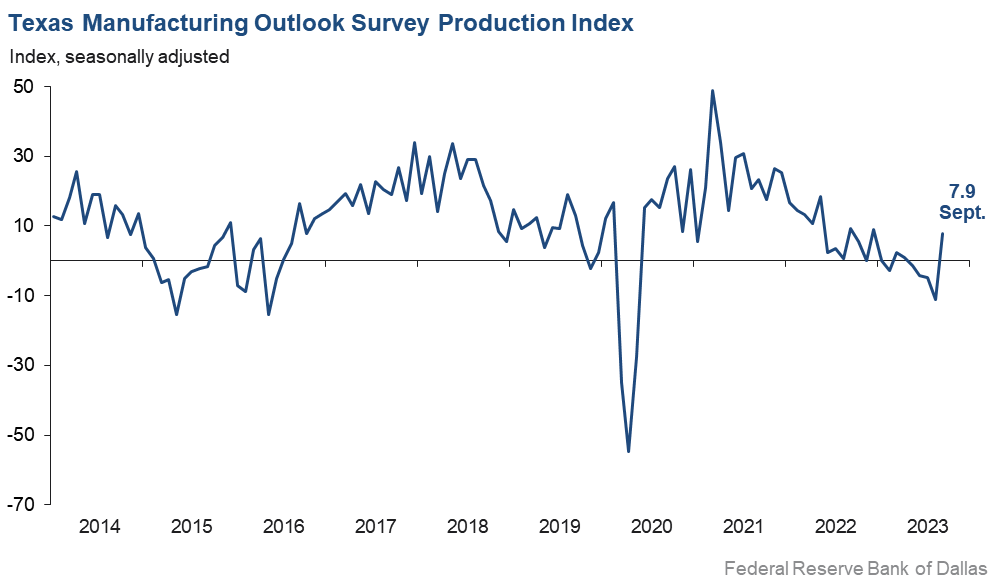

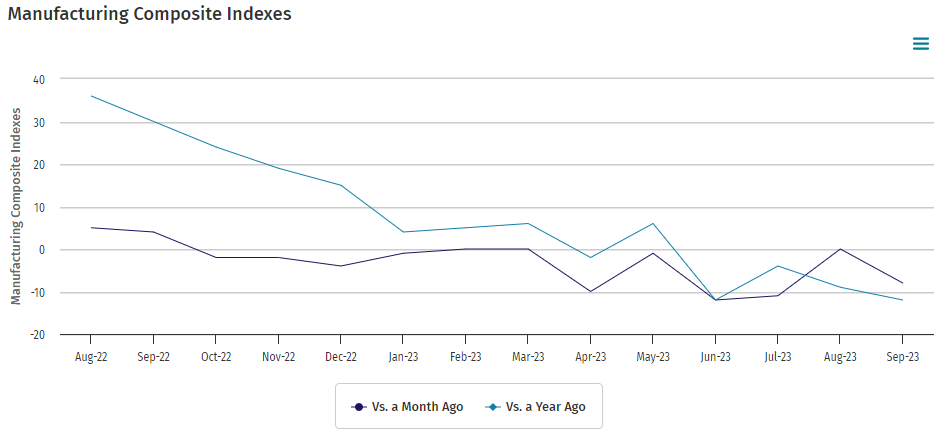

The Kansas City Fed’s manufacturing activity declined somewhat in September 2023. The month-over-month composite index was -8 in September, down from 0 in August and up slightly from -11 in July. The decline from last month was primarily driven by decreases in durable goods, particularly metal manufacturing.

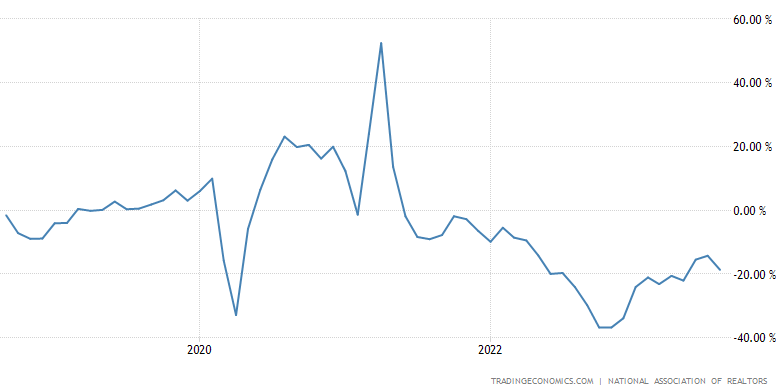

The National Association of REALTORS Pending home sales slid 7.1% in August 2023. A sale is listed as pending when the contract has been signed but the transaction has not closed. All four U.S. regions posted monthly losses and year-over-year declines in transactions. This decline is significant as year-over-year sales are down 18.7% – the existing home sales have collapsed. Lawrence Yun, NAR chief economist stated:

Mortgage rates have been rising above 7% since August, which has diminished the pool of home buyers. Some would-be home buyers are taking a pause and readjusting their expectations about the location and type of home to better fit their budgets.

United States Pending Home Sales YoY

In the week ending September 23, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 211,000, a decrease of 6,250 from the previous week’s revised average. The previous week’s average was revised up by 250 from 217,000 to 217,250.

CoreLogic’s monthly Loan Performance Insights Report for July 2023 shows 2.7% of all mortgages in the U.S. were in some stage of delinquency (30 days or more past due, including those in foreclosure), representing a 0.3 percentage point decrease compared with 3% in July 2022 and a 0.1% increase from June 2023. CoreLogic projects that home price growth will pick up over the next year. There is no indication of stress in home loan performance.

Here is a summary of headlines we are reading today:

- Oil Prices Fall After 2-Day Rise

- Revolutionary Nickel-Gold Thermoelectric Surpasses Semiconductors

- U.S. Says Chinese Minerals Control Will Make Energy Security More Complex

- China’s Latest Move Could Further Raise Global Diesel Prices

- EIA Cuts U.S. Hydropower Generation Forecast By 6% For 2023

- Saudi Arabia May Start Unwinding Its Production Cuts Sooner Than Expected

- History shows a September stock sell-off typically begets a fourth-quarter rally

- New Orleans residents brace for salt water intrusion as Biden declares national emergency

- California School District Considers Removing Honors Courses For Sake Of “Equity”

- Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.