Summary Of the Markets Today:

- The Dow closed down 220 points or 0.65%,

- Nasdaq closed down 0.94%,

- S&P 500 closed down 0.81%, High 4,319: 4,200 = critical resistance level)

- Gold $1,964 up $5.70,

- WTI crude oil settled at $76 up $0.26,

- 10-year U.S. Treasury 4.634% up 0.126 points,

- USD Index $105.95 up $0.350,

- Bitcoin $36,560 up 2.64%,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

In the week ending November 4, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 212,250, an increase of 1,500 from the previous week’s revised average. The previous week’s average was revised up by 750 from 210,000 to 210,750.

Retailers approach October cautiously, but optimistically,

adding 147,800 positions, a 3% increase from the 143,700 added in October 2022. Meanwhile, Transportation and Warehousing companies added 27% fewer workers in October than the same month last year, according to a new analysis of non-seasonally adjusted data from the Bureau of Labor Statistics by global outplacement and executive coaching firm Challenger, Gray & Christmas, Inc. Andrew Challenger, workplace and labor expert and Senior Vice President of global outplacement added:

Retailers are ramping up for the holiday season, and no doubt monitoring conditions to determine staffing ahead of the December holidays. As consumers continue to spend and interest rates hold, Retailers may be expecting solid sales and in-store foot traffic heading into Black Friday.

Here is a summary of headlines we are reading today:

- Still On The Auction Block, Citgo Sees 19% Jump In Q3 Net Profit

- Egypt Can’t Ramp Up LNG Supply To Europe Due To The Hamas-Israel War

- Saudi Arabia’s Energy Minister Blames Speculators For Oil Price Plunge

- Shell Sues Greenpeace For Boarding Oil Production Vessel

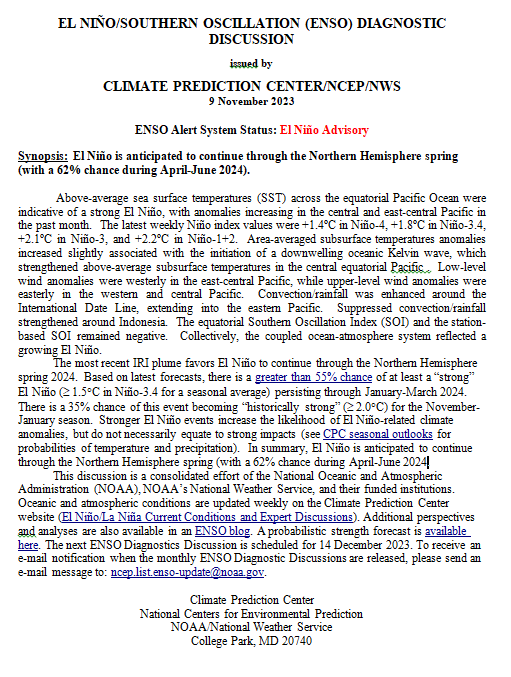

- Powell says Fed is ‘not confident’ it has done enough to bring inflation down

- S&P 500 snaps 8-day winning streak, Dow closes 200 points lower as bond yields rise: Live updates

- IRS announces new income tax brackets for 2024

- SEC chair Gary Gensler says an FTX reboot could happen if it follows the law: CNBC Crypto World

- Stocks Tumble, Yield Surge After Catastrophic 30Y Auction Stops With Biggest Tail On Record As Foreign Demand Craters

- TaxWatch: Standard deductions for 2024 taxes will jump 5.4% due to inflation, IRS numbers show

- Futures Movers: Oil ends higher after 2-day drop to nearly 4-month lows

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.