23 July 2024 Market Close & Major Financial Headlines: Markets Opened Fractionally Lower, Then Traded Back And Forth Across The Unchanged Line Finally Closing About Where They Opened

Summary Of the Markets Today:

- The Dow closed down 57 points or 0.14%,

- Nasdaq closed down 0.06%,

- S&P 500 closed down 0.16%,

- Gold $2,410 up $15.10,

- WTI crude oil settled at $77 down $1.04,

- 10-year U.S. Treasury 4.251 down 0.008 points,

- USD index $104.47 up $0.15,

- Bitcoin $65,662 down $1,896 or 2.81%,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – July 2024 Economic Forecast: One Recession Flag Removed But Little Indication The Economy Is Strengthening

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

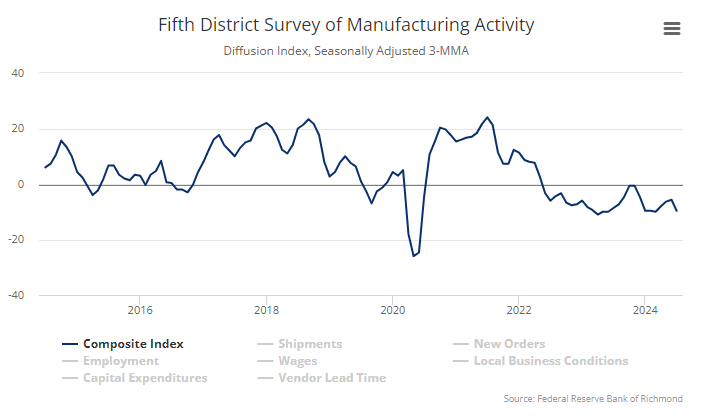

Richmond Fed manufacturing activity worsened in July 2024 with the composite manufacturing index decreasing from −10 in June to −17 in July. Of its three component indexes, shipments fell notably from −9 to −21, new orders decreased from −16 to −23, and employment edged down from −2 to −5. No matter how you cut it, manufacturing is not doing well in the U.S.

Existing-home sales faded 5.4% year-over-year in June 2024 . The median existing-home sales price grew 4.1% from June 2023 to $426,900. The inventory of unsold existing homes rose 3.1% from the previous month – the equivalent of 4.1 months’ supply at the current monthly sales pace. With the high mortgage rates, I see little ability of the lower segment of the middle class to buy a home. NAR Chief Economist Lawrence Yun’s view:

We’re seeing a slow shift from a seller’s market to a buyer’s market. Homes are sitting on the market a bit longer, and sellers are receiving fewer offers. More buyers are insisting on home inspections and appraisals, and inventory is definitively rising on a national basis.

Here is a summary of headlines we are reading today:

- U.S. Electricity Prices Surge Amid Grid Strains and Rising Demand

- Luxury Car Maker Rolls-Royce Posts Strong Results Despite Economic Challenges

- Algorithms Push Oil Prices to Five-Week Low

- Artificial Intelligence Is Sparking a Copper Boom in Zambia

- Porsche Shares Slide as Sportscar Maker Slashes Revenue Forecast

- Oil Sinks as Signs of Tepid Crude Demand in Asia Multiply

- U.S. Commands Higher Prices for Crude Amid Growing Global Oil Market Influence

- Major Automakers Returning to Gasoline Cars as EV Demand Slows

- June home sales slump, pointing to a buyer’s market as supply increases

- Stocks close slightly lower as Wall Street gears up for major tech earnings: Live updates

- UPS shares fall 12%, post worst day on record after earnings miss and guidance cut

- GM shares sink 7% despite second-quarter beat as Wall Street fears ‘good times won’t last’

- ‘Worst Since COVID Lockdowns’ – Regional Fed Surveys Plunged In July

- Treasury yields slip from 2-week highs after Harris gets enough support to be likely Democratic nominee

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.