11May2022 Market Close & Major Financial Headlines: Wall Street Falls In Volatile Trading After Hot Inflation Report Of 8.3%, Cryptos Continue To Slip, Investors Fear Of An Economic Slowdown Accelerates

Summary Of the Markets Today

- The Dow closed down 1.02% -327,

- Nasdaq closed down 3.18%,

- S&P 500 closed down 1.65%,

- WTI crude oil settled at 105.33, up 6.03%

- USD $103. up 0.02%

- Gold 1854, up 0.02%,

- Bitcoin down 2.5% to $29,113,

- 10-year U.S. Treasury down -0.07% / 2.923%

Today’s Economic Releases

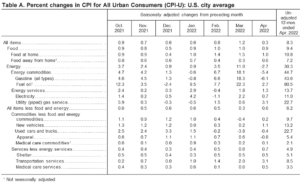

The Consumer Price Index (CPI) for April 2022 shows year-over-year inflation moderated from 8.5% to 8.3%.

A summary of headlines we are reading today:

- Kyiv Halts Russian Gas Shipments Through Key Hub

- Southwest is upgrading its planes with faster Wi-Fi, bigger overhead bins and new drinks to woo travelers

- Toyota warns ‘unprecedented’ raw materials costs could cut profits by 20%

- Major Trucking Firms Prepare For “Imminent Diesel Shortage In Eastern Half Of US”

- Does the cryptocurrency crash pose a threat to the financial system?

- Market Extra: What’s next for markets after inflation data fails to deliver ‘watershed moment’

These and other headlines and news summaries moving the markets today are included below.