11July2022 Market Close & Major Financial Headlines: Wall Street Moved Lower As Labor Market Reality-Check Sends Stocks, Bond Yields Tumbling

Summary Of the Markets Today:

- The Dow closed down 164 points or 0.52%,

- Nasdaq closed down 2.26%,

- S&P 500 down 1.15%,

- WTI crude oil settled at 104 down 1.05%,

- USD $108.14 up 1.07%,

- Gold $1731 flat 0.00%,

- Bitcoin $20469 down 1.69% – Session Low 20293,

- 10-year U.S. Treasury 2.998% down 0.103%

Today’s Economic Releases:

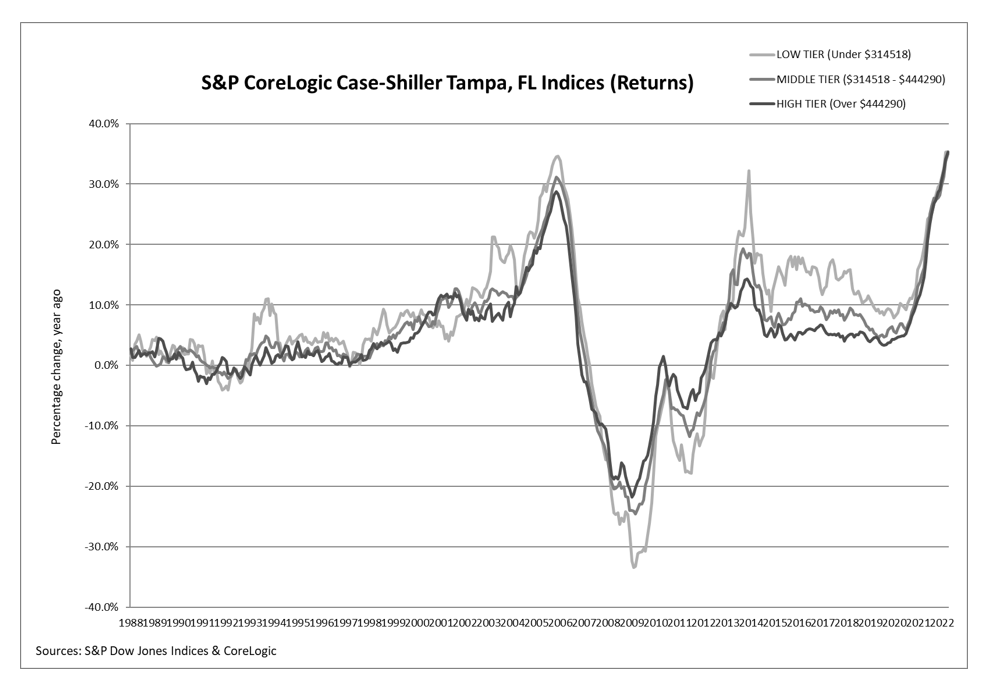

The June 2022 Survey of Consumer Expectations which showed an increase in short-term inflation expectations but a decline in medium-term and longer-term inflation expectations. Home price growth expectations declined sharply.

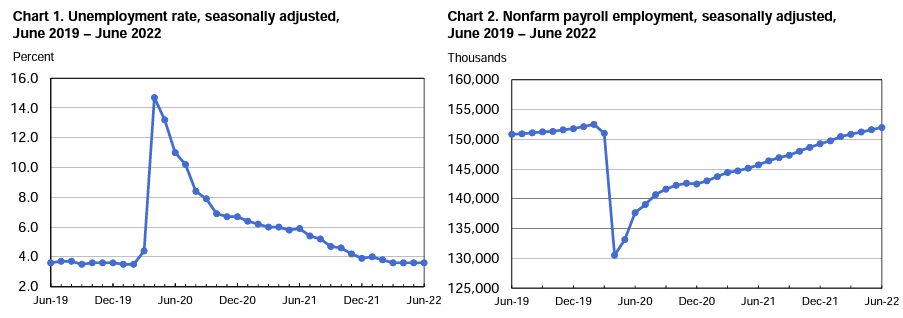

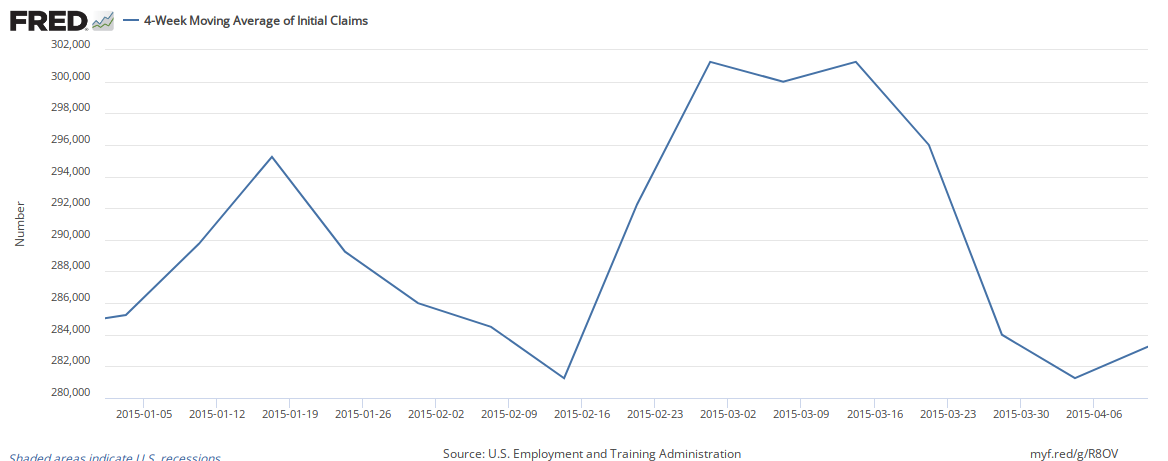

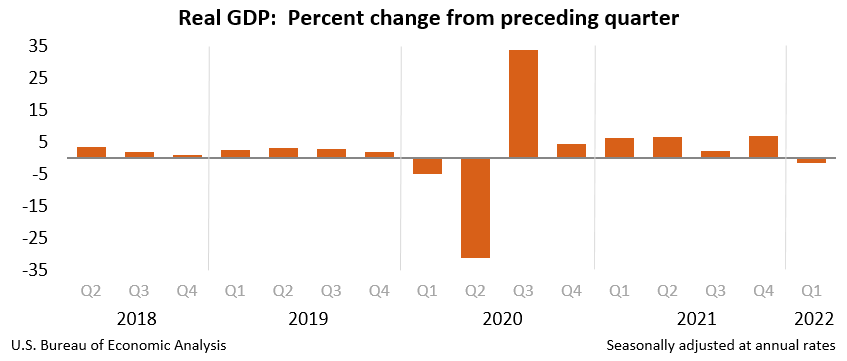

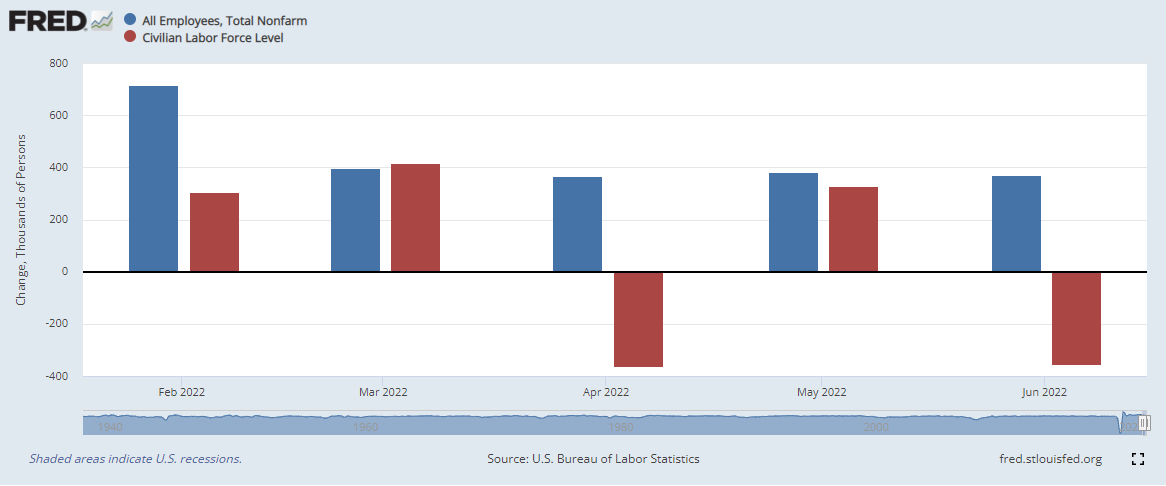

Thinking of the June 2022 BLS Employment report which came in red hot last Friday – there was a big bust between the two surveys that comprise the report. The household survey showed a 353,000 DECLINE in jobs whilst the establishment survey showed a 381,000 GAIN in jobs. This is not the first month this year this “bust” has occurred. It could be that an underlying dynamic change is invalidating the accuracy of the data gathering methodology of one or both of the surveys. The graph below shows the net change monthly for the last 5 months in the household and the establishment surveys.

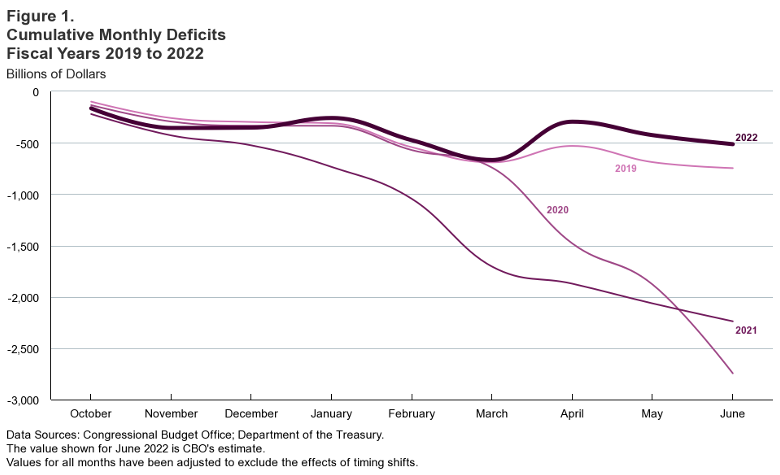

The federal budget deficit was $514 billion in the first nine months of the fiscal year 2022.

A summary of headlines we are reading today:

Soaring Prices Have Led To An Uptick In Oil Theft In Colombia

- French Industry Switches To Oil From Gas Amid Uncertainty Over Russian Supply

- Homebuyers are canceling deals at the highest rate since the start of the pandemic

- Texas grid operator tells residents to curb power as heat hits record highs

- Ford’s Mustang Mach-E electric crossover is a hit with industry insiders — that could help it take on Tesla

- Labor Market Reality-Check Sends Stocks, Bond Yields Tumbling

- Oil Dumped By Hedge Funds On Soaring Recession Risk

- Living With Climate Change: ERCOT warning: 5 electricity blackout risks facing the entire U.S., not just Texas

- Futures Movers: Natural-gas futures gain more than 6% on the shutdown of key European pipeline

These and other headlines and news summaries moving the markets today are included below.