19 September 2022 Market Close & Major Financial Headlines: Wall Street Investors See Volatile Trading Ahead Of The Fed’s Next Possible 100-Point Rate Hike, Inflation Remains High

Summary Of the Markets Today:

- The Dow closed up 197 points or 0.64%,

- Nasdaq closed up 0.76%,

- S&P 500 up 0.69%,

- WTI crude oil settled at 85 up 0.45%,

- USD $109.63 strengthened 0.12%,

- Gold $1683 up 0.02%,

- Bitcoin $19,514 up 0.45% – Session Low 18,340,

- 10-year U.S. Treasury 3.487 Unchanged,

Today’s Economic Releases:

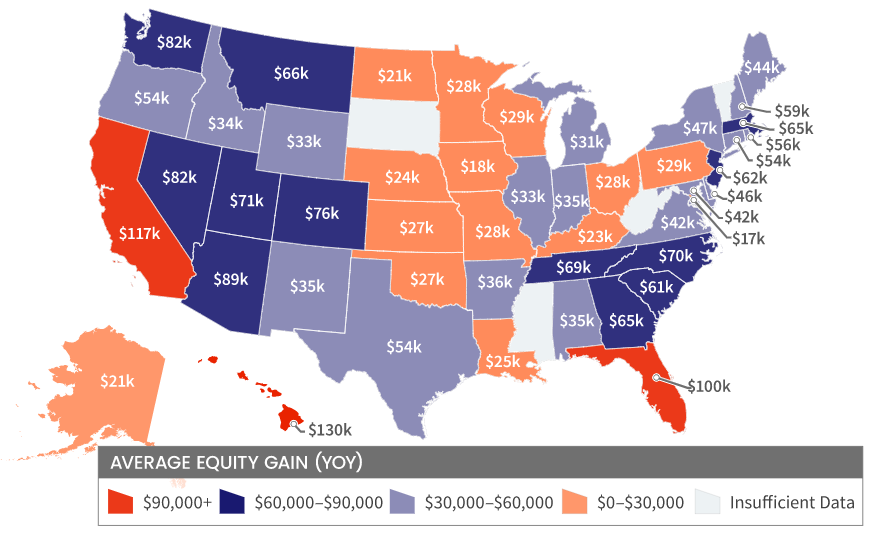

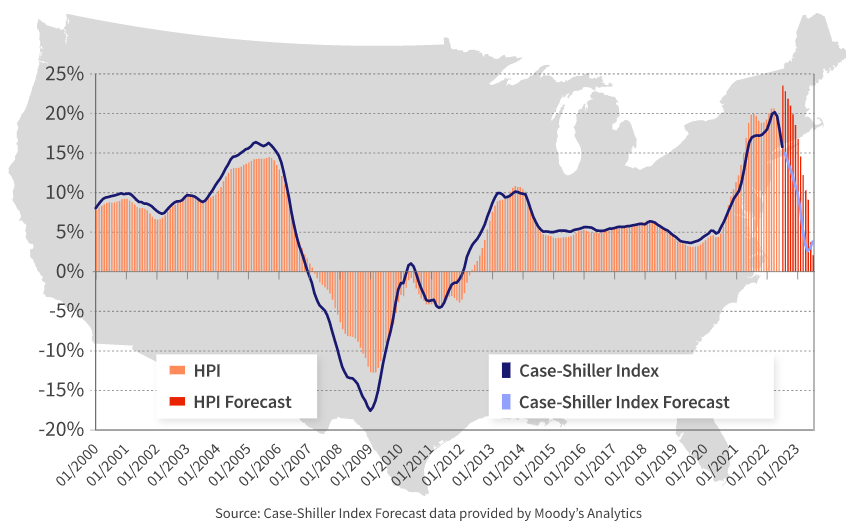

In another sign that the slowdown in the housing market continues, builder sentiment fell for the ninth straight month in September as the combination of elevated interest rates, persistent building material supply chain disruptions and high home prices continue to take a toll on affordability. Builder confidence in the market for newly built single-family homes fell three points in September to 46, the lowest level since May 2014 with the exception of the spring of 2020.

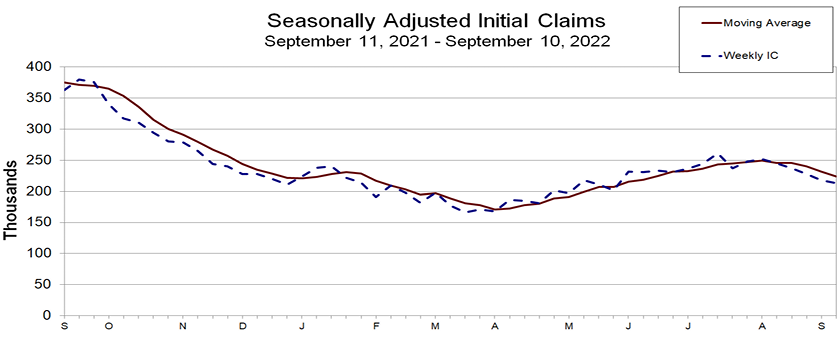

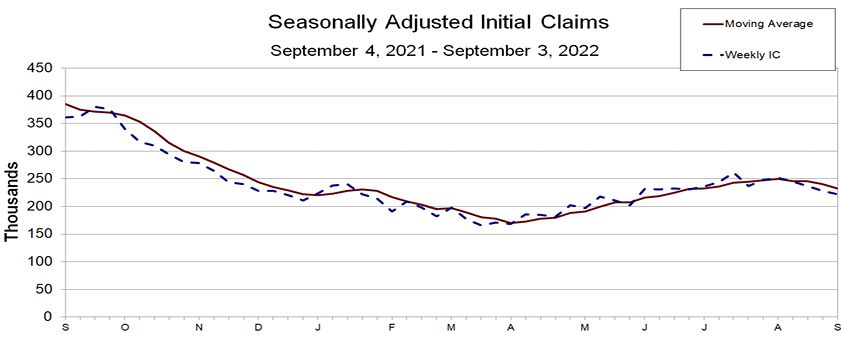

In a still-tight labor market, 85% of companies are actively hiring, up from 81% in the spring of this year. Despite the need for workers, 53% of companies expect a recession and 31% are taking actions to prepare for a slowdown, according to new survey results from global outplacement and executive leadership coaching firm Challenger, Gray & Christmas, Inc.

- Gasoline Prices See Longest Downward Streak Since 2015

- Germany’s Natural Gas Storage Will Last For Two And A Half Months

- FAA rejects proposal to halve flight-time requirement for pilots as shortage prompts route cuts

- Tesla Is Hiking Supercharger Prices “Significantly” Across Europe

- Powerful Earthquake Shakes Central Mexico, Tsunami Warning Issued

- US Gas Producers Struggle To Meet Demand: Kemp

- Dow closes nearly 200 points higher, stocks snap two-day losing streak to start big Fed week

These and other headlines and news summaries moving the markets today are included below.