14 November, 2022 Market Close & Major Financial Headlines: Wall Street Pauses Rally Slipping Moderately Lower During Last Hour

Summary Of the Markets Today:

- The Dow closed down 211 points or 0.63%,

- Nasdaq closed down 1.12%,

- S&P 500 down 0.89%,

- WTI crude oil settled at $85 down $3.60,

- USD $106.85 up $0.56,

- Gold 1776 up $6.50,

- Bitcoin $16,279 down 0.39% – Session Low 15,831,

- 10-year U.S. Treasury 3.872% up 0.043%

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases:

From the Survey of Consumer Expectations:

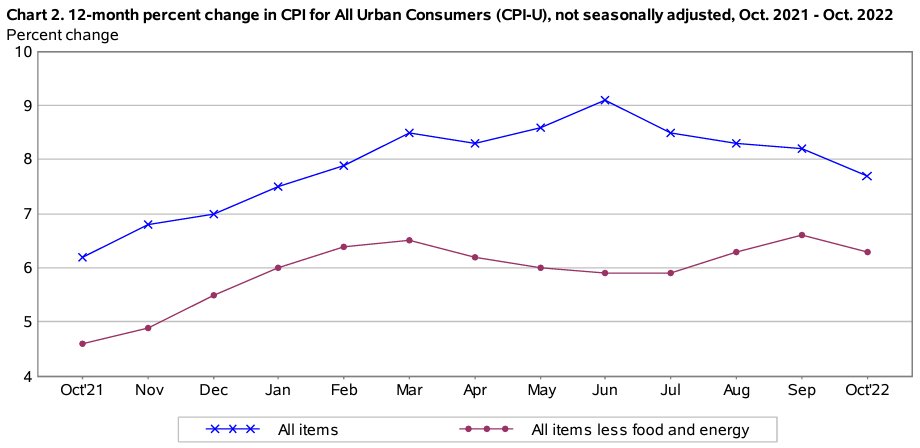

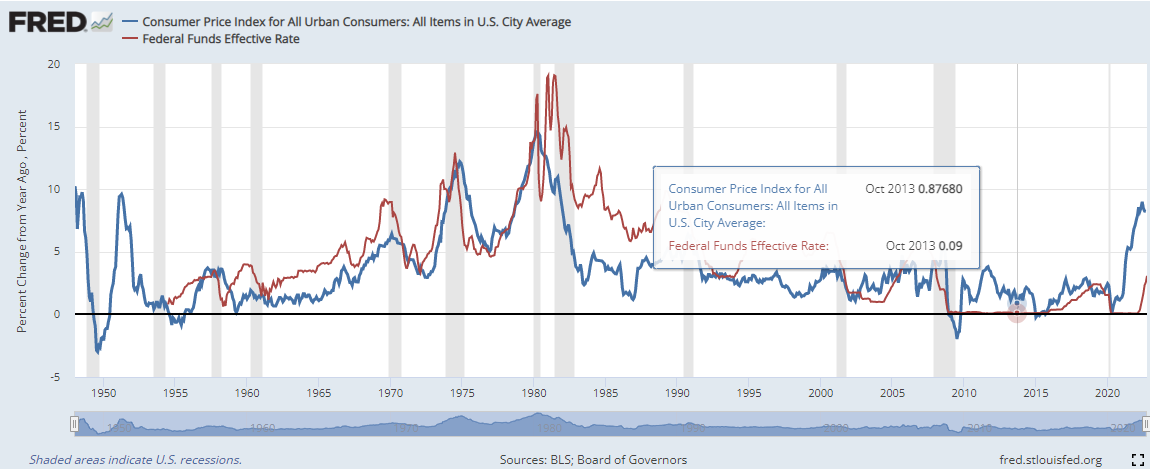

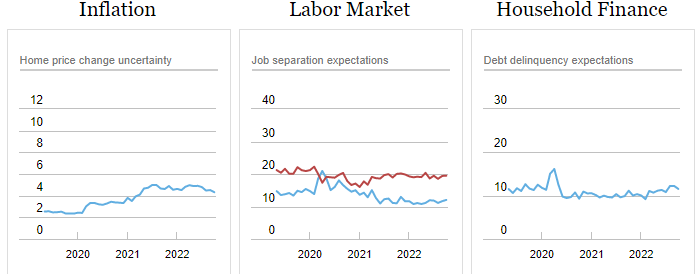

Median one- and three-year-ahead inflation expectations increased to 5.9 percent and 3.1 percent from 5.4 percent and 2.9 percent, respectively. The median five-year-ahead inflation expectations, meanwhile, rose by 0.2 percentage point to 2.4 percent. Household income growth expectations touched a series high of 4.3 percent, up from 3.5 percent in September, while households’ expectations about credit access one year from now worsened. Median home price growth expectations were unchanged at 2.0 percent, the measure’s lowest reading since July 2020. Mean unemployment expectations—or the mean probability that the U.S. unemployment rate will be higher one year from now—increased to its highest reading since April 2020 of 42.9 percent.

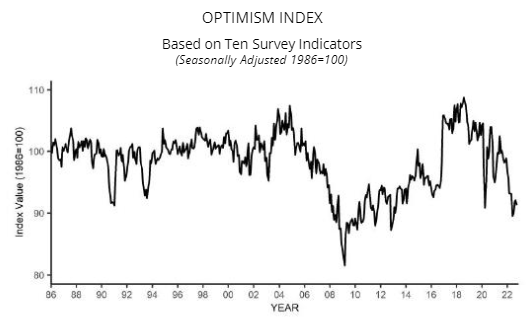

From the Fourth Quarter 2022 Survey of Professional Forecasters:

The outlook for the U.S. economy looks weaker now than it did three months ago, according to 38 forecasters surveyed by the Federal Reserve Bank of Philadelphia. The forecasters predict the economy will expand at an annual rate of 1.0 percent this quarter, down from the prediction of 1.2 percent in the last survey. Over the next three quarters, the panelists also see slower output growth than they predicted three months ago. On an annual-average over annual-average basis, the forecasters expect real GDP to increase 0.7 percent in 2023 and 1.8 percent in 2024. These annual projections are lower than the estimates in the previous survey.

Median Forecasts for Selected Variables in the Current and Previous Surveys

| REAL GDP (%) | UNEMPLOYMENT RATE (%) | PAYROLLS (000S/MONTH) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| PREVIOUS | NEW | PREVIOUS | NEW | PREVIOUS | NEW | ||||

| Quarterly data: | |||||||||

| 2022:Q4 | 1.2 | 1.0 | 3.7 | 3.7 | 167.9 | 217.6 | |||

| 2023:Q1 | 1.1 | 0.2 | 3.8 | 3.8 | 89.0 | 79.0 | |||

| 2023:Q2 | 1.5 | 0.2 | 3.9 | 4.0 | 96.6 | 35.8 | |||

| 2023:Q3 | 1.5 | 0.9 | 4.0 | 4.3 | 80.7 | 41.8 | |||

| 2023:Q4 | N.A. | 2.1 | N.A. | 4.4 | N.A. | -14.5 | |||

Here is a summary of headlines we are reading today:

- Container Glut Growing As Global Trade Slips

- Global Markets Breathe Sigh Of Relief As China Relaxes Covid Rules

- Potential Ban On Russian Metals Pushes Aluminum Prices Higher

- Bed Bath & Beyond’s stock falls as retailer plans to issue shares to pay off some debt

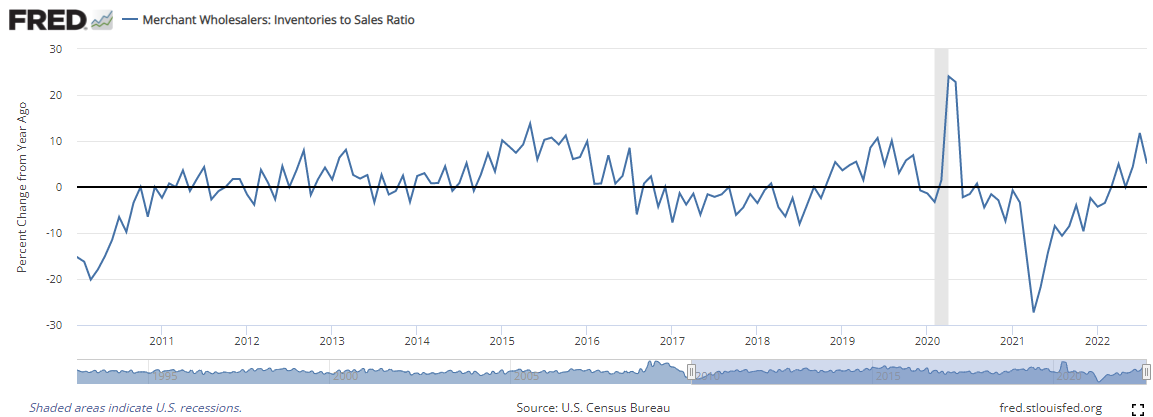

- Retailers’ biggest holiday wish is to get rid of all that excess inventory

- “All We Know He’s Alive”: Jay Leno Seriously Burned In Car Fire

- Bond Report: 2-year Treasury yield jumps by most in more than a week as Fed official pushes back on inflation optimism

- Market Snapshot: Dow gains fade, S&P 500 slightly lower as investors evaluate peak-inflation narrative

These and other headlines and news summaries moving the markets today are included below.