Summary Of the Markets Today:

- The Dow closed up 402 points or 1.26%,

- Nasdaq closed up 1.28%,

- S&P 500 up 1.36%,

- WTI crude oil settled at $93 up $4.48,

- USD $110.81 down $2.16,

- Gold $1684 up $53.40,

- Bitcoin $20,258 down 0.92% – Session Low 20,199,

- 10-year U.S. Treasury 4.175% up 0.049%,

- Baker Hughes Rig Count: U.S. +2 to 770 Canada -3 to 209

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases:

Headline total nonfarm payroll employment increased by 261,000 in October 2022, and the headline unemployment rate rose to 3.7%. Notable job gains occurred in health care, professional and technical services, and manufacturing. However, there is little correlation between the household and establishment surveys this month with the household survey showing a DECLINE of employment of 328,000 vs the headline establishment survey showing a gain of 261,000. Interestingly, the household survey also shows the labor force declined by 22,000 and the number of unemployed rising 306,000 from the previous month – all this leading to the increase in the headline unemployment rate to 3.7% from 3.5%. These two surveys which comprise the BLS employment report are so different that I would not rely on much analysis of this data. The employment growth has been relatively strong but has a general bias towards moderation of employment gains (see graph below).

A summary of headlines we are reading today:

- The Worlds Biggest EV Battery Producer Is About To Get Even Bigger

- U.S. Rig Count Still 305 Below Pre-Pandemic Levels

- Maersk Reports Record Profits But Warns Of Challenges Ahead

- Retailers have a new holiday headache — people are spending their money on travel

- U.S. faces highest flu hospitalization rate in a decade with young kids and seniors most at risk

- US Debt-Servicing Costs Skyrocket: $1.4 Trillion In Interest Payments On Deck

- Energy Is Still A Bargain Even After 65% Rally

- US jobs growth solid but slowing amid inflation fight

- The cloudburst is upon us: Cloud-software stocks suffering worst declines on record

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

The Worlds Biggest EV Battery Producer Is About To Get Even BiggerEV battery manufacturer Contemporary Amperex Technology Co. Ltd. (CATL) is growing its global expansion yet again. The world’s largest EV battery producer, which had announced a $233 million factory in Germany back in 2018, has made several moves this year to increase its global footprint. Over the summer, it announced it would be building a $7.2 billion factory in Hungary. Now, plans for a factory in Mexico are also being finalized, according to Caixin. The report also says that the manufacturer could be looking to expand with plants in Read more at: https://oilprice.com/Energy/Energy-General/The-Worlds-Biggest-EV-Battery-Producer-Is-About-To-Get-Even-Bigger.html |

|

OPEC: Higher Oil Investments Are Needed To Avoid Rampant VolatilityThe oil industry needs to increase investment in capacity and new production so that the oil market can avoid high volatility in the future, OPECs Secretary General Haitham Al Ghais said this week. Al Ghais stressed the importance of increasing investments in the oil sector in an exclusive interview with the Emirates News Agency (WAM) on the sidelines of the ADIPEC energy conference in Abu Dhabi. The significant decline in investments in the oil industry, which began with the price crash of 2015 and then again in 2020 with the first COVID Read more at: https://oilprice.com/Energy/Energy-General/OPEC-Higher-Oil-Investments-Are-Needed-To-Avoid-Rampant-Volatility.html |

|

Germany Calls For An End To Regional Conflicts In Balkan StatesGerman Chancellor Olaf Scholz has called on Balkan leaders to overcome regional conflicts as they look to make progress down the path to European Union membership amid Russia’s war against Ukraine. Speaking at a meeting of six Balkan leaders in Berlin on November 3, Scholz said EU membership for Serbia, Kosovo, Bosnia, Montenegro, North Macedonia, and Albania is in the interest of the bloc, as well as the aspirants. Russia’s brutal war of aggression against Ukraine forces us to stand together to preserve Europe’s freedom and security… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Germany-Calls-For-An-End-To-Regional-Conflicts-In-Balkan-States.html |

|

U.S. Rig Count Still 305 Below Pre-Pandemic LevelsThe number of total active drilling rigs in the United States rose by 2 this week, according to new data from Baker Hughes published on Friday. The total rig count increased to 770 this week220 rigs higher than the rig count this time in 2021, and 305 rigs lower than the rig count at the beginning of 2019, prior to the pandemic. Oil rigs in the United States rose by 3 this week, to 613. Gas rigs fell 1 to 155. Miscellaneous rigs stayed the same at 2. The rig count in the Permian Basin held steady again this week at 346. Rigs in the Eagle Read more at: https://oilprice.com/Energy/Energy-General/US-Rig-Count-Still-305-Below-Pre-Pandemic-Levels.html |

|

Maersk Reports Record Profits But Warns Of Challenges AheadThree months ago, executives of Maersk expected the container shipping market to peak and turn downward sometime in the fourth quarter. Just a few weeks later, they were proven wrong. It peaked sooner. Demand for ocean shipping began its decline in August, and this was clearly observed in both rates and volumes, said Maersk CEO Soren Skou during a quarterly call on Wednesday. Third-quarter profits marked yet another record high for Maersk’s net income was $8.9 billion but it will be the last hurrah of the boom era. We Read more at: https://oilprice.com/Latest-Energy-News/World-News/Maersk-Reports-Record-Profits-But-Warns-Of-Challenges-Ahead.html |

|

Russian Oil Price Cap Will Not Apply To Resold CargoesThe United States and its Western allies have agreed that a cargo of Russian oil will only be subject to the price cap mechanism at the first sale of the oil to a buyer on land, sources familiar with the ongoing discussions told The Wall Street Journal on Friday. This means that the upcoming price cap will not apply to the resale of the same Russian cargo. The price cap will not apply to a cargo of Russian crude processed into gasoline when the gasoline is sold, either. However, intermediary sales and trades of Russian oil happening at sea should Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russian-Oil-Price-Cap-Will-Not-Apply-To-Resold-Cargoes.html |

|

Shonda Rhimes is among the creators unhappy with Netflix’s mid-video ads, sources sayShonda Rhimes is among a group of creators who have expressed displeasure with Netflix’s midroll advertising, sources say. Read more at: https://www.cnbc.com/2022/11/04/shonda-rhimes-others-unhappy-netflix-ads.html |

|

Retailers have a new holiday headache — people are spending their money on travelThe peak shopping season will test spending priorities of consumers who are facing high inflation. Read more at: https://www.cnbc.com/2022/11/04/travel-has-edge-over-shopping-holiday-season-amid-inflation.html |

|

Sean ‘Diddy’ Combs to acquire cannabis businesses for up to $185MHip-hop mogul and businessman Sean “Diddy” Combs is venturing into the world of cannabis. Read more at: https://www.cnbc.com/2022/11/04/sean-diddy-combs-to-acquire-cannabis-businesses-for-up-to-185m.html |

|

DraftKings shares tumble after monthly users fall short of estimatesDraftKings stock fell as much as 26% Friday despite the sports betting company posting higher-than-expected revenue for its third quarter earnings report. Read more at: https://www.cnbc.com/2022/11/04/draftkings-shares-tumbles-after-monthly-users-fall-short-of-estimates.html |

|

Rocket Lab launches mission, but calls off attempt to catch Electron booster with a helicopterSpace company Rocket Lab made another attempt at catching one of its Electron boosters with a helicopter, as it pursues reusability. Read more at: https://www.cnbc.com/2022/11/04/rocket-lab-live-stream-company-attempts-electron-booster-catch-with-helicopter.html |

|

United Airlines opens a new grab-and-go lounge in Denver for time-crunched travelersUnited’s new lounge offers customers grab-and-go food options and made-to-order coffee drinks. Read more at: https://www.cnbc.com/2022/11/04/united-airlines-denver-mini-lounge-opens-for-time-crunched-travelers.html |

|

U.S. faces highest flu hospitalization rate in a decade with young kids and seniors most at riskSeniors and children younger than age 5 are most at risk right now, public health official said. Read more at: https://www.cnbc.com/2022/11/04/us-faces-highest-flu-hospitalization-rate-in-a-decade.html |

|

Carvana stock on pace for worst day ever as outlook darkens for used vehicle marketShares of Carvana were on pace for their worst day on record Friday after the company missed Wall Street’s top- and bottom-line expectations for the third quarter. Read more at: https://www.cnbc.com/2022/11/04/carvana-stock-craters-as-outlook-darkens-for-used-vehicle-market.html |

|

House hunting this weekend? There’s more out there nowAfter more than two years of a historically lean housing market, listings are now starting to rise, and swiftly. Read more at: https://www.cnbc.com/2022/11/04/house-hunting-this-weekend-theres-more-out-there-now.html |

|

Puma CEO Bjorn Gulden in talks to succeed Kasper Rorsted as chief of AdidasAdidas has faced a recent public relations crisis in its dealings with Ye, formerly known as Kanye West. Read more at: https://www.cnbc.com/2022/11/04/puma-ceo-bjorn-gulden-in-talks-to-succeed-kasper-rorsted-as-adidas-chief.html |

|

Starbucks U.S. sales climb as customers spend more on pricey drinksShares of Starbucks have fallen nearly 28% this year, dragging its market value down to $97.11 billion. Read more at: https://www.cnbc.com/2022/11/03/starbucks-sbux-q4-2022-earnings.html |

|

Warner Bros Discovery reports underwhelming revenue, says new streaming service coming earlierWarner Bros. Discovery reported third-quarter earnings and said its merged HBO Max-Discovery+ streaming service will come in spring instead of summer. Read more at: https://www.cnbc.com/2022/11/03/warner-bros-discovery-wbd-earnings-q3-2022.html |

|

Virgin Galactic CEO outlines remaining steps before commercial spaceflight service begins next yearVirgin Galactic CEO Michael Colglazier outlined the remaining steps before the space tourism company aims to launch its long-delayed service next year. Read more at: https://www.cnbc.com/2022/11/03/virgin-galactic-q3-2022-earnings.html |

|

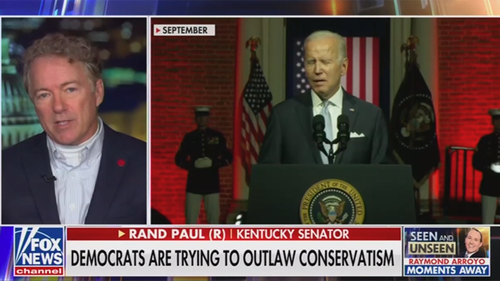

Rand Paul Vows To Introduce Bill To Stop Government And Big Tech Colluding To Censor SpeechAuthored by Steve Watson via Summit News, In the wake of fresh revelations that The Department of Homeland Security has been working relentlessly to shut down speech it deems to be ‘dangerous’ or ‘disinformation,’ Senator Rand Paul has promised to introduce legislation that would make it illegal for government agencies and private big tech to secretly collude on such enterprises.

Appearing on Fox News, Paul said of the Democratic Party, “You know, for all the talk of democracy, it seems to be that they’re undermining the very basic principles of our constitutional republic.” “Freedom of speech was listed in the first amendment because it was one of the most important rights that … Read more at: https://www.zerohedge.com/political/rand-paul-vows-introduce-bill-stop-government-and-big-tech-colluding-censor-speech |

|

US Debt-Servicing Costs Skyrocket: $1.4 Trillion In Interest Payments On DeckBy Howard Wang of Convoy Investments Jerome Powell has been talking tough on inflation and clearly wants to leave a Volcker-like legacy. But the US is far different today than it was in the 80s. The recent Q3 US government borrowing report may throw a wrench in his plans. US debt servicing costs skyrocketed in Q3 as the rate shock propagated to the $31 trillion worth of federal debt, a number that continues to grow at a $1.5 trillion per year clip. Because of the high debt base, any small changes in average financing rate has a huge impact on ultimate debt costs to the government. This number will only worsen as we continue to retire cheaper old debt and replace it with costlier new debt. If the current ~4.5% average yield curve rate propagates to all $31 trillion worth of debt, we are looking at $1.4 trillion per year just in interest payments. This would be 29% of the 2022 FY total Federal tax receipt. Read more at: https://www.zerohedge.com/markets/us-debt-servicing-costs-skyrocket-14-trillion-interest-payments-deck |

|

Energy Is Still A Bargain Even After 65% RallyBy Tatiana Darie, Bloomberg Markets Live reporter, and analyst As stock-picking gains importance in a tough macro environment for markets, energy stands out as the S&P 500 Index’s cheapest sector, despite its massive rally this year. Omega Advisors CEO Leon Cooperman is right: Energy stocks are still cheap, by one measure at least. That’s even after the sector gained roughly 65% this year, making it the only S&P 500 segment in the green YTD. Remarkably, energy commands the lowest multiple among major sectors in the index despite oil companies posting some of their largest profits in history. The S&P 500 Energy index’s 12-month forward price-to-earnings ratio as of Wednesday’s close was 8.7, roughly half the other 10 sectors’ average forward multiple of nearly 19 and less than a third of the most expensive sector by this metric — real estate — which has a multiple of 30. And while we’re not technically in a recession, what’s even more surprising is how energy’s current valuation based on forward earnings compares with past economic downturns. Controlling for the stratospheric jump in 2020 (when oil prices turned negative), the average median forward P/E ratio seen in the past four downturns is 14, based on weekly data going back to 1990. Read more at: https://www.zerohedge.com/energy/energy-still-bargain-even-after-65-rally |

|

Apple Adds iPhone 14 Production In India Amid China Zero Covid ChaosTrade conflicts, zero Covid policy, and geopolitical tensions have all impacted Apple’s global supply chains in China, necessitating a significant rethink on diversifying iPhone production worldwide. Apple continues to learn the painful lessons of concentrating on iPhone production in China. The company’s latest woes are at the world’s largest iPhone factory in the central Chinese city of Zhengzhou. Local officials have locked down the surrounding city while Covid restrictions create unrest at the plant. There are no reports of major disruptions, but all the uncertainty has led the Cupertino, California-based tech giant, to diversify some iPhone production out of the country. It appears Apple has done just that. People familiar with the supply chain overhaul told Bloomberg that Apple had shifted some production of the new iPhone 14 to India. Apple supplier Pegatron Corp. now produces the latest iPhone model in India’s southern Tamil Nadu state. Read more at: https://www.zerohedge.com/markets/apple-adds-iphone-14-production-india-amid-china-zero-covid-chaos |

|

Train strikes: Series of walkouts from Saturday suspendedThe RMT union had been planning to walk out on 5, 7, and 9 November in a dispute over pay. Read more at: https://www.bbc.co.uk/news/business-63510380?at_medium=RSS&at_campaign=KARANGA |

|

Money-off energy scheme launches to avoid blackoutsHouseholds with smart meters could save up to £100 on bills if they cut peak-time use over winter. Read more at: https://www.bbc.co.uk/news/business-63483668?at_medium=RSS&at_campaign=KARANGA |

|

US jobs growth solid but slowing amid inflation fightThe news comes as the economy remains a top concern for voters ahead of the midterm elections. Read more at: https://www.bbc.co.uk/news/business-63507546?at_medium=RSS&at_campaign=KARANGA |

|

Tech View: Nifty forms long bull candle on weekly scale. What traders should do on MondayNow, Nifty has to hold above 18,000 zones, for an up move towards 18,350, then 18,500 zones whereas supports are placed at 17,950 and 17,888 zones,” said Chandan Taparia of Motilal Oswal Financial Services. The index maintained its position above its 200-DMA, and the momentum indicator RSI is in a bullish crossover.. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-long-bull-candle-on-weekly-scale-what-traders-should-do-on-monday/articleshow/95304215.cms |

|

Golden Crossovers: These 4 stocks signal further bullishnessIn the NSE list of stocks, four stocks with a market cap of over Rs 100 crore are witnessing Golden Crossovers, according to stockedge.com’s technical scan data. Golden Cross is an important technical indicator of bullishness. It occurs when the short-term moving average crosses over the major long-term moving average on the upside. These stocks’ 50-day simple moving averages (SMA) crossed their 200-day SMAs on November 3. Take a look: Read more at: https://economictimes.indiatimes.com/markets/stocks/news/golden-crossovers-on-november-3-these-4-stocks-signal-further-bullishness/bullish-signs/articleshow/95294002.cms |

|

ETMarkets Smart Talk: Planning to invest Rs 10 lakh in the market? Try Dipan Mehta’s sectoral allocation“I would advocate zero allocation to gold as an investment class. It is good for jewelry and nothing else. Let’s not compare Gold with Equities; there is no comparison. Selectively. In each industry, quality midcaps that have a niche, agility, aggressive management, or company-specific strengths should do very well and provide good outperformance.” Read more at: https://economictimes.indiatimes.com/markets/expert-view/etmarkets-smart-talk-planning-to-invest-rs-10-lakh-in-market-try-dipan-mehtas-sectoral-allocation/articleshow/95282037.cms |

|

Metals Stocks: Gold and silver futures rally; copper hits 2-month peak on China reopening speculationGold and silver advanced Friday as the U.S. dollar pulled back in the wake of the October jobs report. Copper prices settle at the highest level in over two months as rumors of an end to China’s zero-COVID policy sent industrial metals higher. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-714B-88F66DA5374F%7D&siteid=rss&rss=1 |

|

The cloudburst is upon us: Cloud-software stocks suffering worst declines on recordThe lining in cloud-software stocks Friday was blood red instead of silver. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-714B-F947FE0B6A86%7D&siteid=rss&rss=1 |

|

Activist groups urge advertisers to pause Twitter buys after Elon Musk blames them for ‘massive drop in revenue’As Elon Musk laid off thousands of Twitter Inc. employees Friday, more than 60 civil rights and civil-society groups urged companies to stop advertising on the social media platform. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-714B-F2EF9B62BADE%7D&siteid=rss&rss=1 |