Summary Of the Markets Today:

- The Dow closed down 202 points or 0.51%,

- Nasdaq closed down 0.18%, (Closed at 16,802, New Historic high 16.855)

- S&P 500 closed down 0.27,

- Gold $2,381 down $46.60,

- WTI crude oil settled at $77 down $1.34,

- 10-year U.S. Treasury 4.422 up 0.008 points,

- USD index $104.94 up $0.280,

- Bitcoin $69,619 up $147 (0.21%)

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

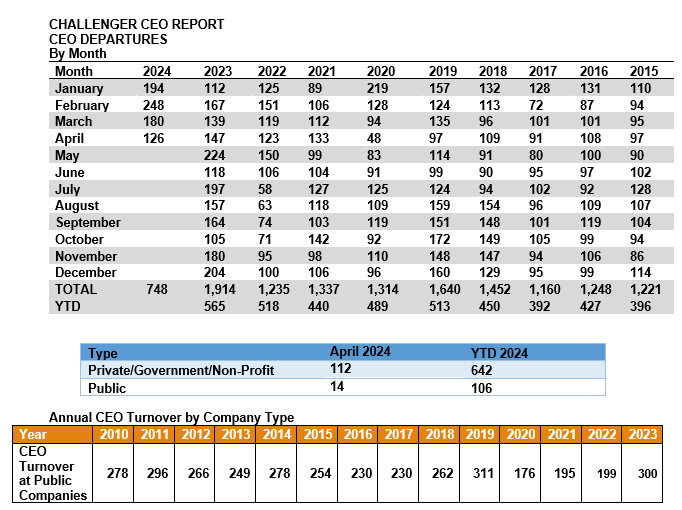

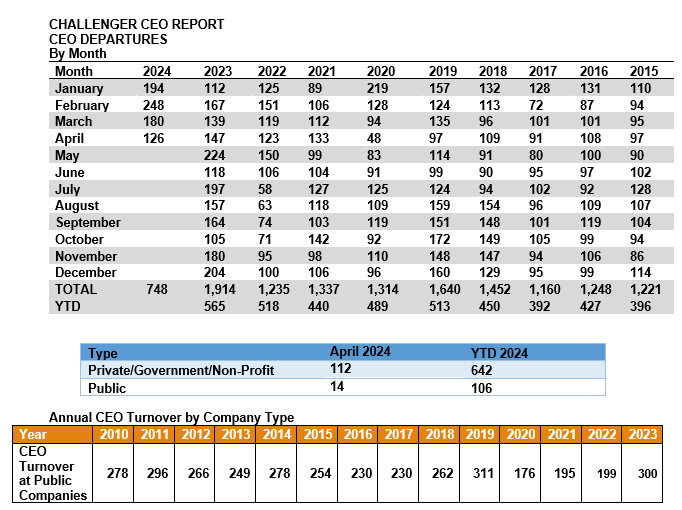

The number of CEO changes at U.S. companies fell 30% to 126 in April, from 180 in March. It is down 14% from 147 CEO exits recorded in the same month last year. April’s total marks the first time in 14 months that CEO exits were lower than the corresponding month a year earlier. So far this year, 748 CEOs have announced their departures, the highest year-to-date total on record. It is up 32% from 565 exits that occurred during the same period last year, which was the previous year-to-date record. Andrew Challenger, Senior Vice President of Challenger, Gray & Christmas, Inc. stated:

The second quarter, on average, sees the fewest CEO changes, while the third quarter sees the most. This slowdown is not that surprising, given the high rate of turnover we’ve seen for the last 14 months. Leaders are navigating enormous change with the advancement of AI technology, as well as changing economic conditions, an uncertain political landscape, and burgeoning global conflicts.

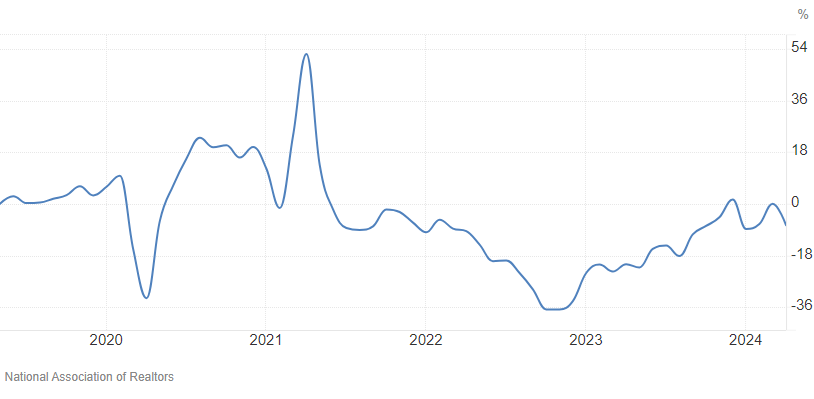

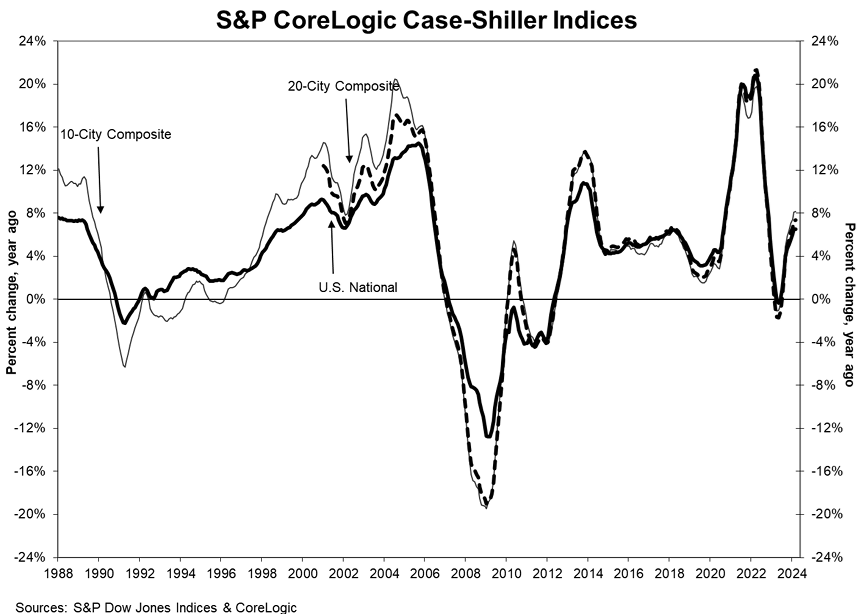

Existing-home sales receded in April 2024. Total existing-home sales fell 1.9% year-over-year. Total housing inventorywas up 16.3% from one year ago. Unsold inventory sits at a 3.5-month supply at the current sales pace, up from 3.2 months in March and 3.0 months in April 2023. For homes priced $1 million or more, inventory and sales increased by 34% and 40%, respectively, from a year ago. The median existing-home price for all housing types in April was $407,600, an increase of 5.7% from the previous year ($385,800). All four U.S. regions registered price gains. NAR Chief Economist Lawrence Yun added:

Home sales changed little overall, but the upper-end market is experiencing a sizable gain due to more supply coming onto the market. Home prices reaching a record high for the month of April is very good news for homeowners. However, the pace of price increases should taper off since more housing inventory is becoming available.

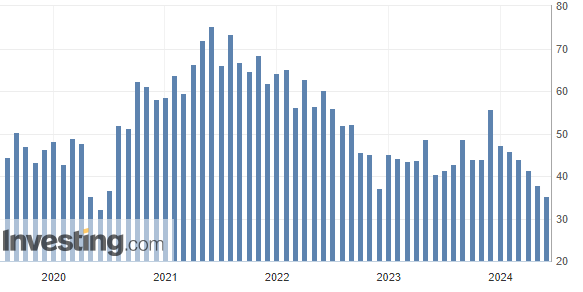

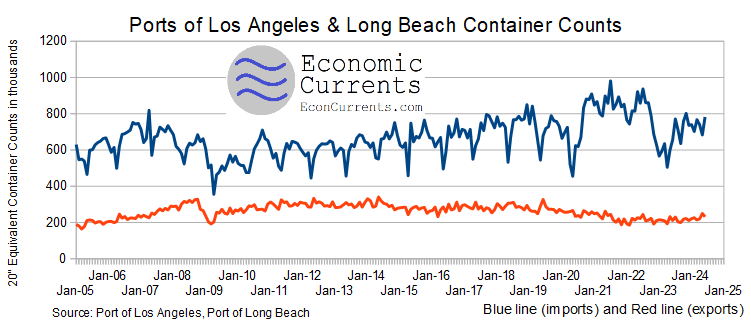

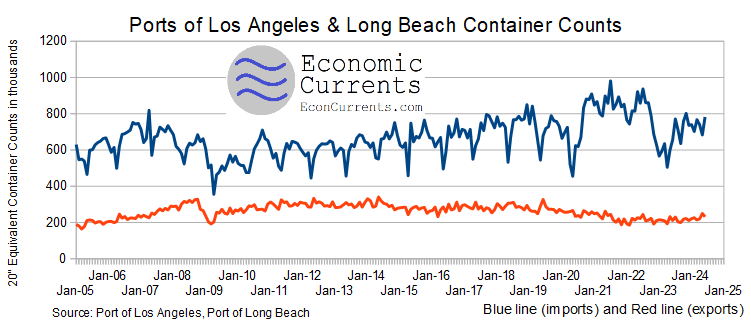

LA area ports handle about 40% of the nation’s container port traffic. In April 2024, container imports are up 19% year-over-year whilst exports are up 9% year-over-year. Still, container traffic remains slightly below pre-pandemic levels – but container traffic appears to be on a slightly improving trend line.

Much time was spent discussing inflation, according to the 01May2024 Federal Open Market Committee (FOMC) meeting minutes. Highlights of the meeting minutes:

… Participants observed that while inflation had eased over the past year, in recent months there had been a lack of further progress toward the Committee’s 2 percent objective. The recent monthly data had showed significant increases in components of both goods and services price inflation. In particular, inflation for core services excluding housing had moved up in the first quarter compared with the fourth quarter of last year, and prices of core goods posted their first three-month increase in several months.

… Participants noted that they continued to expect that inflation would return to 2 percent over the medium term. However, recent data had not increased their confidence in progress toward 2 percent and, accordingly, had suggested that the disinflation process would likely take longer than previously thought.

… Participants assessed that demand and supply in the labor market, on net, were continuing to come into better balance, though at a slower rate.

… High interest rates appeared to weigh on consumer durables purchases in the first quarter, and growth of business fixed investment remained modest. Despite the high interest rates, residential investment grew more strongly in the first quarter than its modest pace in the second half of last year.

… Participants noted the important influence of productivity growth for the economic outlook. Some participants suggested that the recent increase in productivity growth might not persist because it reflected one-time adjustments to the level of productivity or reflected continued elevated volatility in the data over the past several years. A few participants commented that higher productivity growth might be sustained by the incorporation of technologies such as artificial intelligence into existing business operations or by high rates of new business formation in the technology sector.

… A number of participants judged that consumption growth was likely to moderate this year, as growth in labor income was expected to slow and the financial positions of many households were expected to weaken. Many participants noted signs that the finances of low- and moderate-income households were increasingly coming under pressure, which these participants saw as a downside risk to the outlook for consumption.

… Participants discussed the risks and uncertainties around the economic outlook. They generally noted their uncertainty about the persistence of inflation and agreed that recent data had not increased their confidence that inflation was moving sustainably toward 2 percent. Some participants pointed to geopolitical events or other factors resulting in more severe supply bottlenecks or higher shipping costs, which could put upward pressure on prices and weigh on economic growth. The possibility that geopolitical events could generate commodity price increases was also seen as an upside risk to inflation.

… participants who commented noted vulnerabilities to the financial system that they assessed warranted monitoring. Participants discussed a range of risks emanating from the banking sector, including unrealized losses on assets resulting from the rise in longer-term yields, high CRE exposure, significant reliance by some banks on uninsured deposits, cyber threats, or increased financial interconnections among banks.

Here is a summary of headlines we are reading today:

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.